Credit card companies don’t have one simple formula they use to make a decision when you apply for a new credit card. Instead, card companies consider a variety of factors.

Among them are your income and, more importantly, whether it’s high enough to manage your current debt obligations, and an additional monthly card payment. What follows are answers to common questions about annual income on credit card applications.

1. What Income is Needed for a Credit Card Approval?

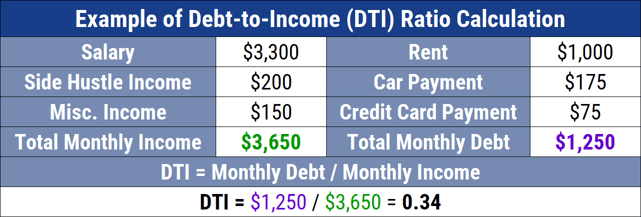

Card companies typically don’t disclose a specific income you need to have to be approved for a card. One reason is that your income as a raw figure usually isn’t as important as your debt-to-income ratio, or DTI.

Your DTI shows how much of your income you use every month to make your minimum debt payments. Examples of debt payments include your home mortgage, car loan, student loan, personal loan, and credit cards. Rent isn’t considered to be debt.

DTI is shown as a percentage. Here’s an example:

Monthly income: $4,000

Student loan payment: $400

Car payment: $400

Total payments: $800

DTI: $800 / $4,000 = .20 = 20%

Following their stance on income, card companies don’t require applicants to have a specific DTI for card approval. But keeping your DTI as low as possible is a good guideline, with 36% frequently suggested as the maximum DTI.

2. Why Do Credit Card Companies Check Income?

The federal Credit Card Accountability Responsibility and Disclosure Act of 2009, known as the CARD Act, requires credit card companies to take into account a person’s ability to make monthly card payments before they give you a card.

Of course, there’s no guarantee that your income will continue or you won’t charge more on your card than you can afford to repay. The CARD Act aims to protect you from card offers that you clearly cannot afford by reasonable income standards.

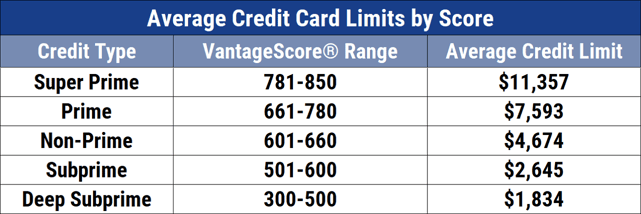

Your income and DTI aren’t the only factors that determine whether you’ll be approved for a card. One other important factor is your credit score, a three-digit number that measures how well you’ve managed your debt payments.

Your employment status, whether you own a home, and other factors related to your personal finances may also be considered.

Personal characteristics, such as your gender, race, or religion, aren’t considered in card approval.

3. Do Credit Card Companies Verify Your Income?

A credit card issuer may request proof of income documents to verify your stated income. But a lender won’t typically call your employer or the IRS to verify your income.

Proof of income documents may include, but aren’t limited to:

- Pay stubs

- Tax documents

- Annuity statement

- Pension distribution statement

- Unemployment benefits

- Bank statements

- Profit and loss statements for business credit card applications

If you don’t have the requested documents, don’t panic. You’ll only need to provide them if you have them, and they may not be required to be approved for a card you want.

4. Can You Include Your Spouse’s Income on a Credit Application?

If you’re 21 or older and you can reasonably expect to have access to your spouse’s income, then yes, you can include it on your credit card application.

If you’re not yet 21, you don’t have access to your spouse’s income, or you can’t reasonably expect that access to continue, then no, you shouldn’t include that income when you apply for a credit card.

“Spouse” in this context can include a life partner as well as someone you’re legally married to.

5. Can I Lie About My Income on a Credit Card Application?

A more important question is not can you, but should you? The answer is no, you shouldn’t.

Lying on an application for credit may lead to fraud charges. The maximum penalties if you’re caught lying include a fine of up to $1 million and a prison term of up to 30 years.

Though you shouldn’t lie about your personal income, you don’t need to calculate an exact dollar figure. You can report your best estimate based on how much you expect to earn and receive during the year.

If you make an honest mistake or your income changes in a way you couldn’t have anticipated, that’s generally not considered fraud.

6. How Do You Calculate Annual Income?

You can use your best estimate of how much you expect to earn.

If you’re paid monthly, multiple your monthly income by 12. If you’re paid weekly, multiple by 52. If you’re paid weekly, but the credit card application asks for your monthly income, multiply your weekly income by 52 and then divide the result by 12. You can use a calculator to convert hourly wages into a salaried amount.

As discussed above, you can include all household income on an application if you have reasonable access to money from a spouse or other person you live with.

