Credit cards are a convenient and effective way to pay for all sorts of goods or services without having to carry cash. Nothing’s easier than pulling out that little piece of plastic when it comes time to settle the bill.

However, credit cards can also cause problems if you don’t carefully monitor your spending and budget. One alternative used by people who either can’t qualify for a credit card or choose not to use credit cards is to rely on a reloadable card — also known as a prepaid card.

Although they are often called reloadable credit cards, this term is a bit of a misnomer. In fact, these aren’t credit cards at all, but rather they act more like a prepaid debit card. The money you are spending when you use one of these cards is your own cash — either deposited by you into the card account or added to the account by payroll direct deposit or government benefits deposit.

Continue reading to see our list of favorite reloadable cards, or skip ahead to the benefits of choosing a prepaid card for purchases.

Best Overall: Brink’s Armored™ Account

Best For Everyday Use: NetSpend® Visa® Prepaid Card

Best For Direct Deposit: PayPal Prepaid Mastercard®

Best For Flexibility: NetSpend® Visa® Prepaid Card

Best For Budgeting: Bluebird® American Express® Prepaid Debit Account

Best For Cash Back: Serve® American Express® Prepaid Debit Account

Best For Saving: The Mango Prepaid Mastercard®

Best For Walmart Shoppers: Walmart MoneyCard®

Best For Families: Greenlight – Debit Card For Kids

Best: Overall | Everyday Use | Direct Deposit | Flexibility | Budgeting | Saving

1. Brink’s Armored™ Account: Best Overall

The Brink’s Armored™ Account is our top overall pick for reloadable cards, as its simple online interface and market-leading mobile app make it super-easy to reload funds. This Mastercard prepaid card also charges very little in the way of fees compared to its competitors, making it an attractive option for those who need the flexibiity of a reloadable card on the cheap.

Brinks does not require a credit check, so your credit history does not impact your ability to get the card. The best part? Cardholders can earn cash-back credit via the card’s Payback Points program, which offers simple enrollment and easy-to-follow points tracking.

2. NetSpend® Visa® Prepaid Card: Best for Everday Use

The NetSpend® Visa® Prepaid Card charges no late fees or interest charges and comes with the PayBack Rewards℠ program, which enables cardholders to earn cash back on many everyday purchases. By using this Visa prepaid card for purchases rather than your bank debit card, you could accrue hundreds in cash back rewards.

The card also boasts a handy mobile app, where you can set up account alerts, check your balance, and view the rewards you’ve earned to date.

3. PayPal Prepaid Mastercard®: Best for Direct Deposit

With the PayPal Prepaid Mastercard®, cardholders can receive their paychecks and/or benefits up to two days earlier than payday, which certainly comes in handy when it comes to paying bills on time.

The PayPal Prepaid Mastercard® card also features no late fees, no interest charges, and no minimum balances. It can be used everywhere Mastercard is accepted, including ATMs, grocery stores, utility companies, online subscriptions, and other purchases. In other words, if you need to pay a bill, the PayPal Prepaid Mastercard® is a great reloadable option for doing just that.

4. NetSpend® Visa® Prepaid Card: Best for Flexibility

The NetSpend® Visa® Prepaid Card offers its users all the convenience of a Visa-backed debit card, plus the flexibility of three different usage plan options. The NetSpend Pay-As-You-Go plan comes with no monthly fee, but does charge a small purchase fee each time it’s used and $2.50 ATM withdrawal fees.

This plan may be right for those who use the card minimally for purchases and withdrawals. The NetSpend FeeAdvantage™ and Premier FeeAdvantage™ plans offer no transaction fees, but charge a $9.95 and $5.00 per month plan fee respectively.

All of NetSpend’s card plans allow for no-fee direct deposit, along with free online balance inquiries. Users can qualify for the FeeAdvantage plan with a monthly direct deposit in the amount of $500 or more.

5. BlueBird® by American Express®: Best for Budgeting

The Bluebird® American Express® Prepaid Debit Account is as close to a no-fee card as we’ve found. With no monthly or annual fees, no transaction or purchase fees, no bill pay fees, and no initial card fee if you order online, the Amex BlueBird Card can save regular users a lot of money.

