When you’re renting a car for international or domestic travel, you may be wondering what some of the best credit cards with car rental insurance are. Many different credit cards offer some form of car rental insurance, so knowing which benefits you are eligible for can help you decide whether you need to pay the egregious car insurance rates of the car rental agency.

The car rental insurance benefits that come with different credit cards vary in a few important aspects. Only a few credit cards offer primary car rental insurance, which means that it will be the first insurance used if there is a problem.

Most credit cards offer secondary insurance. That means that the credit card car rental insurance benefit will only come into play after your own personal auto insurance is billed.

Knowing the different benefits and nuances of credit card car rental insurance is important in deciding which credit card to use for your auto rental coverage. Now let’s take a look at some of the best credit cards with car rental insurance.

Best Overall | More Cards | FAQs

Best Overall Credit Card With Car Rental Insurance

Our pick for the best overall credit card with car rental insurance is the Chase Sapphire Preferred® Card. Not only is it one of our best overall travel rewards cards, but it comes with probably the best car rental insurance around.

The main reason the car rental insurance benefit with the Sapphire Preferred is so valuable is that it is primary rental car coverage. That means it kicks in before any other type of insurance.

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

- Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more.

- Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Travel℠. For example, 60,000 points are worth $750 toward travel.

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2024.

- Member FDIC

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

21.49%-28.49% Variable

|

$95

|

Good/Excellent

|

With the Chase Sapphire Preferred® Card, you are covered for theft, damage, valid loss-of-use charges imposed and substantiated by the auto rental company, administrative fees, and reasonable and customary towing charges (due to covered theft or damage) to the nearest qualified repair facility. Rentals of up to 31 consecutive days are included with the coverage.

There are a few exclusions, including travel in a few different countries (such as Ireland) and some types of vehicles. If you’re planning on using the Chase Sapphire Preferred® Card to rent a car, you’ll want to familiarize yourself with the fine print on the car rental insurance benefit on Chase’s website.

More Top-Rated Cards With Car Rental Insurance

In addition to the Chase Sapphire Preferred® Card, several other credit cards offer car rental insurance. Pay attention to the fine print on the auto insurance benefits offered, since agreement conditions vary greatly, and the details are important.

While it won’t matter in 99% of car rentals that end without a claim, you’ll want to know whether your credit card offers a collision damage waiver benefit, a loss damage waiver benefit — or both. Here are a few other credit cards to consider when renting a car:

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

- $300 Annual Travel Credit as reimbursement for travel purchases charged to your card each account anniversary year.

- Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases

- Get 50% more value when you redeem your points for travel through Chase Travel℠. For example, 60,000 points are worth $900 toward travel.

- 1:1 point transfer to leading airline and hotel loyalty programs

- Access to 1,300+ airport lounges worldwide after an easy, one-time enrollment in Priority Pass™; Select and up to $100 application fee credit every four years for Global Entry, NEXUS, or TSA PreCheck®

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

22.49%-29.49% Variable

|

$550

|

Good/Excellent

|

The Chase Sapphire Reserve® has car rental insurance that is similar to that offered by its sister card above. Both the Chase Sapphire Preferred® Card and Chase Sapphire Reserve® generally offer primary rental car coverage on rentals of up to 31 days. One difference is that the Sapphire Preferred will cover you up to the actual cash value of the car, while the Sapphire Reserve will cover damage caused by theft or collision up to $75,000.

The Chase Sapphire Reserve® does come with a hefty annual fee and you need an excellent credit score to be approved, so it may not be the best option for all customers. Still, there is no doubt that the rental car coverage that comes with the Chase Sapphire Reserve® is one of the best out there.

You will need to decline the extra insurance offered by the car rental company to take advantage of the insurance provided by this card. For further information and details, check out the Benefits Guide that comes with your Chase Sapphire Reserve® card.

Chase is a great card issuer when it comes to credit cards that offer car rental coverage. While some of its no-fee credit cards do not offer car rental coverage, many other cards issued by Chase offer car rental coverage.

