Opinions expressed here are ours alone, and are not provided, endorsed, or approved by any issuer. Our articles follow strict editorial guidelines and are updated regularly.

Credit card users make a mind-boggling number of daily transactions every year. The figures are astounding, whether you’re looking at what’s happening in the United States or in countries across the globe.

According to data collected by Capital One Shopping, in 2022, US credit card transactions totaled 54.8 billion. That breaks down to:

- 150.15 million per day

- 6.25 million per hour

- 104,274 per minute

- 1,739 per second.

To further illustrate the magnitude of credit card transactions, here is more data about what’s going on locally and in far-flung locations, as well as how it breaks down by credit card brand. By getting a sense of these trends, you’ll have a richer idea of how to use credit cards in a way that will help you get ahead.

In the US | Worldwide | By Brand

Credit Card Transactions in the US

The Nilson Report found that the eight largest issuers of Visa, Mastercard, American Express, and Discover cards in the US generated $4.642 trillion in purchase volume in 2023. That accounts for 79.76% of the industry total.

If you divide that figure by 365, the results show that more than $12.7 billion in purchase volume in the US every day.

Modern credit cards were established in the US in 1950 and their popularity has grown dramatically since. Americans today use their credit cards liberally, and when the transactions are broken down into a variety of different categories, the facts become even more revealing.

According to the latest data (2021) collected by the credit card processing company Shift:

- 1.06 billion credit cards are currently in use in the US

- 70% of people have at least one credit card.

- 14% of Americans have a minimum of 10 credit cards.

- When making a purchase, 40% of Americans will select credit cards over other types of payment methods.

- Most Americans say they are planning to abandon cash, as 60% believe the US will soon transition into a cashless society.

- The cost of credit is high. The average US cardholder spends $753.80 each year in interest charges.

The Federal Reserve Bank of San Francisco made more discoveries in its 2023 Diary of Consumer Payment Choice report:

- The share of payments made using cash declined slightly from 2020 and 2021 to 18% of all payments.

- The share of in-person purchases and person-to-person payments remained steady since 2020 at 81%.

- Consumers have continued to use credit cards more often, and they were the most used payment method in 2022.

- More than 90% of respondents said credit and debit cards are usually accepted for making payments, but only 82% said cash was accepted.

In 2023, the Federal Reserve Bank of Atlanta published its annual Diary of Consumer Payment Choice report, which analyzed the data from the previous year:

- US consumers made 39 payments per month on average, most of which were by credit card or debit card (31% of the payments were by credit card and 29% by debit card).

- The total value of payments per consumer per month was $5,029.

- 83% used cash in the past 30 days, down from 85% in 2021.

- Two-thirds of consumers used an electronic way to pay from a bank account in the past 30 days, the same as in 2021.

- Two-thirds of consumers adopted an online payment account such as PayPal, Venmo, or Zelle.

- Almost half of consumers reported that they had been offered buy now, pay later options in the prior 30 days, up from one-third in 2021.

Contactless transactions are definitely on the upswing, found a 2023 Marqeta State of Payments report.

- 80% of US consumers reported using peer-to-peer payment transactions

- 86% of US mobile wallet users have made a purchase via a retailer’s embedded mobile app.

Attitudes about peer-to-peer payment methods have changed considerably, according to a 2023 American Express: Digital Payments Edition Insights Report.

- 78% of consumers are using P2P payments in a greater variety of situations other than just paying merchants.

- 58% use P2P to send money to a friend or family member.

- 55% use P2P to purchase goods/services either in-store, online, or from another person.

- 29% use P2P to split the check in restaurants.

- 26% use P2P to pay bills or rent

- 19% use P2P to leave a tip.

Credit card companies are also concerned about losses due to transaction fraud. A 2024 Federal Trade Commission Consumer Sentinel Report found that bank transfers and payments accounted for the highest aggregate losses reported in 2023 at $1.86 billion, followed closely by Cryptocurrency at $1.41 billion. Credit cards were most frequently identified as the payment method in fraud reports.

The credit reporting agency Experian conducted its 2023 Consumer Credit Review and found that most consumer balances grew by 10% from the previous year.

- The average credit card balance was $6,501

- 2.01% of accounts are between 30 and 59 days past due

- 1.26% of accounts are between 60 and 89 days past due

- .81% of accounts are more than 90 days past due

Experian also found that in 2023:

- The total credit card debt in the US reached $1.067 trillion.

- There were 568.6 million new credit card accounts.

- The average credit utilization is 29%.

Consumer attitudes and behaviors are constantly evolving. For example, Deloitte’s 2023 trends report about credit card loyalty programs found that simplicity is a driving force:

- More than 60% of consumers agree or strongly agree that status tiers allowing members to earn more rewards at higher levels are an important part of a loyalty program.

- Less than 40% of Gen X or older respondents are looking to enroll in a credit card connected to a loyalty program or even recognize the exclusive benefits a co-branded credit card unlocks.

- The significance of simplicity and financial rewards increases with age, as 77% of Gen Z participants find both attributes to be important compared to 90% of Baby Boomers.

Credit Card Transactions Globally

According to a 2023 Nilson Report, purchase transactions in the general-purpose payment card industry are projected to reach 515.42 billion in 2024.

Per data collected by Capital One Shopping, there were an estimated 678 billion global credit card transactions in 2022. That breaks down to an average of:

- 1.86 billion per day

- 77.4 million per hour

- 1.29 million per minute

- 21,510 per second

Clearly Payments notes that, on a global scale, the number of credit card holders has steadily grown to reach 1.25 billion in 2023:

- The US accounts for 166 million credit card holders.