Additionally, there are no ATM fees if you use one of the more than 25,000 MoneyPass® ATM locations. But perhaps the best feature of the BlueBird Card is the set of personal finance and money management tools that comes with it. Using the Insight® app lets you categorize, track and set spending limits for up to four separate cards. You can also monitor and manage your account from anywhere. In fact, the BlueBird Card is a great way for anyone to establish or relearn good budgeting and money management habits.

6. American Express® Serve®: Best for Cash Back

The Serve® American Express® Prepaid Debit Account is one of the only prepaid cards that offers unlimited 1% cash back on every dollar you spend shopping in stores or online. It does charge a monthly fee of $5.95 and up to $3.95 for reloads, but this may be well worth the cost if you use your card frequently.

In addition, there are no ATM fees when you withdraw cash from a MoneyPass ATM, and online bill paying is also free. In fact, there are very few additional fees with the Amex Serve card, making it a great go-to card for active users. Oh, and you can’t beat cash-back rewards that are instantly available as soon as you earn them.

7. The Mango Prepaid Mastercard®: Best for Saving

Is it a savings account or a prepaid card? Turns out The Mango Prepaid Mastercard® is both. Sporting an impressive 6% annual percentage yield (APY) on deposits up to $5,000, the Mango card can actually earn you money while you spend.

Of course, there are some minor stipulations to earn your 6% interest, such as having direct deposit amounts totaling at least $800 each month and maintaining at least $1 in your account at the end of the month. The Mango card is free to sign up, but it does charge a monthly fee of $3 and ATM fees of $2 — so it’s a good card for someone who doesn’t make frequent withdrawals and maintains a fairly large balance (so the interest can offset the fees).

8. Walmart MoneyCard®: Best for Walmart Shoppers

The Walmart MoneyCard®, issued by Green Dot Bank, offers cash back rewards at Walmart, whether you shop online or in store, and at Walmart gas staions.

Additional Disclosure: Walmart MoneyCard® is a debit card offer.

*Please see site for full terms and conditions.

Here’s an example of just how much you could save with this card: Say you deposit cash onto the card, shop for groceries on Walmart.com and do curbside pickup, which would earn you the top cash back rate. If you spent $100 a week on groceries, or $5,200 a year, that would net you $156 in cash back just for using the card. You would have to deduct the monthly fee from your net earings, but you’d still come out ahead by about $84 a year, unless you arrange a direct deposit of $500+ a month to your account, in which case the fee is waived.

9. Greenlight – Debit Card For Kids: Best for Families

The Greenlight – Debit Card For Kids‘s best feature is its mobile app that lets parents transfer money to their kids’ accounts for chores, allowance, or any other reason. Parents can set spending limits and restrictions, and the app incentives saving with cash back rewards.

Kids can even get a personalized card by uploading a photo of their choice. These debit cards also come with a chip for extra-secure transactions, a rare feature of prepaid cards. But unlike the other cards on this list, you do have to pay a small fee for each debit card you order.

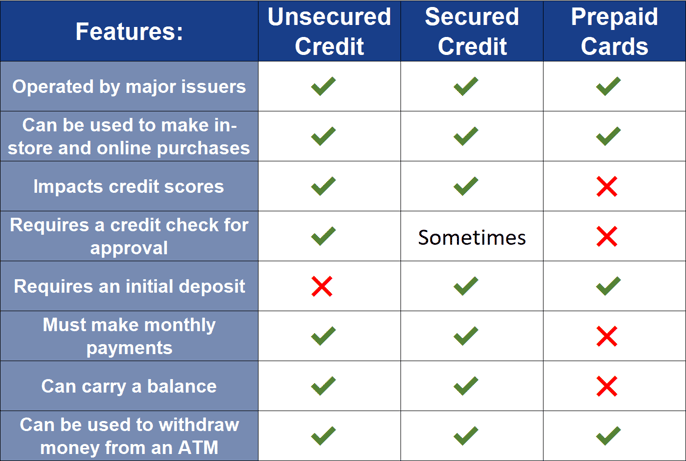

Reasons to Choose Prepaid Over Credit

There are many reasons people choose a reloadable prepaid card over a credit card. First, a prepaid card requires no credit check or other qualification.

Second, a prepaid card charges no interest and no late payment fees. Third, and perhaps most importantly, a prepaid card can function in many of the same ways as a bank account. This is an extremely appealing attribute for many.

