In a Nutshell: Higher learning institutions process trillions of dollars in payments each year for tuition, fees, campus activities, and other goods and services. The handling of payments in different currencies and funding options, like scholarships, federal loans, and prepaid college savings plans, can be a juggling act for university accounting departments. Blackboard’s Cashnet payment solutions have integrated market-leading campus-wide payment portals for more than 25 years and currently run in more than 700 campuses nationwide. Cashnet enables schools to process payments and disbursements, as well as send electronic bills. Student portals can be seamlessly integrated into current campus logins to help maintain student billing and payment records. An iPad application allows school stores to accept in-person payments with full accounting functionality in the backend. //

Earlier this year, my teenage daughter started her first job — at a local college’s campus-run convenience store. Soon after she was hired, the school started a system allowing students to make purchases at the store using a campus ID card that links to their bank account.

Just seven months later, she’s become the longest tenured employee at the store.

I’d like to think it’s because of the tireless work ethic she inherited from her father, but it’s not. The school-operated payment system was such a disaster that employees quit from the stress. The manager was the first to go when he simply didn’t show up for work one day.

Complaints about the system included rejected payments, overpayments, and accounting errors that made it difficult to balance cash register transactions at the end of their shifts.

After four months, an email from the school president admitted the software wasn’t ready for use and announced a partnership with a company that promised to fix the errors.

Many education providers like this one are experimenting with modern ways to streamline their payment framework so students can more easily pay tuition, fees, and other debts.

The idea isn’t new — Cashnet, a Blackboard company, has provided market-leading secure transaction services to campuses for more than 25 years. Today, over 700 institutions use Cashnet’s PCI-compliant platform to electronically deliver bills, offer flexible tuition payment plans, and create online storefronts.

“Payments on campus have come a long way since we rolled out our first Cashiering product 30 years ago. Today, we as a higher education community are (and should be) focused on student success. It is essential that we work together to help students understand their options for meeting their financial obligations so they may matriculate without the difficulty of unmanageable debt. With the help of our campus partners, we have worked hard to leverage technology to empower students and their families to make better financial decisions as they seek to earn their degrees,” said Don Smith, Vice President of Payments Product Management at Cashnet.

In 2016, Blackboard increased Cashnet’s stake in the market with the acquisition of Higher One Holdings, Inc., which included new clients like Coppin State University, Pfeiffer University, the University of California-Davis, and the University of the Cumberlands, among others.

Cashnet’s platform reduces administrative costs by automating bill presentment and electronically delivering complete student accounts that detail new charges and payment history. The secure, single sign-on compatibility works within existing campus portals and makes it easy for students to access and use.

Accepted payment options include credit and debit cards, ACH, campus account cards, 529 plans, and foreign currency.

“Blackboard is focused on supporting institutions in their efforts to enable fundamental access to education,” said David Marr, President of Blackboard Transact, in a press release announcing the acquisition of Higher One Holdings. “Providing students and parents with a comprehensive set of tools that assist them in managing tuition payments is a critical piece of the access equation.”

25 Years of Payment Solutions for Every Campus Department

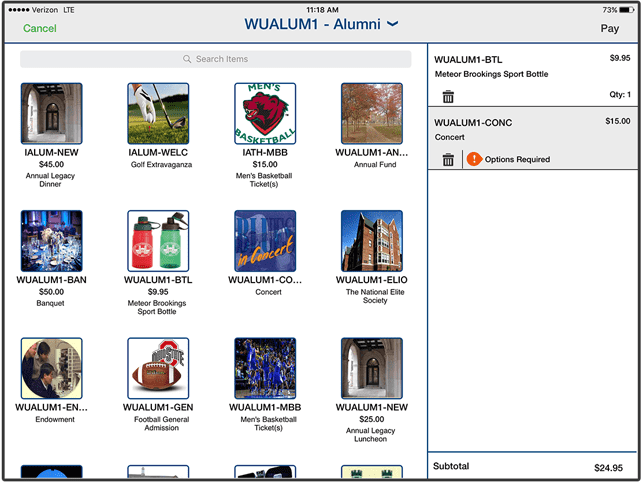

Cashnet’s services aren’t just for tuition billing. Departmental online storefronts can include a virtual shopping cart and payment pages with fully customizable inventory controls. Current clients use these storefronts to handle lab fees, study abroad trip payments, or other student expenses. Alumni portals make it easier to offer event tickets and other merchandise.

