It’s happened to all of us at some point; we think we’ve found the best deal on a new device or gadget we’ve been eyeing, only to see a lower advertised price after we’ve bought it. No worries, that’s what price protection is for, right? But if you’re wondering about the best credit cards with price protection, you may want to start asking a different question.

For years, credit card companies touted their price protection programs — sometimes called price matching, price guarantees, or self-branded programs, such as Citi’s Price Rewind — but many of these so-called secondary benefits are becoming harder to find. Luckily, some cards still offer price protection as part of their benefits package.

Here are some of the cards we recommend that currently offer this popular perk.

Consumer Cards | Business Cards | FAQs

Best Consumer Cards with Price Protection

Prices on consumer goods, especially things like electronic devices, can vary widely among retailers. Between special promotions, online deals, markdowns, and overstocks — it’s enough to make your head hurt.

So, when you’re trying to get the best price on something you want, use a credit card that features a price protection guarantee. That way, if you find a lower price later, you can get reimbursed for the difference.

1. Capital One® Savor® Cash Rewards Credit Card

This card is currently not available.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

Additional Disclosure: Information for this card not reviewed by or provided by Capital One.

The Capital One® Savor® Cash Rewards Credit Card has a lot to offer, including price protection on most purchases made with the card. To qualify for price protection coverage, your purchase must be made entirely with the Savor card or associated points, the item must be purchased new, and it cannot be an auction item.

Coverage is for the difference between the actual purchase cost and the advertised cost, not including taxes or other charges. The lower advertised price must have been posted within 120 days of the purchase, and the items must be identical. Coverage limits are $250 per item, and a maximum of four claims not to exceed $1,000 per year.

- Earn a one-time $200 cash bonus after you spend $500 on purchases within the first 3 months from account opening

- Earn unlimited 3% cash back on dining, entertainment, popular streaming services and at grocery stores (excluding superstores like Walmart® and Target®), plus 1% on all other purchases

- Earn 10% cash back on purchases made through Uber & Uber Eats, plus complimentary Uber One membership statement credits through 11/14/2024

- Earn 8% cash back on Capital One Entertainment purchases

- Earn unlimited 5% cash back on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options. Terms apply

- No rotating categories or sign-ups needed to earn cash rewards; plus cash back won't expire for the life of the account and there's no limit to how much you can earn

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 15 months

|

0% for 15 months

|

19.99% - 29.99% (Variable)

|

$0

|

Excellent, Good

|

The Capital One SavorOne Cash Rewards Credit Card is identical to the Savor card in price protection benefits, as both cards are part of the World Elite Mastercard® family. Purchases must be made entirely with the Capital One SavorOne Cash Rewards Credit Card or associated points, and for personal use or as a gift.

No commercial or resale use is covered by purchase protection. The lower advertised price must have been posted within 120 days of purchase, and the items must be identical. Coverage limits are $250 per item, and a maximum of four claims not to exceed $1,000 per year.

- No annual or hidden fees. See if you're approved in seconds

- Be automatically considered for a higher credit line in as little as 6 months

- Help build your credit through responsible use of a card like this

- Enjoy peace of mind with $0 Fraud Liability so that you won't be responsible for unauthorized charges

- Monitor your credit score with CreditWise from Capital One. It's free for everyone

- Get access to your account 24 hours a day, 7 days a week with online banking from your desktop or smartphone, with Capital One's mobile app

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

29.99% (Variable)

|

$0

|

Average, Fair, Limited

|

The Capital One Platinum Credit Card is a card that’s meant for even someone with just a fair credit score, which makes its price protection coverage all the more surprising. Similar to the two Savor cards, the Capital One Platinum Credit Card lets you claim reimbursement for items purchased with the card or associated points if you find the identical item advertised at a lower price later.

The only real difference between this card and the other two is the coverage period — in this case, 60 days rather than 120 days from the date of purchase. Coverage limits are still $250 per item, and a maximum of four claims not to exceed $1,000 per year.

4. Capital One® Walmart Rewards™ Card

What happens when Capital One and Walmart, the world’s largest retailer, team up to create a rewards credit card? Sure, it’s kind of obvious, the Capital One® Walmart Rewards™ Card.

What happens when Capital One and Walmart, the world’s largest retailer, team up to create a rewards credit card? Sure, it’s kind of obvious, the Capital One® Walmart Rewards™ Card.

But what’s even better is that this card also comes with price protection on things you buy everywhere — not just at Walmart. Price protection extends for 120 days from your initial purchase and covers eligible items up to $250 each and up to a maximum of $1,000 a year.

(Information for this card not reviewed by or provided by Capital One.)

