This article identifies the best unsecured cards for borrowers with bad credit. We’ve chosen these cards because they are geared toward consumers with bad credit scores, which is a FICO Score of 580 or below.

Most of these cards have fairly high APRs, low credit limits, meager rewards, and high fees — the typical characteristics that credit card companies impose in return for assuming the risk that cardmembers may default on their credit card debt.

Nonetheless, these cards can deliver credit to consumers willing to accept the card’s constraints. At their best, these cards provide a way for you to demonstrate responsible behavior that can help you rebuild your credit.

The Best Unsecured Cards For Bad Credit

Most of these cards allow you to test the waters through a prequalification process that will not hurt your credit score. No matter how bad your credit, at least one of these cards may approve you as a cardmember, letting you conveniently shop without cash, a checkbook, or a debit card.

- Up to $1,000 credit limit doubles up to $2,000! (Simply make your first 6 monthly minimum payments on time)

- All credit types welcome to apply!

- Monthly Credit Score – Sign up for electronic statements, and get your Vantage 3.0 Score Credit Score From Experian

- Initial Credit Limit of $300 – $1,000 (subject to available credit)

- Monthly reporting to the three major credit bureaus

- See if you’re Pre-Qualified without impacting your credit score

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

See website for Details

|

See website for Details

|

29.99% APR (Variable)

|

$75 - $125

|

See website for Details*

|

The Surge® Platinum Mastercard® offers you $0 fraud liability and other basic benefits that come with all Mastercards. While the card’s initial credit limit is low, you may receive a higher limit by paying your bill on time for six months in a row. You can manage the card online and via a mobile app to view balances and make timely payments, among other things.

For a fee, you can purchase credit protection for this card that will waive your outstanding credit card debt if you die. You also get protection in the event of job loss, hospitalization, or disability. The card assists in building credit and tracking your credit score for free.

- Up to $1,000 credit limit doubles up to $2,000! (Simply make your first 6 monthly minimum payments on time)

- See if you’re Pre-Qualified with no impact to your credit score

- All credit types welcome to apply

- Access to your Vantage 3.0 score from Experian (When you sign up for e-statements)

- Initial Credit Limit of $300 – $1,000 (subject to available credit)

- Monthly reporting to the three major credit bureaus

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

29.99% APR (Variable)

|

$75 - $125

|

Bad, Fair, or No Credit

|

The Reflex® Platinum Mastercard® lets you prequalify in less than a minute without affecting your low credit score. This card offers a credit limit range that’s wider than those offered by some competitors. It comes with an annual fee but provides $0 fraud liability.

If you pay at least the minimum payment due each month for six months, the Reflex® Platinum Mastercard® may offer you a higher credit limit. Depending on your credit score, you may be able to avoid the monthly maintenance fee (which in any event is always waived for the first year). Other fees include a foreign transaction fee and fees for additional cards, cash advances, late payments, and returned payments.

3. Revvi Card

- Earn 1% cash back rewards^^ on payments made to your Revvi Credit Card

- Perfect credit not required

- $300 credit limit (subject to available credit)

- Checking account required

- Opportunity to request credit limit increase after twelve months, fee applies

- *See Rates, Fees, Costs & Limitations for complete offer details

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

See website for Details

|

N/A

|

35.99%

|

$75.00 1st year, $48.00 after

|

Fair

|

The Revvi Card is the only card in this review that offers cash back rewards. It also comes with $0 fraud liability, a user-friendly mobile app, and monthly reporting to the credit bureaus to help you build credit.

The purchase APR is high, and it charges an annual fee, a program fee, and fees for cash advances, foreign transactions, late payments, and returned payments.

- $400 credit limit doubles to $800! (Simply make your first 6 monthly minimum payments on time)

- All credit types welcome to apply

- Monthly reporting to the three major credit bureaus

- Initial Credit Limit of $400.00 (Subject to available credit)

- Fast and easy application process; results in seconds

- Use your card at locations everywhere Mastercard® is accepted

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

29.99%

|

$99

|

Fair/Poor/Bad

|

You can use the FIT™ Platinum Mastercard® to whip your credit into better shape because it reports your transactions to all three credit bureaus. The card charges a one-time processing fee, an annual fee, and fees for cash advances, foreign transactions, late or returned payments, and additional cards. You don’t pay the monthly maintenance fee during the first 12 months after opening the account.