- Canada has 36 million credit card holders.

- Canada, Israel, and Norway are the top three countries with the highest percentage of credit card ownership, all having more than 70% of adults holding credit cards.

- Canada leads with 83% of adults holding a credit card.

- 68% of US adults hold credit cards.

In 2023, Allied Market Research predicted that the credit card payments market will reach $1.2 trillion globally by 2032.

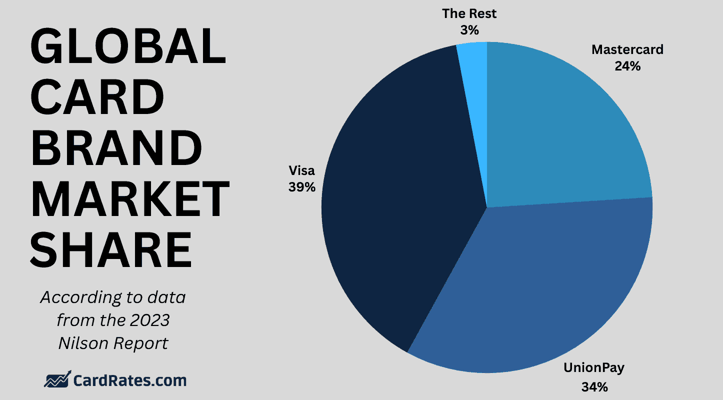

According to 2023 Statista data, Visa and Mastercard combined make up the majority of transactions within most individual countries:

- Nearly four out of 10 global card transactions in 2022 took place with a Visa-branded card.

- Roughly 242 billion purchase transactions worldwide involved Visa payment cards (general purpose) that year, equaling approximately 0.66 billion Visa transactions per day in 2022.

- Mastercard held market shares of 88% in the Netherlands and 70% in Sweden. Mastercard was also bigger than Visa in Brazil, making up nearly half of all card payments in the Latin American country.

In 2024, Statista also found that PayPal dominated the market for global online payment processing technologies, with a market share of 45%. Stripe was in second place with a market share of approximately 21%.

However, a 2024 Business of Apps listed Apple Pay as having the largest transaction volume of any mobile payment service, except for China which is dominated by AliPay.

Credit Card Transactions by Brand

According to data collected by Clearly Payments, the most popular cards in the world are currently:

- Visa, at $2.4 trillion in purchase volume.

- Mastercard, at $1.1 trillion in purchase volume.

- American Express, at $897 billion in purchase volume.

- Discover, at $182 billion in purchase volume.

As for credit card issuers, the most popular are:

- JPMorgan Chase & Co. (Chase)

- American Express

- Citibank (Citigroup)

- Capital One

- Bank of America

- Discover

- U.S. Bank:

- Wells Fargo

- Barclays

Credit Cards Will Remain Popular As Alternative Payment Tools Emerge

Credit cards have become an essential part of consumer life for Americans and consumers in other developed countries. The numbers show that credit card payments result in massive profits for the issuing banks, but cards are undeniably advantageous for consumers.

Learning how to choose the right credit card so you get the best package of benefits while not sacrificing security is essential. Don’t just select the first card you come across.

The world is rapidly changing, with contactless payments and other technologies making spending easier. That’s why it is more important than ever to understand how to avoid getting into deep credit card debt. Knowing where, when, and how to use credit cards will help you build and maintain a good credit rating while accumulating the most helpful rewards and personalized advantages.

So, while debit cards are rising in popularity among some segments, the real perks — such as consumer protection and valuable rewards programs — are still mostly attached to revolving credit products (namely, credit cards).

Mobile payments and contactless transactions will continue to grow in popularity around the world, so focus on cards equipped with the most secure technology and beneficial qualities. Put them at the top of the list on your mobile device so you automatically defer to them.

Be sure to review your transaction history on a regular basis to ensure you don’t become an unwitting statistic. The last thing you want is to acquire high-interest debt that you have a hard time paying off or be confronted with credit card fraud that will make your life more difficult.

To offset these possibilities, check your credit reports regularly and monitor your credit scores to ensure that you stay on the right track.

![12 Best Credit Card Offers Now, Per Experts ([updated_month_year]) 12 Best Credit Card Offers Now, Per Experts ([updated_month_year])](https://www.cardrates.com/images/uploads/2016/05/12-Best-Credit-Card-Offers.png?width=158&height=120&fit=crop)

![Average Credit Card Debt in American Households ([current_year]) Average Credit Card Debt in American Households ([current_year])](https://www.cardrates.com/images/uploads/2018/01/avgdebt.png?width=158&height=120&fit=crop)

![[current_year] Credit Card Debt Statistics (Average U.S. Debt) [current_year] Credit Card Debt Statistics (Average U.S. Debt)](https://www.cardrates.com/images/uploads/2018/04/shutterstock_243114739-edit.jpg?width=158&height=120&fit=crop)

![Average Credit Card Debt by Age in [current_year] Average Credit Card Debt by Age in [current_year]](https://www.cardrates.com/images/uploads/2023/05/CR-AverageCreditCardDebtbyAge.jpg?width=158&height=120&fit=crop)

![Average Credit Card Debt by State in [current_year] Average Credit Card Debt by State in [current_year]](https://www.cardrates.com/images/uploads/2023/06/CR-AverageCreditCardDebtbyState-1250X650.jpg?width=158&height=120&fit=crop)