With the Ink Business Preferred® Credit Card, you are covered up to the actual cash value of the car for damage, theft, loss-of-use charges assessed by the rental car company, and customary towing charges. Rentals of up to 31 days are covered by the Ink Business Preferred® Credit Card, though certain luxury and other vehicle types are excluded from coverage. You must decline the rental car company’s insurance offer to use the coverage from this card.

Because the Ink Business Preferred® Credit Card is a business credit card, the coverage is only valid and primary while you are traveling for business purposes. If you are in your home country but traveling for non-business purposes, then the coverage becomes secondary. In other countries, the coverage on the Ink Business Preferred® Credit Card is primary regardless of whether you are traveling for business or personal reasons.

The Capital One Venture X Rewards Credit Card offers primary rental car coverage. To take advantage of the insurance coverage with this card, make sure to pay for the entire cost of your rental with your Capital One Venture X Rewards Credit Card and decline the coverage offered by the rental car company.

The primary insurance coverage offered is effective before any other type of insurance, including your own personal auto insurance. There is no need to file an insurance claim with your own personal auto insurance carrier and risk having your personal auto insurance rates go up.

Similar to the coverage offered by other credit cards, the coverage on the Capital One Venture X Rewards Credit Card is CDW coverage. The Collision Damage Waiver coverage only covers damage to your car itself. It does not cover liability or damage to other people, cars, or property.

Like its sister card above, the Capital One Spark Miles for Business is another credit card that offers primary rental car coverage. Your rental must be for 31 days or less to get the benefit of rental car insurance coverage from this Visa Signature card.

You just need to pay the entire cost of your rental with your Capital One Spark Miles for Business and decline the coverage that is offered by the car rental company. In case of an accident where you need Collision Damage Waiver (CDW) coverage, your Capital One Spark Miles for Business has you covered without needing to file a claim with your own personal auto insurance.

The Ink Business Cash® Credit Card is another Chase credit card that offers primary car rental coverage on most types of vehicles. You will need to decline the coverage offered by the rental company to take advantage of the coverage from this card, which has some restrictions based on the nature of your travel.

If you are renting a car and traveling outside of your home country, then your rental trip will be covered regardless of whether you are traveling for business or pleasure. Inside your home country, you are only covered with primary coverage when you are traveling for business. Personal rental car trips inside your home country are only covered as secondary insurance.

As with the Ink Business Preferred® Credit Card and Ink Business Cash® Credit Card, the Ink Business Unlimited® Credit Card also offers primary car rental coverage. Again, there are limitations on whether the insurance is primary based on the nature of your rental trip. It makes sense that it would only cover as primary insurance if your trip were for business purposes since the Ink Business Unlimited® Credit Card is a business card.

The coverage with the Ink Business Unlimited® Credit Card will only be primary coverage if you are either traveling outside your home country or if you are traveling for business purposes. Personal rental car trips in your own home country are only covered as secondary insurance.

8. United Club℠ Infinite Card

This card is currently not available.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

Additional Disclosure: The information related to United Club℠ Infinite Card has been collected by CardRates.com and has not been reviewed or provided by the issuer or provider of this product or service.

The United Club℠ Infinite Card is another personal credit card issued by Chase that offers primary rental car coverage. To use this coverage, you should decline the rental company’s insurance and charge the entire cost of your car rental to your United Club℠ Infinite Card. You are then covered up to the actual cash value of the vehicle for theft and collision damage for most rental cars.

Primary United Club cardmembers are also eligible to enroll in Hertz President’s Circle membership, which includes vehicle one-car-class upgrades available at all participating locations in the U.S., Canada, and select European locations, and a 50% bonus on Hertz Gold Plus Rewards Points when you elect to earn points.

(Non-Monetized. The information related to United Club℠ Infinite Card was collected by CardRates.com and has not been reviewed or provided by the issuer of this product. Product details may vary. Please see issuer website for current information. Product details may vary. Please see issuer website for current information. CardRates.com does not receive commission for this product/card.)

United also offers primary car coverage on its United℠ Business Card, but only when renting for business purposes. The United℠ Business Card provides reimbursement up to the actual cash value of the car for theft and collision damage for most cars in the U.S. and abroad.