So, are these cards really worth looking into? And more to the point, can they save people money?

It all depends on how you plan to use your reloadable or prepaid card. Some cards charge ATM fees, which can make them more expensive if you frequently withdraw cash. Others have no ATM fees but may charge monthly or deposit fees.

Still, others can be free of most fees altogether if you choose to direct deposit your payroll or benefits checks. A rare few of them may even pay you interest on the money you deposit in the card account, just like a savings account.

But if you’re interested in avoiding credit card interest fees, saving money on check-cashing fees, and still enjoying the benefits and convenience of a card, then a prepaid card may be right for you.

Reasons to Choose Credit Over Prepaid

The main thing to keep in mind when considering a reloadable prepaid card is that these cards don’t appear on your credit report like a standard credit card does, which means they won’t help you build or rebuild your credit. So if that’s a priority for you, then a prepaid card may not be the best choice.

You can alternatively consider a secured credit card that functions similarly to a prepaid card in that you must deposit money to use the card. But the difference is that with a secured card, your cash deposit is the collateral necessary to open the line of credit — not what you get to spend. But you’ll receive your deposit back when you either close the account or are upgraded to an unsecured credit card.

Secured cards are generally reserved for people who have no credit or bad credit, which is why cash collateral is required. The card issuer will keep your deposit if you fail to make payments on the card.

Prepaid cards are not reported to the credit bureaus like credit cards are. A secured card will report your card activity to each credit bureau, which will then appear on your credit reports. With on-time payments and a low credit utilization ratio, you’ll be on your way to an improved credit score.

You can’t set up direct deposit with secured cards, though, so if you’re looking for more of a credit union or bank account alternative and just need the card to make purchases, a prepaid card can be a good choice.

Curb Overspending with a Reloadable Prepaid Card

Having a reloadable card that you can use just like a credit card can be a great way for many folks to manage their money. Reloadable cards can be a viable alternative to a checking account, helping to avoid check-cashing charges and other fees. Some of these cards even allow you to receive your payroll check a day or two early.

Prepaid cards offer the convenience of swipe-and-go purchasing, but won’t get you into debt like a credit card might. Many prepaid cards let you track your activity on a smartphone app, so you always know where your finances stand.

In that way, using a prepaid card can actually help you keep an eye on your spending patterns, and make you carefully consider your purchases. All good things when it comes to building positive financial habits.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![7 Best Reloadable Visa Cards ([updated_month_year]) 7 Best Reloadable Visa Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/10/Reloadable-Visa-Cards.jpg?width=158&height=120&fit=crop)

![6 Best Reloadable Debit Cards ([updated_month_year]) 6 Best Reloadable Debit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/11/7-Best-Reloadable-Debit-Cards.jpg?width=158&height=120&fit=crop)

![7 Best Prepaid Debit Cards for Bad Credit ([updated_month_year]) 7 Best Prepaid Debit Cards for Bad Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/08/shutterstock_609135914-edit1.jpg?width=158&height=120&fit=crop)

![8 Free Prepaid Credit Cards ([updated_month_year]) 8 Free Prepaid Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/03/Free-Prepaid-Credit-Cards.jpg?width=158&height=120&fit=crop)

![7 Prepaid Cards That Build Credit ([updated_month_year]) 7 Prepaid Cards That Build Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/03/Prepaid-Cards-That-Build-Credit.jpg?width=158&height=120&fit=crop)

![7 Best Credit Cards for Buying Gift Cards ([updated_month_year]) 7 Best Credit Cards for Buying Gift Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/11/Best-Credit-Cards-for-Buying-Gift-Cards-Feat.jpg?width=158&height=120&fit=crop)

![7 Best Prepaid Debit Cards With Direct Deposit ([updated_month_year]) 7 Best Prepaid Debit Cards With Direct Deposit ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/02/Prepaid-Debit-Cards-with-Direct-Deposit--1.jpg?width=158&height=120&fit=crop)

![7 Prepaid Debit Cards With Mobile Deposit ([updated_month_year]) 7 Prepaid Debit Cards With Mobile Deposit ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/08/Prepaid-Debit-Cards-With-Mobile-Check-Deposit.jpg?width=158&height=120&fit=crop)