In a Nutshell: As financial practices evolve in response to the digital age, facilitating a quick, accurate, and secure connection between consumers, their banking institutions, and third-party financial services is a powerful asset. The Plaid platform serves as a technological bridge between banks, consumers, and third-party apps to ensure the secure exchange of data, such as account and transaction information, and leads the way in helping to bring about the next wave in fintech innovation. //

In the rapidly-shifting digital age, banking isn’t what it was 10 years ago — or even 10 months ago. As consumers and businesses shift their banking practices to an increasingly technological sphere, Plaid offers solutions that ensure confidence between consumers, their banks, and the ever-growing field of third-party financial services and apps.

Plaid serves as a technological bridge that connects applications with users’ bank accounts, making the exchange of financial data safe and simple on both ends by allowing the flow of financial data.

Founded in 2012 by Zach Perret and William Hockey, Plaid filled a need in the fintech market for an intermediary between financial institutions, applications, and consumers. As that market grows at a record pace, today Plaid connects more than 9,600 financial institutions in the US with applications and services that are utilized by millions of consumers.

Now, Plaid is also available in Canada to allow digital connectivity to some of the country’s largest financial institutions including Royal Bank of Canada, Scotiabank, TD Canada Trust, Bank of Montreal, CIBC, and Tangerine.

Cutting Edge Technology Simplifies Transactions for Businesses Big and Small

Plaid facilitates the data exchange necessary to marry technology with consumer access on an easy-to-use developer platform. “Companies of all sizes — from big banks to fintech startups — are using Plaid to take advantage of the new wave of digital financial services while simultaneously creating new financial technology solutions of their own,” said a Plaid spokesperson.

Plaid places itself at the center of fintech, helping to evolve formerly manual parts of finance and enable developers to build tools to fit the financial needs of consumers in this increasingly digital world.

The platform empowers developers of all sizes to get on board with digital banking, and to build their own fintech solutions using Plaid.

“In the past five years, we’ve seen more innovation within the financial services industry than in the last five decades, and that’s due in part to the technology we’ve built at Plaid,” the company’s spokesperson explained. “Plaid benefits the financial ecosystem as a whole because it enables the modernization of legacy financial services processes on an industry-wide scale.”

Creating Solutions to Big Problems in Finance

“Plaid makes it easy for developers to access high-quality transaction data, validate account ownership, and mitigate risks in a user-friendly way,” said the company’s spokesperson.

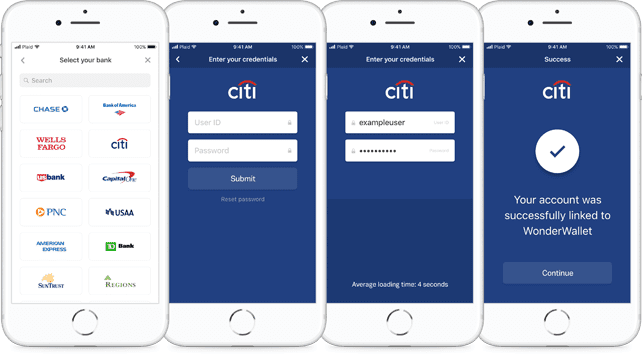

Products built using Plaid’s Auth product allow users to authenticate electronic bank to bank money transfers in just a few simple steps. It works by allowing users to sign into their bank account using their username and password — no checkbook hunting necessary — and retrieves the account holder’s info right away, facilitating instant authentication and the ability to reduce costs from failed transactions.

The product also provides what no checkbook can: the ability to confirm whether there are actually enough funds in the account before initiating a transaction, helping prevent overdraft fees and consumer frustration.

Verifying user identity during a transaction to protect against fraud is a quick, streamlined process with Plaid. It takes 12 seconds or less for users to link their accounts, and Plaid’s Identity product provides the option to check the account holder information on file with the bank for an extra layer of safety. Plaid also enables consumers to validate their income and employment in real time, eliminating the need for the apps and services they use to rely on credit bureaus.

Plaid also puts a wealth of valuable data at its users’ fingertips, offering up to 24 months of transaction history, along with real-time data that includes merchant name, merchant location, and purchase category info. This clean collection of data offers critical insights that help companies better serve their customers.