To activate the car rental insurance on the United℠ Business Card, decline the car rental company’s coverage and pay the full rental amount with your card. There are specific time limits and documentation requirements. Once your account is opened you will be sent a guide to benefits, which includes a full explanation of coverages.

How Does Car Rental Insurance With a Credit Card Work?

When you rent a car, the car rental company will insure it themselves for the legal minimum amount. Depending on the state or country where you’re renting the car, this may be a much lower amount than you expect and may not cover any and all potential damage.

In the rental agreement that you’ll sign when renting a car, you agree to be responsible for any damage to the car during the rental period, and in some cases, regardless of whether you are at fault. Car rental insurance is a popular credit card benefit and can help ensure that you are not on the hook for hundreds or thousands of dollars in damage.

Car rental insurance is a credit card benefit that helps ensure you’re not on the hook for damage to a rental car.

If you have paid for the car rental with a credit card that offers car rental coverage, then the credit card company will get involved if there’s damage that requires an insurance claim.

If your credit card offers primary car rental insurance, then the credit card insurance company will handle all claims. If your credit card only offers secondary insurance, then it will only apply after your own personal liability coverage or other insurance providers are contacted.

What Does Collision Damage Waiver Mean?

The Collision Damage Waiver or CDW is one part of the insurance products available to you when you are renting a car. This collision coverage provides some protection against any damage to the rental car itself.

If you have collision coverage as part of your rental car coverage, then you won’t be charged for some or all of the repair costs of any damage that happens during your rental period. CDW coverage may also cover you for loss of use costs, which represent the lost income for the rental car company while the car is being repaired.

It’s important to understand that collision damage is not the only type of expense that can come up when you’re renting a car. So, if your credit card only offers CDW coverage, you may still be charged for liability-related expenses. These liability-related expenses could include things like damaging other cars, property, or personal injuries to other people.

Which Credit Card is Best for Rental Car Insurance?

The best credit card for car rental insurance is usually going to be the one that you already have. Unless you’re already planning on getting a new credit card, it’s unlikely that you’ll want to get a credit card only for the rental car insurance benefit.

Additionally, if you’re planning on a trip soon, you may not get your card in time to use it, though it is sometimes possible to get a credit card the same day that you apply.

Having said all that, if you already have multiple credit cards and are wondering which of your cards is best for rental car insurance, our pick is the Chase Sapphire Preferred® Card. It offers primary rental car coverage among many other useful benefits, including great rewards and earning potential.

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

- Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more.

- Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Travel℠. For example, 60,000 points are worth $750 toward travel.

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2024.

- Member FDIC

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

21.49%-28.49% Variable

|

$95

|

Good/Excellent

|

If you are looking to apply for a new card for a trip that’s a few months away, consider the Chase Sapphire Preferred® Card or one of the other cards on this list.

Is There a Difference Between CDW and LDW?

Yes, there is an important difference between Collision Damage Waiver (CDW) and Loss Damage Waiver (LDW). These are two different insurance policies that cover different things.

Collision Damage Waiver (CDW) covers damage to the rental car through an accident during the rental period. Loss Damage Waiver (LDW) provides liability insurance if your rental car is stolen during the time you are renting the car.

In some countries, LDW and CDW are packaged together, and in many cases, the credit cards mentioned in this article cover both LDW and CDW. You should understand the difference between the two, and which is covered by your credit card.

It’s also important to understand that neither LDW nor CDW provides liability coverage if you damage another car or injure someone else while driving your rental car.

Do Any Credit Cards Offer Car Rental Discounts?

A variety of different credit cards offer discounts or other perks while renting a car. These discounts and benefits are in addition to (or instead of) car rental insurance.

So, if you are trying to choose between a card that offers a car rental discount but not insurance and a credit card that offers car rental insurance but not a discount, you’ll have to crunch the numbers and see which one makes the most sense in your specific situation.