6. Wells Fargo Visa Signature® Card

The Wells Fargo Visa Signature® Card is a good card for everyday use, with plenty of extra features for those who use their card frequently. Among them is a comprehensive set of protection features, including price protection.

The Wells Fargo Visa Signature® Card is a good card for everyday use, with plenty of extra features for those who use their card frequently. Among them is a comprehensive set of protection features, including price protection.

If you make a purchase with the card and see an eligible item within 60 days advertised for less, you can be reimbursed for the difference. Limits are $250 per item and $1,000 per year, and you must submit a printed advertisement for the exact item from a retail store.

(The information related to the Wells Fargo Visa Signature® Card has been collected by CardRates.com and has not been reviewed or provided by the issuer or provider of this product or service.)

Best Business Cards with Price Protection

Let’s face it, a business credit card is as important to the success of your business as any tool you use. You need your card to work as hard for your business as you do.

And, sure, rewards are great, but being guaranteed you’re paying the lowest price for what you buy is even better. Price protection programs do just that — guarantee that every eligible purchase you make is protected if you find a lower advertised price later.

The Capital One Spark series of business credit cards recognize that businesses need to know they’re getting the best price possible. The Capital One Spark Cash for Business gives business owners that assurance. (Information for this card not reviewed by or provided by Capital One.)

- Earn a $750 bonus when you spend $6,000 in the first 3 months of account opening

- Earn unlimited 1.5% cash back for your business on every purchase, everywhere — with no limits or category restrictions

- No annual fee

- Earn unlimited 5% cash back on hotels and rental cars booked through Capital One Travel

- Rewards won't expire for the life of the account

- Redeem your cash back rewards for any amount

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

18.49% - 24.49% (Variable)

|

$0

|

Excellent

|

- Earn a one-time bonus of 50,000 miles – equal to $500 in travel – once you spend $4,500 on purchases within the first 3 months from account opening

- Earn unlimited 2X miles per dollar on every purchase, everywhere, no limits or category restrictions, and miles won't expire for the life of the account

- Unlimited 5X miles on hotels and rental cars booked through Capital One Travel

- Transfer your miles to 15+ travel loyalty programs

- Redeem your miles instantly for any travel-related purchases, from flights and hotels to ride-sharing services

- Skip the lines with up to a $100 statement credit on TSA PreCheck® or Global Entry

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

26.24% (Variable)

|

$0 intro for first year; $95 after that

|

Excellent, Good

|

8. Capital One Spark Cash Plus

This card is currently not available.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

Additional Disclosure: Information for this card not reviewed by or provided by Capital One.

Be sure to review the restrictions on what is covered and how to claim reimbursement.

How Does Price Protection Work?

Price protection or low price guarantees shouldn’t be confused with purchase protection, which covers theft or damage to something you’ve bought with your card. Price protection programs are different in that they’re intended to ensure you’re getting the best price possible.

If you buy something using a card that offers price protection and later find the same item at a lower price, the credit card company will reimburse you for the difference. At least, that’s the theory.

In practice, card companies place a lot of restrictions on what you can claim price protection for and how long you have to file. Each card differs in the window of time for finding a lower price, the amount of coverage per item, even the maximum amount you can claim each year.

Some cards even place restrictions on the type — print vs. internet ad — of advertised lower price you can use in making a claim. There are also plenty of things that are excluded from price protection, and while each card company has its own list, exclusions are pretty consistent.

Commonly excluded items include:

- Collectables, jewelry, rare and hand-made or custom items

- Motorized vehicles, including boats, cars, trucks, motorcycles

- Items purchased for resale or commercial use

- Cellphones or devices purchased on a contract or as part of a service plan

- Any pet or live animal

- Used or refurbished items

But let’s say you’ve got a card that offers price protection and you’ve met the requirements for filing a reimbursement claim. Some card companies — Capital One and Wells Fargo among them — require you to call a toll-free number to request a claim form, complete it, attach all documentation, then send it back.

This is partly in response to the growth in apps that automate price protection submissions, but we can assume that only the most dedicated claimants will follow through on such a lengthy process.

Which Issuers Still Offer Price Protection?

Fewer credit card issuers are offering price protection, a perk that, just a few years ago, was not only common but an advertised feature. Today, many card companies have eliminated their programs altogether, and the ones that remain are offered on just a handful of cards.

