Our experts and industry insiders blog the latest news, studies and current events from inside the credit card industry. Our articles follow strict editorial guidelines.

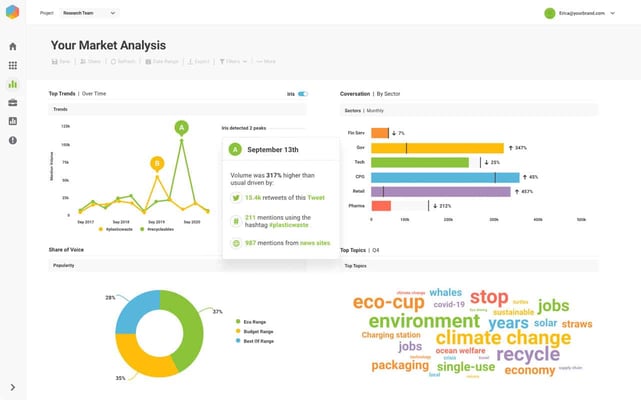

In a Nutshell: Consumers are talking about brands and products more than ever across social media and influencer channels. Brandwatch surfaces insights from those conversations through its suite of consumer intelligence and social media management tools and resources to make them actionable from a marketing perspective. Brands, agencies, and consultancies across every sector vertical, including financial services, rely on Brandwatch to help them tap constructively into the fast-changing social zeitgeist.

As social and influencer sites, forums, and blogs gain authority as spaces for brand and product discussions, so does the need for financial brands to understand and manage conversations and engagement.

Financial providers taking a proactive approach to brand and product management in the social space position themselves as share winners in a market where shifts in consumer sentiment and loyalty are accelerating.

Brandwatch is a leading technology provider for brands, including those in financial services, to engage in the social space. Through its comprehensive suite of consumer intelligence and social media management tools and resources, Brandwatch helps financial brands collect and understand millions of relevant posts, comments, and conversations, and convert insights into actions.

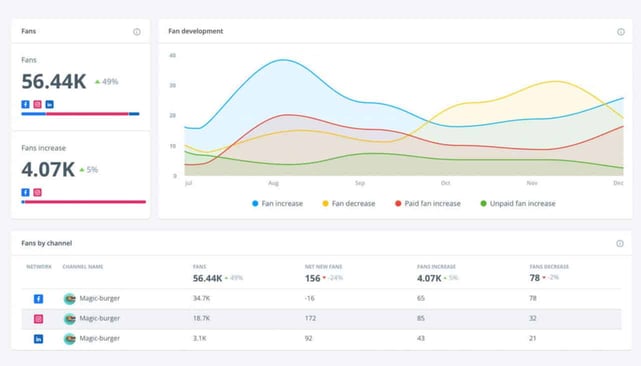

Researchers, analysts, marketers, and managers use Brandwatch to discover new trends before the competition, make smarter decisions, and respond to emerging threats in real time. Brandwatch also helps them manage engagement across channels more efficiently and collaborate across teams to ensure brand alignment and identify new opportunities.

“Our goal is to help brands and agencies distill down to what’s really relevant and important,” said Jeffrey Rosello, SVP of Customer Experience at Brandwatch. “From there, financial brands can take that information and action it into something that will have a net-positive impact for the consumer.”

But Brandwatch’s reach extends well beyond financial services, which is essential for understanding its capability and impact. The company works with every sector vertical in play across social, including retail, consumer packaged goods, media and entertainment, pharma and healthcare, tech, and education.

Many customers are brand-direct relationships, but Brandwatch also works with agencies and consultancies that leverage its solutions to deliver results for their end clients.

“People are talking more and more about brands, products, and services across social networks and blogs,” Rosello said. “We bring meaning to all that unstructured conversation data.”

Market Contextualization for Financial Providers

The financial services sector may be particularly in need of Brandwatch insights. The quick recent rise of fintech providers, instant investments, and digital currencies are symptoms of changes in consumer preferences, and banks need fresh energy to keep up. Brandwatch helps the tradition-bound sector stay relevant by moving the marketing needle forward.

To accomplish that, Brandwatch works with financial customers to understand what consumers are saying about them, assess whether their products and services resonate, and evaluate whether they evolve with consumer needs.

That’s true for conversations and activity even within the app space, where consumers are learning to manage and invest their money across apps such as Instagram and Tik Tok.

“The frequency with which these conversations are taking place, and the urgency around them, impel banks to listen more closely,” Rosello said.

Benchmarking is critical. Financial clients want to understand the nuances of product adoption and how consumers perceive their brands against competitors, and Brandwatch can analyze those variables.