One travel credit card that offers car rental discounts is the Chase Sapphire Reserve®, which comes with discounts of up to 30% off for Avis rentals, up to 25% off for National rentals, and 20% off for Silvercar rentals. As discussed earlier in the article, the Chase Sapphire Reserve® also offers primary rental car coverage, which makes it an attractive card to use when renting a car.

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

- $300 Annual Travel Credit as reimbursement for travel purchases charged to your card each account anniversary year.

- Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases

- Get 50% more value when you redeem your points for travel through Chase Travel℠. For example, 60,000 points are worth $900 toward travel.

- 1:1 point transfer to leading airline and hotel loyalty programs

- Access to 1,300+ airport lounges worldwide after an easy, one-time enrollment in Priority Pass™; Select and up to $100 application fee credit every four years for Global Entry, NEXUS, or TSA PreCheck®

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

22.49%-29.49% Variable

|

$550

|

Good/Excellent

|

The Platinum Card® is another card that offers car rental discounts. Cardholders of this American Express card get complimentary elite status with Avis, Hertz, and National. Elite status lets you cut the line at the airport, snag car upgrades, and get you access to additional discount codes.

The Platinum Card® offers car rental coverage, but it is only secondary coverage. That fact coupled with its high annual fee may mean it’s not the best option for some travelers.

How Do I Know If My Card Offers Rental Insurance?

Many credit cards offer some sort of rental insurance. You’ll want to know the details on your specific credit card because the rental car coverage on different cards varies.

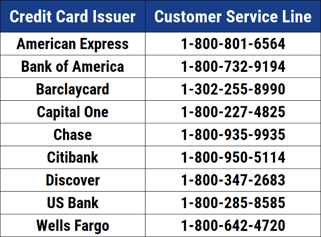

You should know whether your card offers CDW coverage, LDW coverage, or primary car rental coverage, and what the limits are. The best way to know whether your card offers rental insurance is to check your credit card’s official benefits guide or call the number on the back of your card and ask a representative.

Is Credit Card Car Rental Insurance Enough?

Whether the credit card’s car rental insurance is enough depends on which credit card you use and your own personal risk tolerance. Another factor to consider is what other sources of insurance you have that would also apply.

A good rule of thumb is that if you have your own personal auto insurance that can act as primary coverage OR if you have a credit card with primary insurance, then you may consider that your credit card rental insurance is enough.

Dig through the fine print and understand the insurance limits you have either personally or through the credit card. Knowing what those limits are and how likely you would be to hit them is a good indicator of whether you should go ahead and buy the excess insurance that is offered by the rental car company.

How Do I Claim Rental Car Insurance On My Credit Card?

If you’ve paid for your rental car with a credit card that offers car rental insurance, then you may be wondering how to make an insurance claim in case of an accident. The way you file a claim will depend on the card issuer and the particular credit card that you have.

The easiest thing to do is to call the customer service number on the back of your credit card. The customer service agents can let you know how to proceed when filing an insurance claim.

Usually, there will be an online portal of some sort, and you will be asked to upload a series of forms and other documentation. This will include your rental agreement, any pictures you may have, or other information that is relevant to the insurance claim.

Remember too that, if your card only provides secondary insurance, then you will have to first contact your primary insurance carrier. In this case, the car rental coverage that comes with your credit card will only kick in for anything that is not covered by your primary insurance coverage(s).

Can I Drive a Rental Without Insurance?

In most cases, you can drive a rental car without showing any proof of insurance at all. Each rental car is insured by the rental car company to at least the state minimum requirements. However, depending on the state or states where you are traveling or renting the car, those minimums may be quite low.

If you are not using a credit card that offers car rental insurance and your personal car insurance does not cover you, then your rental agreement states that you are on the hook for any damage you cause during the rental. The car rental company will bill you for things including damage to the car, liability for damage to other cars, people, or property, and money from loss of rents by the rental vehicle.

What Happens If You Damage a Rental Car Without Insurance?

As we mentioned in the last section, in many cases you can rent a car without any insurance. But it’s generally a risk that most people are not willing to take.

If your personal auto insurance does not cover car rentals (or if you don’t own your own car), then the car rental company will charge you for any damage to the rental car, according to your rental agreement.

