In a Nutshell: The electronic payments space has made considerable advances in security and affordability over the last two decades. Many of those improvements were possible because early adopters like Charge.com did away with egregious application and setup fees to make their services more affordable to small businesses and startups. In fact, Charge.com’s processing fees, which start at 0.25%, are among the lowest in the industry. With payment processing solutions for nearly any kind of business, Charge.com can help business accept payments via online virtual terminals, in-person keypad terminals, and even smartphones. //

Twenty years ago, online retail was still in its infancy and most consumers weren’t yet comfortable with transmitting their credit card or bank account information via the internet. A few businesses provided gateways for companies to accept electronic payments online, but it wasn’t cheap.

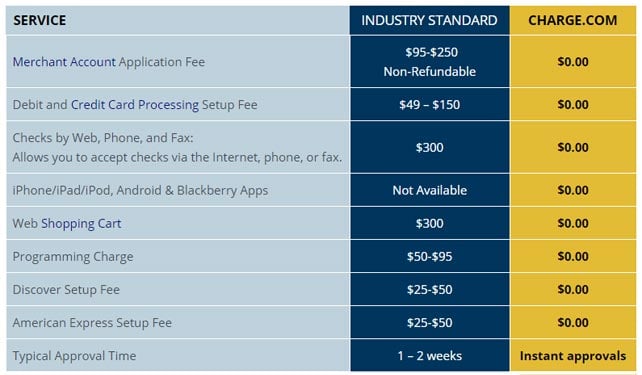

The industry standard was to charge a nonrefundable application fee, typically between $200 and $500, and, upon approval, merchants would receive a second bill — this time for setting up the account.

The risks and high costs associated with just submitting an application kept smaller brick-and-mortar businesses from creating an e-commerce presence, and many of them vowed to remain offline until the standards changed.

Both merchants and the payment processing industry suffered, so Charge.com decided to change what it saw as a broken system. More than two decades later, the company continues to lead innovative change and bring affordable processing services to US businesses of all sizes and verticals — both online and in person.

“We were among the first, if not the first, company to waive setup and application fees,” said Greg Danzig, President of Charge.com. “Most merchants, especially startups, were hesitant to pay just to submit an application. One of the first things we did, early on, was remove the fee and the barrier it creates between us and the merchant.”

After waiving excessive fees, Charge.com made up for the lost revenue through increased transaction processing. As the company continues to grow, it still doesn’t charge application or setup fees and can process transactions for as low as 0.25% — one of the lowest rates in the industry.

But don’t expect the lower rates to result in a cheaper experience. Charge.com understands that its solutions — at any price point — are only as good as its security. To maintain its reputation as a forerunner in the industry, the company invests heavily in the latest security offerings to ensure it handles every transaction in the most professional way.

“Everything that we offer is PCI-certified and comes with the latest EMV equipment and technology,” Danzig said. “Our payment gateways also have the highest level of commercially available encryption.”

Multiple Services Cater to Businesses in Any Vertical

Charge.com can provide payment processing solutions for almost any business vertical. The company currently processes payments for online retailers and subscription companies as well as traditional retail, service, professional, and restaurant businesses.

The company’s internet software allows for automated processing of website orders or manual processing for email, telephone, fax, mail-order, and face-to-face sales. Using the web-based virtual terminal, merchants can access all of the features of an electronic keypad terminal and more.

The electronic keypad terminal is one of Charge.com’s most popular solutions. This terminal, similar to those found in nearly every brick-and-mortar business, allows merchants to sell face-to-face at a single location by swiping the customer’s credit card, or inserting the EMV chip, through the terminal. The terminal prints receipts through thermal paper, which requires no ink.

Charge.com offers a discounted processing rate to clients who process at least 70% of their orders through the keypad terminal.

The growth of mobile merchants — think festival vendors, plumbers, installers, or flea market and trade show merchants — gave rise to a need for mobile credit card processing. Charge.com offers solutions that allow clients to turn their smartphone into a keypad terminal that processes credit cards with immediate approval responses.

“Those are, by far, our most popular options,” Danzig said, “but we have some other niche-type offerings, like point-of-sale solutions for restaurants. We want to make sure that we’re capable of handling whatever the customer needs.”

Secure, Easy-to-Use Terminals and Systems

Security concerns tend to increase among merchants and consumers whenever a corporate data breach or credit card data theft is reported. Customers want to know they can trust whomever accepts their electronic payments, and Charge.com takes that trust seriously.

Charge.com offers echeck processing services, which helps businesses meet the strict approval requirements set by credit card companies for payment processing approval. Despite the requirements, Danzig said Charge.com maintains one of the highest approval ratings in the industry thanks to its diverse menu of solution options.

“We offer so many different solutions that we can get just about any legal business up and running and accepting some form of electronic payment,” he said. “We have very, very close to a 100% approval rate when you combine our echeck and credit card solutions.”

In addition to the security Charge.com ensures, the terminals it provides are designed to be as user-friendly as possible. This means merchants don’t have to spend time learning the ins and outs of a new system before they can accept payments. Danzig said most merchants can be up and running as soon as they have their equipment in place.

“Our virtual terminals and web-based systems are designed with useability in mind,” Danzig said. “Both are easy to use and that’s important to us because we want to make the process of working with the systems as simple as possible.”

Charge.com Can Boost Your Sales by as Much as 500%

Charge.com says that just adding secured electronic payment processing to your business model can increase sales by 50% to 500%. The company’s multiple product offerings give consumers more choice in how they would like to pay for your goods and services and helps attract repeat patronage.

The processor’s affordable rates and ease of use make it a popular choice for businesses of all types. Charge.com has worked with small startups and has even handled incoming contributions for presidential campaigns.

“The majority of our clients are small to medium-sized businesses,” Danzig said. “We don’t target any specific vertical or business size because we feel like we have something to offer for just about anyone who needs payment processing.”

As one of the first companies in the electronic payments space, Charge.com has cemented its reputation for security and affordability while making it easier for entrepreneurs to get their businesses started and keep them thriving.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![15 Cheap Credit Cards: Low Interest & $0 Fees ([updated_month_year]) 15 Cheap Credit Cards: Low Interest & $0 Fees ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/12/cheap.png?width=158&height=120&fit=crop)

![What is a Charge Card? Definition + 3 Top Cards ([updated_month_year]) What is a Charge Card? Definition + 3 Top Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2016/08/what-is-a-charge-card--1.png?width=158&height=120&fit=crop)

![3 Key Differences: Charge Card vs. Credit Card ([updated_month_year]) 3 Key Differences: Charge Card vs. Credit Card ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/03/charge-card-vs-credit-card.jpg?width=158&height=120&fit=crop)

![8 Credit Cards for Approval With Old Charge Off ([updated_month_year]) 8 Credit Cards for Approval With Old Charge Off ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/12/shutterstock_1523119754.jpg?width=158&height=120&fit=crop)

![7 Credit Cards for After Collections & Charge-Offs ([updated_month_year]) 7 Credit Cards for After Collections & Charge-Offs ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/03/Best-Credit-Cards-After-Collections-or-Charge-Offs.jpg?width=158&height=120&fit=crop)

![7 Travel Cards with No Foreign Transaction Fee ([updated_month_year]) 7 Travel Cards with No Foreign Transaction Fee ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/06/foreign.png?width=158&height=120&fit=crop)