7. Will a High Income Help My Approval Odds?

One aspect of approval depends on your outstanding financial obligations and whether you have enough income to manage an added payment. If you have a high income and your monthly minimum debt payments are relatively low, then yes, your income could help you get approved because it will boost your debt-to-income ratio.

If you have a high income and your monthly minimum debt payments are also relatively high, your income may not necessarily help you get approved for a card.

The best combination for card approval is a high income and relatively low monthly minimum debt payments. That boosts your DTI and improves your approval odds.

A high income may also help you get approved for an exclusive card or any card with a higher credit limit. A higher limit means you can charge more purchases with your card before you max it out. If that happens, you’ll typically have to pay off some of your balance before you can charge more.

If you’re struggling to get approved for a card, earning more may help as long as you don’t also add more debts and obligations. Another option may be to apply for a card for low-income earners.

8. What Types of Income Can You Include on an Application?

Generally, you can include any income you receive regularly and that you expect to continue to receive regularly. If you’re 21 or older, married, and reasonably confident that you’ll have access to your spouse’s income to help you make your credit card payment, you can include your spouse’s income with your own. That’s true for a life partner as well as a spouse and is referred to as household income.

Income examples include:

- Salary or hourly wages from a full-time, part-time, or seasonal job

- Self-employment income

- Income from gig work

- Scholarships

- Grants

- Regular distributions from a trust

- Regular distributions from a retirement account

- Social Security or other regular government benefits

- Alimony or child support

If you’re 18, 19, or 20, you can apply for a card on your own, but you’ll have to have your own income to be approved. If you’re under 21, you shouldn’t include your partner’s income when you apply even if you meet the reasonable access test.

You can include funds you receive from your parents on a regular basis to pay your expenses. You should never include proceeds from a loan, such as student loans, in your income. A loan isn’t income — it’s debt.

If you’re not sure whether you can include a specific type of income, contact the credit card company and ask whether you can include that type of income when you complete your application.

9. Can I Get a Credit Card if I Have No Income?

The answer depends in part on how you define income.

If you don’t earn a salary or wages from a job, but you have another source of money that qualifies as income, you may be able to get a card. Examples include scholarships, grants, Social Security checks, or distributions from a trust or retirement account that you receive regularly.

Getting a personal credit card of your own may be difficult if you don’t have any source of income to show the credit card company you can make a payment each billing cycle. But you still have options.

Apply for a secured card. A secured card is one that requires you to make a refundable security deposit, which the issuer holds as colalteral. Your deposit is an amount of money that you agree to keep in a specified account that’s tied to your card. If you don’t make your payment, your card company can collect it from that amount along with any interest, fees, or penalties you owe.

A secured card can be a good choice when you apply for your very first credit card. Here are some to consider:

- No credit check to apply

- Adjustable credit limit based on what you transfer from your Chime Checking account to the secured deposit account

- No interest* or annual fees

- Chime Checking Account and qualifying direct deposit of $200 or more required to apply. See official application, terms, and details link below.

- The secured Chime Credit Builder Visa® Card is issued by The Bankcorp Bank, N.A. or Stride Bank, N.A., Members FDIC, pursuant to a license from Visa U.S.A. Inc. and may be used everywhere Visa credit cards are accepted.

- *Out-of-network ATM withdrawal and OTC advance fees may apply. View The Bancorp agreement or Stride agreement for details; see back of card for issuer.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

$0

|

None

|

- New feature! Earn up to 10% cash back* on everyday purchases

- No credit check to apply. Zero credit risk to apply!

- Looking to build or rebuild your credit? 2 out of 3 OpenSky cardholders increase their credit score by an average of 41 points in just 3 months

- Get free monthly access to your FICO score in our mobile application

- Build your credit history across 3 major credit reporting agencies: Experian, Equifax, and TransUnion

- Add to your mobile wallet and make purchases using Apple Pay, Samsung Pay and Google Pay

- Fund your card with a low $200 refundable security deposit to get a $200 credit line

- Apply in less than 5 minutes with our mobile first application

- Choose the due date that fits your schedule with flexible payment dates

- Fund your security deposit over 60 days with the option to make partial payments

- Over 1.4 Million Cardholders Have Used OpenSky Secured Credit Card To Improve Their Credit

- *See Rewards Terms and Conditions for more information

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

25.64% (variable)

|

$35

|

Poor

|

- No credit score required to apply.

- No Annual Fee, earn cash back, and build your credit history.

- Your secured credit card requires a refundable security deposit, and your credit line will equal your deposit amount, starting at $200. Bank information must be provided when submitting your deposit.