So if you don’t have your own insurance or a credit card with car rental insurance, consider purchasing car rental insurance coverage from the car rental agency.

What Is The Difference Between Primary Car Rental Coverage and Secondary Insurance?

The difference between primary insurance and secondary insurance is an important distinction when renting a car.

When a credit card offers primary rental car insurance, it means that the insurance from that credit card will apply before any other type of insurance. When a credit card offers secondary insurance, the benefits will only apply after other types of insurance are billed. This could include your own personal car insurance, travel insurance, or other types of insurance.

Primary rental car insurance applies before any other type of insurance. Secondary insurance benefits only apply after other types of insurance are billed.

It will definitely complicate the billing and claims process if you need to file an insurance claim with an insurance company.

Do I Need to Decline the Rental Company’s Insurance to Use Credit Card Rental Insurance?

To use the Collision Damage Waiver (CDW) protection that comes with many credit cards, you typically do need to decline the insurance products offered by the car rental company. If you purchase insurance coverage from the car rental company, then that insurance will come into play first.

This is generally true even if your credit card offers primary coverage. As always, check the fine print of your credit card’s benefits guide to understand the full terms and conditions of the insurance offered by your credit card.

The Best Credit Cards With Car Rental Insurance Can Save You Money

Using one of the credit cards reviewed above can save you money by exempting you from having to pay the high insurance rates charged by the car rental company. The rental car company rates for car insurance can add tens if not hundreds of dollars to the cost of your auto rental.

All of the cards above offer primary rental insurance. Primary rental car coverage is coverage that takes effect before any other insurance coverage.

So, if you do happen to get into an accident or otherwise need to file a claim, you won’t have to file that claim with your own insurance company. Instead, the credit card company will take care of the claim. This can help keep your own personal auto insurance rates lower.

While many credit cards offer some sort of car rental insurance, you should understand the differences in coverage types and limits. If your credit card only offers secondary car rental coverage, that means that it only comes into play after you use your personal auto insurance and any other coverage that may be in place. If you have the option, it’s best to pay for your car rental with a card that offers primary insurance and a high coverage amount.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![5 Best Credit Cards For Paying Car Insurance ([updated_month_year]) 5 Best Credit Cards For Paying Car Insurance ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/07/Best-Credit-Cards-for-Paying-Car-Insurance.jpg?width=158&height=120&fit=crop)

![7 Best Vacation Rental Credit Cards ([updated_month_year]) 7 Best Vacation Rental Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/08/Best-Vacation-Rental-Credit-Cards.jpg?width=158&height=120&fit=crop)

![7 Best Credit Cards With Travel Insurance ([updated_month_year]) 7 Best Credit Cards With Travel Insurance ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/08/Best-Credit-Cards-With-Travel-Insurance.jpg?width=158&height=120&fit=crop)

![7 Best Credit Cards for Buying a Car ([updated_month_year]) 7 Best Credit Cards for Buying a Car ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/10/Credit-Cards-for-Buying-a-Car-Feat.jpg?width=158&height=120&fit=crop)

![8 Best Credit Cards For Free Car Rentals ([updated_month_year]) 8 Best Credit Cards For Free Car Rentals ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/04/Best-Credit-Cards-For-Free-Car-Rentals--1.jpg?width=158&height=120&fit=crop)

![5 Best Secured Credit Cards For Car Rentals ([updated_month_year]) 5 Best Secured Credit Cards For Car Rentals ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/08/Best-Secured-Credit-Cards-For-Car-Rentals.jpg?width=158&height=120&fit=crop)

![Does My Credit Card Have Travel Insurance? How to Check ([updated_month_year]) Does My Credit Card Have Travel Insurance? How to Check ([updated_month_year])](https://www.cardrates.com/images/uploads/2015/11/Credit-Card-Travel-Insurance-2.png?width=158&height=120&fit=crop)

![3 Do’s & Don’ts: Buying a Car with a Credit Card ([updated_month_year]) 3 Do’s & Don’ts: Buying a Car with a Credit Card ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/03/carbuy--1.jpg?width=158&height=120&fit=crop)