Our experts and industry insiders blog the latest news, studies and current events from inside the credit card industry. Our articles follow strict editorial guidelines.

In a Nutshell: Like many options traders in the early 2010s, Ed Kaim started by tracking trades on a spreadsheet. But as his strategies grew more sophisticated, his spreadsheets couldn’t keep up. In 2014, Kaim leveraged his expertise as a tech entrepreneur to create Quantcha, a suite of power tools for successful options investors. Quantcha tracks positions based on real-time market data, incorporates trade analytics, and enables users to refine strategies through InvestOps. With Quantcha, traders at all levels can better understand how their plans will play out.

The basics of puts and calls in options trading are reasonably straightforward, even for unseasoned investors. Put options give the buyer the right, but not the obligation, to compel a stock sale at a specified strike price and expiration date. Calls work in the opposite direction, compelling a purchase.

The bet on puts is that the stock will decline below the strike price. The bet on calls is that the stock will rise.

Either way, options are hedges against unpredictability. If the stock doesn’t conform to expectations, the holder can decline to exercise the option and only lose the premium — the option’s price.

But scaling up options and buying and selling them as part of a larger strategy is another matter. As a new options trader in the early 2010s, tech entrepreneur Ed Kaim followed the crowd and used a spreadsheet to handle the complex arithmetic and track his trades.

That could only take him so far because his spreadsheets couldn’t integrate real-time market data and perform the analytics necessary to determine the best strategy from a given position.

So in 2014, Kaim put his tech startup skills to work and built Quantcha, a search engine for optimal options trades that integrates analytical tools to perform trades with confidence.

Quantcha includes screeners to scan the entire market for stocks and trades, customizable alerts to stay abreast of specified market events, a portfolio and book manager, and tools for in-depth tracking of current and past transactions.

“I wanted to bring in market data, execute trades, analyze P&Ls, and compare thousands of theoretical trades simultaneously,” Kaim said. “Quantcha was born from that idea.”

A Modern Options Trading Solution

At first, Kaim assumed he was building a tool for his use only. But when he showed his trader friends what he was doing, they wanted to use it too.

That was a testament to the less-than-desirable state of trading software in the early 2010s. Kaim’s institutional investor friends commented that Quantcha, even in its early stages, rivaled the tools they used internally, which had cores built in a bygone era that developers continually added to and subtracted from.

“The nature of trading software was to start with some legacy code and just rev it year after year,” Kaim said. “But it’s still this massive, clunky application with a ton of stuff that’s not super relevant to the way you trade today.”

Quantcha is an entirely different animal — a lean, web-based, mobile-friendly platform that has improved over time.

“Our tools were cutting-edge when we built them,” Kaim said. “And we’ve evolved to keep up with the latest technology, support the latest trends, add additional safeguards, and incorporate more customer feedback.”

The result is a multifaceted, task-based environment that handles diverse trading scenarios and supports the most sophisticated strategies without alienating novices.

A free trial option enables users linked to a supported brokerage account to receive full subscription access for the first five days of each month. Personal accounts offer real-time account, trade, and market access to those with linked brokerage accounts and intraday delayed market data to all others. Unlimited accounts add commission-free stock and options trading with a required Tradier Brokerage account.

“A lot of trading platforms, especially the brokerage tools, focus exclusively on how you get into a position and then manage it until you close it,” Kaim said. “For us, that’s the tip of the iceberg.”

InvestOps Enables Dynamic Monitoring and Execution

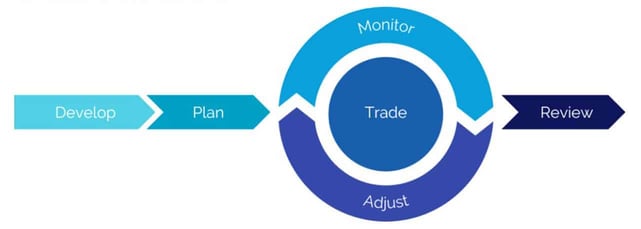

InvestOps is the reason. Quantcha provides a structure for investors to learn from the past and evolve through InvestOps.

InvestOps is a component of Quantcha Learn, Quantcha’s collection of free interactive training courses on investing, options trading, and the Quantcha platform. Its inspiration is the concept of DevOps in Kaim’s world of tech development, where software development and operations are intertwined.