To get there, Brandwatch’s offering looks mainly at organic customer behavior, probing the owned and earned media spaces to track conversational health — the emotions behind what people say.

Consumer Research learns whether sentiments are positive, negative, or neutral and how they evolve. It then connects the dots between how those conversations drive revenue by attributing them, for example, to lead funnel creation that’s happening on a website.

The power and reach of the tools mean insights reach decision-makers on time. Because consumers often take conversations around finances seriously, and the consequences of negative sentiment can be great, Brandwatch gives its customers the insight and clarity to respond effectively.

“Whether it’s a compliance concern or just a general perception, you want to make sure you’re responding in that real-time way,” Rosello said.

Assess and Manage Public Sentiment

Brandwatch organizes its solutions suite into two components. Both deliver value to the company’s relationships with financial providers.

The first, its consumer intelligence platform, draws on trillions of historical conversations dating back to 2010, with more than 500 million new conversations added in real time daily. Data from 100 million unique sites and billions of sources include official firehouse access to Twitter and other popular social destinations.

“We use Boolean logic to create queries that bring all this data in, and we go through an activation process that sets clients up for success,” Rosello said.

Queries alert, for example, to potentially risky or noncompliant conversations that could instigate a PR crisis if not quickly addressed. The platform automatically segments data to fit client needs and surfaces relevant insights at a glance.

Machine learning techniques train data sets and then apply learned logic across wider data sets collected over time. AI assistance removes the need for human intervention, so hours of human analysis happen in milliseconds to surface risk based on pre-established thresholds.

“If we see a shift in sentiment, we alert the client team accordingly,” Rosello said. There are a lot of ways for us to stay ahead of that.”

Social media management tools comprise the second side of the platform. When Brandwatch identifies a conversational moment warranting a response, management tools help brands push content out through their social channels. Or, when a heated conversation regarding previously published content surfaces, moderation tools facilitate the most appropriate response.

The financial services sector, in particular, benefits from built-in checks and balances that accommodate compliance processes before content goes out.

“Time to deployment for financial content typically has a bit of a longer runway because of internal approvals,” Rosello said. “We capture an entire audit trail to support the work if an examination were to happen.”

Engage Modern Consumers in Ways They Expect

Brandwatch uses its blog and webinar content, case studies and reports, and a weekly bulletin to inform customers and the public about social media marketing and other issues and trends that are shaping industries in real time.

Even with the staid reputation of the financial services industry overall, Rosello said many newer financial brands are surprisingly flexible and agile. More social-friendly or millennial-focused brands offer an active voice of engagement with their audiences.

“And their customers enjoy that,” Rosello said. “One of the biggest learning curves for the financial industry is thinking beyond legacy infrastructure and habits and getting in front of their consumers in ways they expect.”

Brandwatch helps by listening closely to customers, taking feedback, and acting on it. A dedicated account team for each client maintains a bidirectional flow of feedback and communications between the two parties.

One goal of these services and teams is to co-define success markers, which vary based on the composition and function of teams. For example, when Brandwatch works with business development folks focused on driving leads and improving revenue growth, success is about understanding how content delivery trends those numbers.

If the goal is to reduce the number of people calling in for help, the strategy is for the customer care team to use social media to create an enabling environment for the brand.

With an insight team interested in increasing brand perception or communicating brand goals to consumers, success is about measuring initial sentiment around those initiatives and then looking at whether conversation analysis and social media work drive an increase in positive conversation and awareness.

Brandwatch has the breadth of cross-sector experience to meet financial providers where they are in the marketplace and make any of these strategies work.

“Change is hard regardless of the sector,” Rosello said. “It’s just a matter of legacy institutions catching up and being willing to innovate in what they do.”

![6 Credit Strategies to Help You Financially Prepare for the Holidays ([current_year]) 6 Credit Strategies to Help You Financially Prepare for the Holidays ([current_year])](https://www.cardrates.com/images/uploads/2019/10/Holiday-Credit-Strategies-Feat.jpg?width=158&height=120&fit=crop)

![3 Credit Cards For Kids & Ways to Help Them Build Credit ([updated_month_year]) 3 Credit Cards For Kids & Ways to Help Them Build Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/03/Credit-Cards-For-Kids.jpg?width=158&height=120&fit=crop)

![12 Ways Credit Cards Help Save on Vacations ([updated_month_year]) 12 Ways Credit Cards Help Save on Vacations ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/05/Ways-Credit-Cards-Help-You-Save-on-Summer-Vacations.jpg?width=158&height=120&fit=crop)