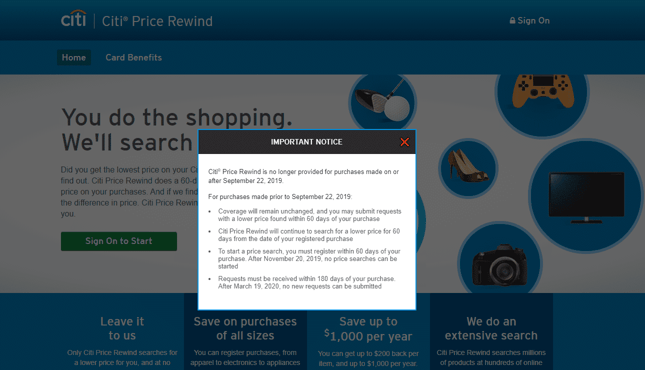

The issuers that no longer offer price protection programs are some of the biggest — Discover and Citi have done away with them entirely.

Citi® Price Rewind is no longer offered as of September 2019.

Of the remaining issuers, most offer it on a select handful of cards. And don’t expect to see advertisements for price protection, let alone promotions. If a card does come with this feature, the details will likely be buried in the fine print of your benefits guide.

Some issuers have price protection or price guarantees on a few of their cards only because the card’s network offers the feature. Examples of this are the Visa Signature® and World Elite® Mastercard® networks.

Still, there are other ways to get price protection when you shop. Many retailers will match a competitor’s pricing if you ask.

In fact, some credit card price protection programs stipulate that their benefits are secondary to any store price-matching programs. And, when it comes down to it, these in-store price guarantees are certainly easier to get and less time-consuming than requesting reimbursement from your card company.

How Do I Know if My Credit Card Has Price Protection?

If you’re not sure whether your card offers price protection, you’re not alone. Few cards these days still offer the perk, and even fewer actually advertise or promote it. But just because it isn’t in your card’s promotional material doesn’t mean you’re out of luck.

Read your credit card’s benefits guide to see if your card has price protection benefits.

Any feature available on a credit card must be listed in the card’s benefits guide. Sure, you may have to search the fine print, but if it’s offered, it will be there. The perk may be called anything from Price Guarantee to Best Value Guarantee, or even the obvious Price Protection, depending on the card issuer.

Price protection may also be a feature your card network offers. The prior examples given — Visa Signature® and World Elite® Mastercard® — are just two of the larger networks you may be covered under.

Finally, if all else fails and you’re unable to determine whether your card has price protection by reading the fine print, call the toll-free number and ask. The customer service reps are trained to answer any and all questions regarding the issuers’ many cards and features.

If price protection is available, they’ll quickly let you know. And if not, ask if it’s offered on any of the other cards they issue.

Get the Best Price on the Things You Buy

When it comes to the benefits and features of a credit card, most of us wouldn’t put price protection at the top of our list. Which, come to think of it, might be another reason this perk is gradually being eliminated.

Still, it is nice to know your credit card company cares that you’re getting the best price on the things you buy. If that peace of mind is important to you, we hope this guide will help you choose a card that satisfies your needs.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![7 Best Credit Cards For Purchase Protection ([updated_month_year]) 7 Best Credit Cards For Purchase Protection ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/05/Best-Credit-Cards-For-Purchase-Protection.jpg?width=158&height=120&fit=crop)

![7 Credit Cards With Cell Phone Protection ([updated_month_year]) 7 Credit Cards With Cell Phone Protection ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/07/Credit-Cards-With-Cell-Phone-Protection.jpg?width=158&height=120&fit=crop)

![5 Prepaid Cards with Overdraft Protection ([updated_month_year]) 5 Prepaid Cards with Overdraft Protection ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/11/shutterstock_284500220.jpg?width=158&height=120&fit=crop)

![What is Credit Card APR? 9 Best 0% APR Cards ([updated_month_year]) What is Credit Card APR? 9 Best 0% APR Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/05/what-is-apr.jpg?width=158&height=120&fit=crop)

![7 Best Credit Cards for Buying a Car ([updated_month_year]) 7 Best Credit Cards for Buying a Car ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/10/Credit-Cards-for-Buying-a-Car-Feat.jpg?width=158&height=120&fit=crop)

![7 Best Credit Cards for Auto Repairs ([updated_month_year]) 7 Best Credit Cards for Auto Repairs ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/12/Best-Credit-Cards-for-Auto-Repairs.jpg?width=158&height=120&fit=crop)

![6 Best Credit Cards for Emergencies ([updated_month_year]) 6 Best Credit Cards for Emergencies ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/12/Best-Credit-Cards-for-Emergencies.jpg?width=158&height=120&fit=crop)

![11 Best Credit Cards For Subscriptions ([updated_month_year]) 11 Best Credit Cards For Subscriptions ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/01/Best-Credit-Cards-for-Subscriptions.jpg?width=158&height=120&fit=crop)