Cardholders receive $0 fraud liability and automatic evaluation for a higher credit limit after six months of timely payments. You can purchase optional credit protection against loss of life, job loss, disability, or hospitalization. Continental Finance issues this card.

- Earn 1% cash back rewards on payments made to your Total Credit Card

- Checking Account Required

- $300 credit limit (subject to available credit)

- No security deposit, simply pay a one-time $95 program fee to open your account.*

- User friendly Mobile App.

- *See Rates, Fees, Costs & Limitations for complete offer details

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

35.99%

|

$75.00 1st year, $48.00 after

|

Fair, Bad Credit

|

The Total Visa® Card offers a quick application process and an immediate decision. The card’s APR is higher than some other cards in this review, and the 21-day grace period is one of the shortest. The card charges a one-time program fee, an annual fee, and a monthly servicing fee that’s waived for the first year, as is the cash advance fee.

The card assesses a program fee that will be deducted from your initial credit limit. Late and returned payments also trigger fees. Because the initial credit limit is low, you should find your monthly payment requirement easy to manage.

- Greater access to credit than before - $700 credit limit

- Get a Mastercard accepted online, in store and in app

- Account history is reported to the three major credit bureaus in the U.S.

- $0 liability* for unauthorized use

- Access your account online or from your mobile device 24/7

- *Fraud protection provided by Mastercard Zero Liability Protection. If approved, you'll receive the Mastercard Guide to Benefits that details the complete terms with your card.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

See terms

|

See terms

|

Fair/Good

|

The Milestone® Mastercard® from the Bank of Missouri will consider your application despite your less-than-perfect credit. You can apply for this card in a few steps, and the issuer may direct you towards another bank’s card if it can’t match you to one of its own cards.

The card charges an annual fee and a foreign transaction fee, but no monthly maintenance fee. There are also fees for cash advances, over-limit transactions, and late or returned payments. You can enjoy mobile access with the accompanying app, and the card automatically protects you if your card is lost or stolen.

- Earn 1% cash back rewards on payments made to your First Access Credit Card

- Checking Account Required

- $300 credit limit (subject to available credit)

- No security deposit, simply pay a one-time $95 program fee to open your account.*

- User friendly Mobile App.

- *See Rates, Fees, Costs & Limitations for complete offer details

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

35.99%

|

$75.00 1st year, $48.00 after

|

Bad Credit

|

The First Access Visa® Card is a full-featured card that routinely approves applications from consumers with imperfect credit, although applicants must have a checking account to qualify. Decisions are quick — in fact, you should receive a decision in about a minute. You can choose from six different card designs when applying for this card.

This card carries a high APR and plenty of fees, including a one-time program fee, an annual fee, late/returned payment fees, and two fees (for monthly servicing and cash advances) that are waived during the first year. There are also fees for additional cards, credit limit increases, express delivery, and duplicate copies of any monthly billing statement.

8. Progress Credit

This card is currently not available.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

Progress Credit partners with two issuers to provide you with both an unsecured Visa credit card and a secured Mastercard despite your imperfect credit history. In fact, the unsecured card is among the easiest to obtain. The unsecured Visa card from the Bank of Missouri boasts nationwide acceptance and security protections.

Both cards help build credit because each separately reports your transaction activity to each major credit bureau. The unsecured card charges a one-time program fee if your application is approved. You can’t use the card at fuel pumps, for gambling transactions, or with foreign merchants.

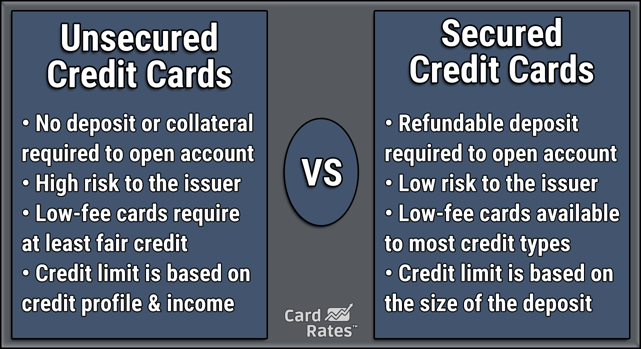

What Is an Unsecured Credit Card?

