Credit cards are a smart way to pay for your purchases. They are convenient, safe, and many can pack a large amount of buying power. When you are using your credit card to pay for pretty much anything, you can enjoy some great fraud protections that can help to keep your money safe from crooks and scam artists.

Believe it or not, credit cards may help you save money — if you use them wisely — since many of them offer attractive perks. With some credit cards, the use of the account can help you earn valuable purchase rewards. These rewards can add up to free flights and travel, statement credits, or just some extra cash to put back into your bank account.

Yet as helpful as your credit cards may be, sometimes it’s probably best to keep them tucked comfortably inside your wallet. Here are some purchases you should not make with a credit card, and the consequences you may face if you do so.

Purchases You Can’t Afford to Pay Off Right Away

The number one key to using credit cards successfully is to make sure you never charge more on your account than you can afford to pay off in full by your statement due date. If you use your credit card to make purchases you can’t afford to pay off quickly, this habit can cost you money in the form of interest.

Worse yet, if you charge a high percentage of your available credit limits, you may unknowingly inflict damage on your credit scores as well, even if the bill is always paid on time each month.

Although any purchase could technically be a bad idea if you can’t afford to pay it off immediately, here are a few examples of credit card purchases that may lead to trouble:

- Medical Bills

- School Tuition

- Student Loans

- Property Taxes

- Vacations

- Business Equipment

- Vehicles

- Down Payments

- Cash Advances

Many of the above are very large ticket items. The merchant or vendor is likely going to charge you a fee to cover its interchange costs, which is the fee it pays to accept payments via a credit card. So, you may be tacking an extra few percentage points on top of the retail cost of your purchases, thus making them even more expensive.

Of course, even small everyday purchases can get you into trouble with a credit card. The average credit card interest rate hovers somewhere around 19%.

If you don’t pay your full balance by the due date, interest fees will kick in on your account. Once interest is added, you’ll start to pay much more for any purchases you made using your credit card.

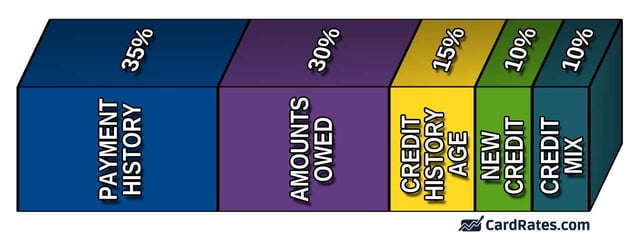

When you start charging more than you can pay off on a credit card, the account balance on your credit reports may grow each month. This leads to an increase in your credit utilization ratio. Credit scoring models, like FICO and VantageScore, pay close attention to your credit utilization because it is an excellent indicator of elevated credit risk. In fact, as a part of the amounts owed factor, it can impact as much as 30% of your credit score.

As a result, when your utilization ratio goes up, your credit scores are likely to go down. The good news is that once you bring your utilization rate back down again by paying down your debt, your scores are likely to bounce back after your credit reports have been updated.

Payments on Other Credit Cards

It can also be a bad idea to use one credit card to “pay” other debts. For example, many credit card issuers will allow you to transfer balances from other credit cards to your account. Sometimes card issuers will even offer you an introductory balance transfer rate — usually as low as 0% if you have great credit — for a certain period of time as a way to entice you to move debt over to their bank.

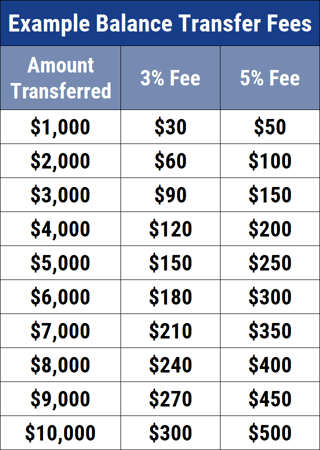

Of course, while a low-rate balance transfer offer may be appealing, you should understand that it isn’t free. You’ll typically have to pay a fee for the privilege.

Balance transfer fees can vary from issuer to issuer, but they commonly hover around 3% to 5% of the funds you’re transferring. So, if you transfer $5,000 and the transfer fee is 5%, it will cost you $250 to move your credit card debt over to the new account.

There’s nothing wrong with using a balance transfer strategically as part of a plan to save interest and get out of credit card debt. In fact, it can be a smart move. However, if you’re rolling credit card balances over from one account to another as a way to get out of making your monthly payment, you may be setting yourself up for a financial disaster down the road.

Balance transfer fees can add up if you use them frequently. You should only pay one credit card with another if you plan on taking advantage of a low-rate offer.

This strategy may help you reduce your interest rate and get out from under expensive credit card debt more quickly. If you abuse the balance transfer process, however, it won’t save you money.

If You Can’t Pay It Off Quickly, Don’t Charge It

Ultimately, it doesn’t matter what type of purchases you’re making with your credit card as long as you can make a firm commitment to pay your bill in full every month. You can charge small and large ticket items without fear — as long as you know, without a doubt, that you have the money set aside to pay them off right away.

On the other hand, when you start leaving a balance on your credit cards, it can potentially lead to money problems caused by spiraling debt. Plus, if your credit utilization ratio on a credit card climbs, you could be risking credit score damage and all of the negative consequences that can come with it as well.

Low credit scores can make it hard to qualify for a loan, purchase a vehicle, or even secure a place to live. They can also lead to higher insurance premiums and larger interest rates when you borrow money.

No purchase is worth risking the health of your credit and finances. If you can’t afford to pay off a purchase right away, it’s best to either wait to make it or find a better way to finance the expenses than a high-interest credit card.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![4 Best Credit Cards for Jewelry Purchases ([updated_month_year]) 4 Best Credit Cards for Jewelry Purchases ([updated_month_year])](https://www.cardrates.com/images/uploads/2015/11/Jewelry-Credit-Cards.jpg?width=158&height=120&fit=crop)

![9 Best Credit Cards for Large Purchases ([updated_month_year]) 9 Best Credit Cards for Large Purchases ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/10/largepurchase.png?width=158&height=120&fit=crop)

![12 Best Credit Cards for Electronics Purchases ([updated_month_year]) 12 Best Credit Cards for Electronics Purchases ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/12/Best-Credit-Cards-for-Electronics-Feat.jpg?width=158&height=120&fit=crop)

![3 FAQs: ATM Card vs. Debit Card vs. Credit Card ([updated_month_year]) 3 FAQs: ATM Card vs. Debit Card vs. Credit Card ([updated_month_year])](https://www.cardrates.com/images/uploads/2016/05/atm-card-vs-debit-card-vs-credit-card--1.png?width=158&height=120&fit=crop)

![Can You Pay a Credit Card with a Credit Card? 3 Ways Explained ([updated_month_year]) Can You Pay a Credit Card with a Credit Card? 3 Ways Explained ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/02/card-with-card-2.png?width=158&height=120&fit=crop)

![3 Ways Closing a Credit Card Can Hurt Credit ([updated_month_year]) 3 Ways Closing a Credit Card Can Hurt Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/10/closecard.png?width=158&height=120&fit=crop)

![3 Key Differences: Charge Card vs. Credit Card ([updated_month_year]) 3 Key Differences: Charge Card vs. Credit Card ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/03/charge-card-vs-credit-card.jpg?width=158&height=120&fit=crop)