Plaid’s real-time balance and account status insights not only play a vital role in reducing fraud costs, but keep customers happy in their day-to-day banking. With the combination of historical transaction data and real-time info, users can avoid overdrafts and enable pre-funded transactions.

Put simply by Plaid’s spokesperson, “Plaid is the technology platform providing the tools and access needed for the development of a fully modern, and digitally-enabled financial system.”

Emerging Fintech Empowers Consumers and Institutions

In recent years, the fintech industry has seen an uptick in the sector of consumer-minded financial technologies such as Venmo, Acorns, Robinhood, Drop, and Tally.

“Solutions like these give consumers more transparency into their own financial records, empowering them to take even more control of their financial lives. This real-time connectivity to new customer data ultimately allows developers to build better and smarter consumer products,” said Plaid’s spokesperson.

Developers who are currently exploring the relatively new landscape of digital finance management might look to Plaid’s model of multi-layer security and easy data transmission to craft increasingly better products.

“We issued our first Fintech Request for Startups last year to offer support to other industry disruptors who can help bring about the next wave of innovation in financial services, including consumer-centric loan servicing, personalized insurance, hardware and software for bank branches, better mobile bank account opening, and more,” said Plaid’s spokesperson.

“One of the most talked about topics is the best way to share personal financial data, which underpins the entire industry. We believe in protecting data access so that developers can continue to improve pre-existing products and create new ones to enable all consumers to use their data in ways that they permission; without this, innovation within the industry will become stunted.”

Plaid Unveils New Asset Verification Service to Streamline Mortgage Lending

Assets, Plaid’s newest offering, aims to digitize and simplify the loan application process. The company unveiled its Assets product in April, and is now an accepted provider of asset verification for Fannie Mae’s Desktop Underwriter® (DU®) validation service, part of its Day 1 Certainty™ initiative.

Using Assets, lenders in mortgage and beyond can embed Plaid directly into their application process, providing borrowers with a quick and seamless experience that eliminates the need to manually collect paper documentation, helps reduce closing time, and protects lenders against buyback risk.

“The current mortgage application process is mired with paper-based processes. Not only is this a time-consuming process for the applicants and those processing the applications, but translating and recording a scanned paper document leaves room for inaccuracies given that documents can be altered or pages lost. On average, getting a mortgage in the US takes four to eight weeks and requires more than 50 pages of paper documents that have to be hand-delivered or faxed to your bank. There are more efficient, accurate, and technologically available ways to modernize these processes today,” Plaid’s spokesperson said.

Welcome to the age of digital finance innovation, where dressing in Plaid matches with everything.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![Credit Card Applications: 5 Most Popular Cards ([updated_month_year]) Credit Card Applications: 5 Most Popular Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/06/Credit-Card-Applications_How-To-Apply-edit.jpg?width=158&height=120&fit=crop)

![8 Best Prepaid Cards With Mobile Apps ([updated_month_year]) 8 Best Prepaid Cards With Mobile Apps ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/07/Best-Prepaid-Cards-With-Mobile-Apps.jpg?width=158&height=120&fit=crop)

![9 Loans & Credit Cards: 550 to 600 Credit Score ([updated_month_year]) 9 Loans & Credit Cards: 550 to 600 Credit Score ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/07/550-to-600-Credit-Scores.jpg?width=158&height=120&fit=crop)

![7 Best Loans & Credit Cards: 600-650 Score ([updated_month_year]) 7 Best Loans & Credit Cards: 600-650 Score ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/07/650.png?width=158&height=120&fit=crop)

![8 Best Credit Cards for 600 to 650 Credit Scores ([updated_month_year]) 8 Best Credit Cards for 600 to 650 Credit Scores ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/09/Best-Credit-Cards-for-600-to-650-Credit-Scores-Feat.jpg?width=158&height=120&fit=crop)

![7 Credit Cards For Scores Under 600 ([updated_month_year]) 7 Credit Cards For Scores Under 600 ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/03/Credit-Cards-For-Scores-Under-600.jpg?width=158&height=120&fit=crop)

![9 Balance Transfer Cards For 600-700+ FICO Score ([updated_month_year]) 9 Balance Transfer Cards For 600-700+ FICO Score ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/08/Balance-Transfer-Cards-For-600-700-FICO-Score.jpg?width=158&height=120&fit=crop)