An unsecured card is what most folks think of as a normal credit card. You use it to charge purchases at stores and online and can stretch out the payments over multiple months. An unsecured card does not require a cash deposit to qualify for the card.

In contrast, a secured credit card is collateralized by your cash deposit into a special locked account maintained by the credit card company. The amount of your deposit may be less than or equal to your credit limit, depending on the card and your credit score.

We regularly review secured cards with deposit requirements ranging from $49 to $3,000 or more.

Your secured card’s cash deposit remains in the issuer’s account (normally a non-interest-bearing, FDIC-insured account) as long as the credit card account remains open. If you close the account, you’ll receive a full refund minus any money you still owe.

The cash deposit will be used if you fail to pay your bill on time or if you exceed your credit limit. This will reduce your credit limit until you restore the funds. If you need to tap into the deposit often, the issuer may decide to close the account.

You may be able to upgrade to an unsecured credit card from the same issuer if you show creditworthy behavior over a period of time. If you do receive an upgrade, you’ll get your deposit back and you’ll have to properly dispose of your secured credit card.

How Does an Unsecured Credit Card Work?

An unsecured credit card allows you to charge purchases for products and services at retail locations or online stores. Unsecured credit cards operate as follows:

- You apply for the card online or over the phone by supplying personal information about your income and expenses. If you are approved, you will be mailed the credit card right away and should receive it within a week or two.

- The card will feature your name, account number, expiration date, and a security code. There is usually a place to sign the back of the card.

- Modern credit cards contain an embedded microchip that encrypts important information, including transaction history and your current balance, among other things. They also have magnetic swipe strips for backward compatibility with older card-reading devices.

- Your unsecured credit card comes with a credit limit, an interest rate (called the annual percentage rate or APR), and a schedule of fees. Different cards have different fees and APRs. CardRates reviews and compares credit cards to help you find the perfect one for your purposes.

- Credit cards divide the year into billing cycles, usually one per month. The period between the end of the billing cycle and the payment due date is the grace period, which is usually in the 21- to 25-day range.

- You charge purchases on your credit card up to the credit limit. You can pay off your balance in full by the next payment due date and avoid paying any interest. Any unpaid balance from the previous billing cycle that remains unpaid after the grace period expires will incur interest every day until you fully repay your balance.

- Your card may also offer cash advances, which are like instant loans. There is no grace period for a cash advance — you accrue interest every day until you repay the advance.

- While rewards aren’t common with unsecured credit cards for bad credit, many credit cards for good credit offer rewards in the form of cash back, miles, or points. You earn rewards when you charge purchases on a rewards card, and you can redeem these rewards in various ways. Cards may offer simple or complex reward schemes — you’ll have to read all the fine print to understand the details.

- Most credit cards report your activity to one or more of the three major credit bureaus. The bureaus compile your credit history and calculate a credit score that depicts your creditworthiness in a single number. Your credit score helps determine which credit cards you can obtain and how much interest you’ll pay for credit and loans.

- Credit cards offer various benefits, such as free insurance, discounts on purchases, security and purchase protections, and free access to airport lounges, among several other lesser-known perks.

Many consumers hold multiple credit cards. That’s usually a good idea in case one card is stolen or you utilize the full credit limit on a card.

If your card is lost or stolen, you should immediately report it to the card issuer. The issuer will close the credit card account and send you a new credit card with a different account number.

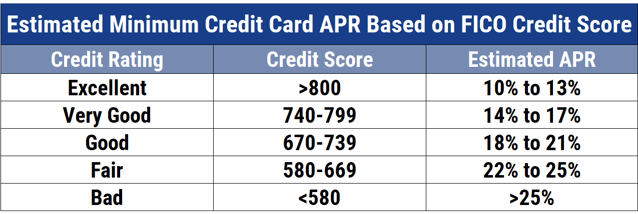

What Is a Bad Credit Score?

Your credit score defines your credit profile. About 90% of lenders and creditors in the United States use the FICO credit score system, which has a range from 300 (worst credit) to 850 (perfect credit).

A score below 580 is generally considered bad credit, whereas fair credit scores range from 580 to 669.

Some credit cards, including those reviewed here, are especially suited for consumers with bad to fair credit. Although secured cards for bad credit are fairly easy to get, you can also get an unsecured card despite a bad score. These cards all share certain characteristics:

- They offer low credit limits, as low as $200.