Cashnet’s departmental online storefront solutions can be tailored to current students or alumni.

Whether departmentalized or used across an entire campus, Cashnet’s payment solutions handle credit card reconciliation, chargebacks, refunds, and voice authorizations. The SmartPay clearinghouse offers a daily settlement to help boost liquidity.

Campus stores — similar to the one my daughter works for — can be fully integrated with the Cashnet Mobile Payments Application that turns an iPad® device into a fully functioning cash register capable of accepting in-person payments.

The application integrates with many ERP systems, including homegrown programs, and simplifies end-of-day balancing and reconciliation with bookkeeping functions.

To further extend its reach across campus, the application can be used to sell tickets or merchandise at campus-sponsored events like theater productions or sporting events.

An eRefund capability streamlines disbursing refunds like financial aid or general reimbursements. Students can sign up for direct deposits and receive disbursement notifications via email and/or text message.

Complete 529 Plan and International Payment Integration

University payment systems need to be flexible and compliant with the funds it accepts to meet the growing diversity of US campus populations.

More than 1 million international students are enrolled in US universities, which doesn’t include international enrollment in other institutions of higher learning. Many of these students rely on parents who pay for tuition and other fees in various currencies.

Cashnet’s payment solutions accept foreign currency payments through partnerships with Western Union and Flywire. Payments can be made in one lump sum or set up over a recurring payment plan.

As of March 2017, the US had approximately 12.2 million active 529 prepaid college plan accounts, with $266 billion in total assets. While the growth in new accounts has slowed, several states are offering tax breaks on funds invested in prepaid college programs to encourage new parents to start saving early.

As those 12.2 million accounts mature, the number of students using their proceeds to further their education will increase. Cashnet’s solutions prepare schools with add-on features that allow payments directly from supported 529 accounts.

Keeping More than 700 Campuses Certified and Compliant

Students are no longer willing to wait for the financial affairs office to pay their fees. A modern, always-connected world demands not only constant access to payment accounts, but the process must also be fast, easy, and flexible — not to mention secure.

Many international students pay in foreign currencies, and various forms of domestic payment options, like federal loans, 529 prepaid plans, and scholarships, which makes the task of managing payments and refunds overwhelming.

Cashnet, a Blackboard company, has spent the last 25 years managing the payment systems for colleges, universities, and other US schools. More than 700 clients currently use the company’s solutions to accept tuition and other fees, as well as manage departmental online storefronts, campus stores, and ticket options for campus events.

The extensive options cut out the paperwork and accounting that comes with receiving daily payments through multiple channels. Cashnet’s full PCI-compliance means it can accept credit, debit, and ACH payments with the latest technology that protects your brand against potential backlash from financial security breaches.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![When To Request a Higher Credit Card Limit ([updated_month_year]) When To Request a Higher Credit Card Limit ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/02/when-to-request-a-higher-credit-card-limit.jpg?width=158&height=120&fit=crop)

![6 Ways to Save on Credit Card Interest Fees ([updated_month_year]) 6 Ways to Save on Credit Card Interest Fees ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/11/Ways-to-Save-on-Credit-Card-Interest-Fees.jpg?width=158&height=120&fit=crop)

![12 Ways Credit Cards Help Save on Vacations ([updated_month_year]) 12 Ways Credit Cards Help Save on Vacations ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/05/Ways-Credit-Cards-Help-You-Save-on-Summer-Vacations.jpg?width=158&height=120&fit=crop)