In the DevOps approach, software teams closely monitor use patterns, cross-collaborate, and quickly iterate new versions. InvestOps is Quantcha’s way of engendering a similar culture of creativity and growth among its users.

“In DevOps, you don’t just build software, throw it over the wall, and call it done,” Kaim said. “And in InvestOps, you don’t open a trading position, throw it over the wall, and wait for it to exit.”

Based on Kaim’s years of experience, InvestOps is not specific to options investing. And it isn’t a set of recommendations about which trades to make but a structured approach to building and managing an investment plan.

InvestOps calls on options traders to actively monitor their positions and manage their trades. Traders often sell an option and buy a new one to replace it because they’re rolling a position. As events progress, they need to hedge their books based on dynamic metrics that are important for understanding the health of their accounts.

That’s why InvestOps materials start by helping investors determine a trading philosophy. Then, they express that view through their trades, and InvestOps helps them outline trade positions, entry prices, exit conditions, and adjustment strategies.

Through the cycle of active trading, they adjust their books over time. Upon exit, a postmortem review analyzes the results of the investment and process.

“You can go back and learn about your investments and really understand the way you trade and how you stayed healthy,” Kaim said.

Accessible Tools for Diverse Investors and Strategies

InvestOps is also flexible enough to accommodate diverse investors and strategies, ensuring the broadest potential user base for Quantcha.

Institutional investors use Quantcha to trade sophisticated, “delta-neutral” books in which they seek to profit off the time value of their investments, buying and selling to protect themselves from small movements up and down in the underlying stock.

Quantcha helps them instantly understand their overall position. Alerts help them make the right moves at the right time.

At the other end of the user spectrum are folks who are newer to options investing. They tend to be more speculative than other traders because they’re seeking earnings trades and betting they’re right on stock ups and downs.

Quantcha helps them understand when to make those trades. Alerts indicate when forecasting models are unlikely and act as guardrails to help people protect their capital. The goal is to nudge people toward being more risk-aware.

Traders who sell to make a profit on an option’s premium are the platform’s bread-and-butter customers. They’re looking to make an incremental profit month after month based on calculations that take price, volatility, time value, and intrinsic value into account.

“You want to sell premium to the people speculating wildly,” Kaim said. “There’s almost always money to be made there.”

Meanwhile, after almost 10 years online, Kaim and the Quantcha team continue to invest time and energy into the platform. Integrations with major brokers, such as TD Ameritrade and E-Trade, offer Quantcha users immediate access to their portfolios so they can do all their work within the platform. Quantcha remains focused on helping traders transition seamlessly from their brokerage platforms.

“The way we build our tools, it’s super easy to ramp up,” Kaim said. “We’ve evolved to the point where we’re really the only full end-to-end options trading platform.”

![Chase Refer-A-Friend Offer: Earn Bonus Points ([updated_month_year]) Chase Refer-A-Friend Offer: Earn Bonus Points ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/05/refer.png?width=158&height=120&fit=crop)

![12 Credit Cards that Offer Free Checked Bags ([updated_month_year]) 12 Credit Cards that Offer Free Checked Bags ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/02/Credit-Cards-that-Offer-Free-Checked-Bags.jpg?width=158&height=120&fit=crop)

![11 Banks That Offer Secured Credit Cards ([updated_month_year]) 11 Banks That Offer Secured Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/12/Banks-That-Offer-Secured-Credit-Cards.jpg?width=158&height=120&fit=crop)

![Capital One Quicksilver Card: Review & Options ([updated_month_year]) Capital One Quicksilver Card: Review & Options ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/03/Capital-One-Quicksilver-Card-Review.jpg?width=158&height=120&fit=crop)

![8 Prepaid Debit Cards with Free Reload Options ([updated_month_year]) 8 Prepaid Debit Cards with Free Reload Options ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/01/Prepaid-Debit-Cards-With-Free-Reload.jpg?width=158&height=120&fit=crop)

![Citi Credit Card Preapproval Options ([updated_month_year]) Citi Credit Card Preapproval Options ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/03/Citi-Credit-Card-Preapproval.jpg?width=158&height=120&fit=crop)

![Apply For a Prepaid Card: 5 Best Card Options ([updated_month_year]) Apply For a Prepaid Card: 5 Best Card Options ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/09/Apply-For-a-Prepaid-Card.jpg?width=158&height=120&fit=crop)