- Automatic reviews starting at 7 months to see if we can transition you to an unsecured line of credit and return your deposit.

- Earn 2% cash back at Gas Stations and Restaurants on up to $1,000 in combined purchases each quarter, automatically. Plus earn unlimited 1% cash back on all other purchases.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Get an alert if we find your Social Security number on any of thousands of Dark Web sites. Activate for free.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

10.99% Intro APR for 6 months

|

28.24% Variable APR

|

$0

|

New/Rebuilding

|

Get a cosigner. A cosigner is a second person who applies for a card with you. A cosigner with adequate income and a good credit score can help you get approved. Your cosigner will be responsible for your debt if you don’t repay it yourself. Paying late could hurt your cosigner’s credit as well as your own.

Apply for a starter card. A starter card is one designed by a card company for young people, students, and other first-time or inexperienced card users. You may need to make a deposit to secure a starter card or obtain a cosigner to help you get approved.

Become an authorized user. An authorized user is a person who’s allowed to use someone else’s card. If you know someone who has a card and trusts you to use it, you can become an authorized user on that person’s card and use it as if it were your own. Unlike a cosigner, an authorized user isn’t responsible for the monthly payment.

10. What is the Difference Between Net and Gross Income?

The differences are as follows:

Gross income: Your gross annual income is the amount you earn before any deductions, such as income tax withholding, employee benefit costs, or retirement plan contributions, are deducted from your pay. If your annual salary is $48,000, your gross monthly income would be $48,000 / 12 = $4,000.

Net income: Your net income is the amount you earn after deductions are taken from your pay. If your monthly income was $4,000 and your deductions totaled $950, your net income would be $3,050.

11. How Does My Debt-to-Income Ratio Affect Approval?

Your DTI ratio likely will affect whether you’ll be approved for a card. A low DTI suggests that you have enough income to manage your credit card debt.

If that’s the case, card companies may be more likely to approve your application since you should be able to make regular payments.

A high DTI suggests that you may not have enough income to manage your debt. If that’s the case, card companies may be less likely to approve your application since you may not be able to make future payments.

Having a high or low DTI are, of course, relative terms. A good general guideline is to try to keep your DTI below 36%. If your DTI is high, you may still be approved, but with a lower credit limit.

While DTI is important, it’s not the only factor card companies consider. Your income and credit score are other factors that matter.

12. Does My Income Affect My Credit Score?

Your income doesn’t directly affect your credit score, but there could be a relationship between your score and your income.

Your credit scores — most people have more than one — don’t measure how much money you have or how much you earn. Instead, your scores measure whether you’re responsible with credit and able to manage the debt you have. Your credit score is determined from the information contained within your credit report.

The top five factors that affect your credit scores are:

- Your payment history. A perfect record of on-time payments can help your scores. Missed or late payments can bring your scores down.

- Your credit utilization. Using a lower percentage of the total credit you have available to you could boost your scores. Maxing out your credit could hurt your scores.”Using more than 30% of your available credit is a negative to creditors,” according to Experian.

- How long you’ve had your credit accounts. A long credit history with older credit accounts can boost your scores. Being inexperienced with credit or churning through a lot of short-term credit accounts could lower your scores.

- Your credit mix. Using a mix of different types of credit accounts can give your scores a boost. Examples of credit accounts include a mortgage, car loan, student loans, or a personal loan as well as credit cards. Don’t apply for a credit card account just to add another type of loan to your credit mix.

- New accounts and hard inquiries. Opening more credit accounts or having several hard credit inquiries appear on your credit report may suggest you’re struggling with debt. That could hurt your scores.

13. How Does My Income Affect My Credit Limit?

When you get approved for a new card, your card company may use your income as a factor to determine your initial credit limit. Your income probably won’t be the only factor in that decision.

Other factors may include:

- Your credit score.

- How long you’ve had and used credit.

- Your existing card debt.

- Your DTI.

- Your mortgage or rent payment.

- The type of card you were approved for.

- The typical credit limit band for the card you were approved for.

- Whether you have other cards with the same company.

- How strong the U.S. economy is.

Generally, you may get a higher limit if:

- Your income is high.

- Your credit scores are high.

- You’ve used credit for a longer time period.

- Your existing card debt is low.

- Your DTI is low.

- Your mortgage or rent payment is low.

- You’re approved for a premium card that comes with a high limit.

- You don’t have another card with the same company.

- The U.S. economy is strong and growing.

“If an individual has a high salary with a relatively low rent or mortgage, odds are they have more discretionary income and thus may qualify for a higher spending limit,” according to Discover.

