Our experts and industry insiders blog the latest news, studies and current events from inside the credit card industry. Our articles follow strict editorial guidelines.

In a Nutshell: As member-owned financial institutions, credit unions gain their purpose in service. TruWest Credit Union, based in Arizona and Texas, exemplifies that commitment through its TruDifference philosophy. TruDifference means providing card, loan, and savings products with market-leading rates and wealth management services to help make retirement years more productive and fulfilling. TruDifference also means making a difference in communities through in-person and online financial training and support. For embodying the TruDifference philosophy in everything it does, TruWest Credit Union earns our Editor’s Choice™ Award.

Like many credit unions, TruWest Credit Union started as a corporate financial cooperative. In 1952, eight employees of the Motorola Government Electronics Group contributed $5 each to start pooling their resources.

Based in Scottsdale, Arizona, the Motorola Government Electronics Group was a secretive branch of Motorola that manufactured sensitive electronic equipment for the US government.

Also like many credit unions, TruWest changed with the times, expanding its charter and membership, building branches in Arizona and Texas, and adopting a new name in 2003. By 2004, anyone who lived or worked in Maricopa County, Arizona, or Travis County, Texas, could be a member.

But TruWest hasn’t rested on those impressive laurels. Today it serves more than 90,000 members, manages more than $1.5 billion in assets, and operates 11 branches with 275 employees.

And through its TruDifference philosophy — a belief in the sheer, simple power of helping — the credit union and its members aim toward an even more impressive future. Chief Financial Officer Mike Ward said TruDifference impacts every aspect of TruWest’s mission, from providing best-in-class products and services to its commitment to community building.

“It’s about creating a culture of caring across the board,” Ward said. “We’re continually focused on taking care of our members, our employees, and our communities.”

Getting there requires intentionality addressing what’s most important. For members, TruWest offers excellent rates on card, loan, and savings products, and a pathway to retirement security. For employees, it’s about earning their loyalty. And for communities, it’s about being there through thick and thin with resources that can help.

And for covering all the bases to make the broadest possible impact through TruDifference, TruWest has earned our Editor’s Choice™ Award.

TruDifference Philosophy Powers Market-Leading Rates

New members come to TruWest every day because the principles of TruDifference can be seen in the credit union’s pledge to offer great rates. Its card program highlights that commitment with options that earn up to across-the-board 1.5% cash back through TruRewards.

That’s distinctive because most institutions entice consumers with higher rates for a subcategory of purchases, such as dining, and lower rates for everything else. In addition to offering a special introductory APR, zero annual fees, and protection against unauthorized charges, TruWest’s Signature and Platinum Points cards put consistent earning potential in front of all users all the time.

In addition to the cash back benefit, Signature and Platinum Plus cardholders earn one point for every dollar spent, redeemable for cash, travel, gift card, and even charity donations. Signature cardholders enjoy additional benefits, including luxury hotel upgrades and concierge services. The Platinum Card, which offers the lowest APR, rounds out TruWest’s card offerings.

The commitment to great rates extends to deposit products. TruWest maintains top-of-market rate status on CD and money market accounts. And in return for $500 in qualifying direct deposits and 15 or more qualifying debit or credit card transactions, its High Yield Checking product earns 3% on up to $10,000 in deposits.

There’s no monthly service fee required to use High Yield Checking, which functions like an extra interest-earning savings account. TruWest offers access to a network of more than 30,000 free ATMs.

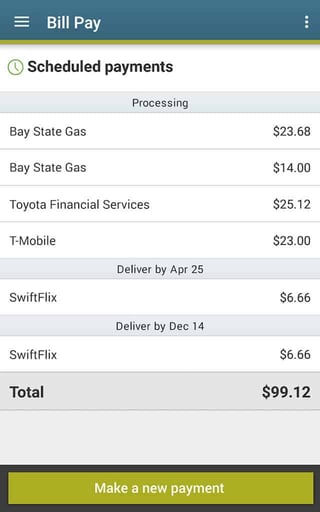

And through the TruWest Card Manager app, users gain anytime/anywhere power to turn credit and debit cards on and off, set restrictions, pay bills, and even apply for new accounts and loans.

“We don’t have the economies of scale of a large financial institution,” Ward said. “Our differentiator is always great rates.”

Wealth Services Help All Members Plan and Prepare

Today’s economy of ebbs and flows requires financial consumers to make wise decisions about their financial future. That’s true no matter how much money they have or where they are on their financial journey.

TruWest Wealth Management Services help all TruWest members gain access to a team of highly qualified and experienced fiduciary advisors. The team is always ready and able to guide every member to the best wealth management, estate planning, retirement planning, college planning, and insurance strategy. There’s never a cost or obligation to consult TruWest’s wealth management team.

“Usually, you need to have a million or two to just sit down with someone, even at a small firm,” Ward said. “But at TruWest, every single member can come in and have a one-on-one with a financial advisor.”

That’s true even though recent TruWest research concluded the minimum break-even point for providing the service was higher than most members could bring to the table. But there’s something more important at stake.

Members from all walks of life come in for consultations. Investors nearing retirement who may be more financially savvy consult with TruWest to transfer assets and explore protection strategies. But members run the gamut from the most sophisticated to youngsters coming out of college with a few dollars and a dream.

Either way, they get the same excellent service from advisors and a commitment to credit union values.

For the advisor, it’s about building long-term relationships. When those relationships happen, both the member and the credit union benefit.

“Our advisors work at a credit union for a reason,” Ward said. “They believe in the philosophy of what we’re doing and take time with people, no matter their financial state.”

Difference-Making Financial and Community Resources

TruWest’s emphasis on building long-term member relationships through its wealth management program parallels its commitment to employee retention. As the COVID-19 pandemic receded and Americans began job hopping in what became known as the Great Resignation, TruWest workers stayed on board.

“It points to our focus on caring and doing what’s right by people,” Ward said.

The communities TruWest serves get the same treatment. TruWest embodies the tenets of TruDifference by reaching out to schools and the public to provide financial education, volunteer in the community, and contribute charitable donations.

For example, TruWest partners with Arizona’s Mesa Community College to provide financial education to first-year students — part of a general outreach program the credit union offers through trained staff members. From time to time, branches also host education events covering mortgages, retirement, and investing.

Online, the TruWest Financial Resource Center offers financial education to everyone. Content from Enrich™ helps people better understand themselves as financial consumers, while It’s a Money Thing® teaches financial basics, from budgeting and saving to credit, loans, income, and investments.

TruWest’s partnership with the American Lung Association performs a double function. First, it’s a valued outlet for volunteerism and charitable giving at the credit union. But it’s also a way for the credit union to recruit new members.

“No matter where you are in the United States, you can become a member of TruWest with a donation to the American Lung Association,” Ward said.

It’s a lot for an institution that began with eight members and a few dollars. But the TruWest team is used to taking on big responsibilities. To celebrate its 70th anniversary in 2022, the credit union challenged employees to contribute 700 hours of service to local communities within 70 days. They ended up exceeding that goal by a large margin.

“When it was all said and done, we completed 882 hours of community service to 48 organizations,” Ward said. “That’s what we’re all about.”

![12 Credit Cards with the Best Customer Service ([updated_month_year]) 12 Credit Cards with the Best Customer Service ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/01/Credit-Cards-with-the-Best-Customer-Service.jpg?width=158&height=120&fit=crop)