14. Can a College Student with No Income Get a Credit Card?

College students who don’t earn income can get credit cards. In fact, most credit card companies offer student cards designed specifically for students who don’t have a credit history. A student card can help you establish and build your credit history. Some of our top-rated student cards are listed below:

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! So you could turn $50 cash back into $100. Or turn $100 cash back into $200. There’s no minimum spending or maximum rewards. Just a dollar-for-dollar match.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- No credit score required to apply.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- No annual fee and build your credit with responsible use.

- 0% intro APR on purchases for 6 months, then the standard variable purchase APR of 18.24% - 27.24% applies.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 6 months

|

10.99% Intro APR for 6 months

|

18.24% - 27.24% Variable APR

|

$0

|

Fair/New to Credit

|

- Earn unlimited 1.5% cash back on every purchase, every day

- Early Spend Bonus: Earn $50 when you spend $100 in the first three months

- Earn 10% cash back on purchases made through Uber & Uber Eats, plus complimentary Uber One membership statement credits through 11/14/2024

- Enjoy peace of mind with $0 Fraud Liability so that you won't be responsible for unauthorized charges

- Enjoy no annual fee, foreign transaction fees, or hidden fees

- Lock your card in the Capital One Mobile app if it's misplaced, lost or stolen

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

19.99% - 29.99% (Variable)

|

$0

|

Average, Fair, Limited

|

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! So you could turn $50 cash back into $100. Or turn $100 cash back into $200. There’s no minimum spending or maximum rewards. Just a dollar-for-dollar match.

- Earn 2% cash back at Gas Stations and Restaurants on up to $1,000 in combined purchases each quarter, automatically. Plus earn unlimited 1% cash back on all other purchases.

- Redeem your rewards for cash at any time.

- No credit score required to apply.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- No annual fee and build your credit with responsible use.

- 0% intro APR on purchases for 6 months, then the standard variable purchase APR of 18.24% - 27.24% applies.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 6 months

|

10.99% Intro APR for 6 months

|

18.24% - 27.24% Variable APR

|

$0

|

Fair/New to Credit

|

You’ll need to be at least 18 years old and have a regular source of income you can access to make your card payment to be approved for a card without a cosigner.

For example, you may have a scholarship or grant money you can use as a source of income to apply for a credit card. If you’re 21 or older and married, you can use the income earned by your spouse (or life partner) to apply for a card if you’re reasonably certain you’ll be able to access that money.

15. What is the Best Credit Card for Low Income?

There’s no one credit card that’s best for low-income earners. In fact, you can apply for a number of secured and unsecured cards even if you don’t earn much money.

Your income isn’t the only factor credit card companies consider when determining your application. If you have a good credit score, low DTI, steady employment, and/or other positive factors in your credit report, your low income may not be essential to get approved for a credit card.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![Credit Card Applications: 5 Most Popular Cards ([updated_month_year]) Credit Card Applications: 5 Most Popular Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/06/Credit-Card-Applications_How-To-Apply-edit.jpg?width=158&height=120&fit=crop)

![9 Best Credit Cards for Students With No Income ([updated_month_year]) 9 Best Credit Cards for Students With No Income ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/11/noincome.png?width=158&height=120&fit=crop)

![12 Best Credit Cards for Low-Income Earners ([updated_month_year]) 12 Best Credit Cards for Low-Income Earners ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/01/low-income2.jpg?width=158&height=120&fit=crop)

![7 Credit Cards For High Debt-to-Income Ratios ([updated_month_year]) 7 Credit Cards For High Debt-to-Income Ratios ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/01/shutterstock_232260670.jpg?width=158&height=120&fit=crop)

![3 FAQs: ATM Card vs. Debit Card vs. Credit Card ([updated_month_year]) 3 FAQs: ATM Card vs. Debit Card vs. Credit Card ([updated_month_year])](https://www.cardrates.com/images/uploads/2016/05/atm-card-vs-debit-card-vs-credit-card--1.png?width=158&height=120&fit=crop)

![7 FAQs: The Different Types of Credit Cards & Which to Carry ([updated_month_year]) 7 FAQs: The Different Types of Credit Cards & Which to Carry ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/11/types.png?width=158&height=120&fit=crop)

![Can I Use My Walmart Credit Card Anywhere? 3 FAQs ([updated_month_year]) Can I Use My Walmart Credit Card Anywhere? 3 FAQs ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/06/can-i-use-my-walmart-credit-card-anywhere--1.jpg?width=158&height=120&fit=crop)

![5 Credit Cards For Bad Credit: No Annual Fee ([updated_month_year]) 5 Credit Cards For Bad Credit: No Annual Fee ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/12/Credit-Cards-For-Bad-Credit-With-No-Annual-Fee.jpg?width=158&height=120&fit=crop)