- APRs are usually between 24% and 35%.

- Fees are plentiful and can include signup fees, annual fees, and fees for cash advances, foreign transactions, and late payments.

- These cards usually offer no rewards and few benefits, although exceptions exist. For example, the Revvi Card is a cash rewards credit card.

- Typically, these cards report your card activity to all three credit bureaus. This allows you to rebuild your credit score if you pay your bills on time and maintain a credit utilization ratio below 30%.

- Derogatory items such as missed payments, delinquencies, defaults, collections, foreclosures, and bankruptcies remain on your credit history for up to 10 years. These items can devastate your credit score, but the impact will begin to wear off after a couple of years.

The cards in this review can help you raise your credit score if you maintain good financial habits. The higher your score, the bigger the credit limit, the lower the APR, and the greater the rewards and benefits.

What Is the Minimum Credit Score Needed For an Unsecured Card?

We’ve found that credit cards aimed at consumers with bad credit generally consider FICO scores as low as 550. They can do so by requiring you to show proof of income and own a checking account in your name. While there are no guarantees, these cards offer you your best chance of obtaining an unsecured card.

Some credit cards do not require a credit check, meaning they may approve applications from consumers with scores as low as 300 or with no score at all. A student credit card may fall into this category, as does a secured card. We have seen reviews on credit cards that perform credit checks and yet are willing to accept any credit score, but we cannot confirm these claims.

Unsecured cards that accept low credit scores are not to be confused with the high-quality rewards cards you see advertised on TV. Cards for low credit scores seldom offer rewards and usually come with high APRs, high (and plenty of) fees, and low credit limits. These cards are truly aimed at consumers with credit so bad that their only other alternatives are secured or prepaid credit cards.

Our top card for bad credit scores is the Surge® Platinum Mastercard®. The card offers basic liability protection and the opportunity for a higher credit limit after a period of on-time payments. However, the card comes with many fees, a high APR, and a modest credit limit.

The Credit One Bank® Platinum Visa® for Rebuilding Credit is worth a try because it’s the only card in this group that offers cash back rewards. You can attempt to prequalify for this card without hurting your credit score. The card does come with several fees, but it offers a relatively low APR and several perks, including allowing you to choose your payment due date.

Can I Get a Credit Card With a 500 Credit Score?

Your best bet if you have a 500 credit score is to apply for a secured credit card. Your cash deposit serves as collateral for a secured card, making your credit score irrelevant. When comparing secured credit cards, check the fees, rewards, APR, and whether your deposit will earn interest.

Our favorite secured card when your score is bad is the Applied Bank® Secured Visa® Gold Preferred® Credit Card. This card will not turn you down for having a poor credit history and has a relatively low annual fee and minimum security deposit.

Its standout feature, however, is the low fixed APR.

- Better than Prepaid...Go with a Secured Card! Load One Time - Keep On Using

- Absolutely No Credit Check or Minimum Credit Score Required

- Automatic Reporting to All Three National Credit Bureaus

- 9.99% Low Fixed APR - Your Rate Won’t Go Up Even if You Are Late

- Activate Today with a $200 Minimum Deposit - Maximum $1,000.

- Increase Your Credit Limit up to $5,000 by Adding Additional Deposits Anytime

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

9.99% Fixed

|

$48

|

Poor/Fair/Limited/Damaged

|

If you are philosophically opposed to annual fees, check out the Capital One Platinum Secured Credit Card. The card may allow you to semi-secure the account by putting down a deposit that’s smaller than your credit line. You may also be rewarded with a higher credit limit after six months of on-time payments without the need to increase your deposit.

- No annual or hidden fees. See if you're approved in seconds

- Building your credit? Using the Capital One Platinum Secured card responsibly could help

- Put down a refundable security deposit starting at $49 to get a $200 initial credit line

- You could earn back your security deposit as a statement credit when you use your card responsibly, like making payments on time

- Be automatically considered for a higher credit line in as little as 6 months with no additional deposit needed

- Enjoy peace of mind with $0 Fraud Liability so that you won't be responsible for unauthorized charges

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

29.99% (Variable)

|

$0

|

Limited, Bad

|

Another option when your credit score is down in the dumps is a prepaid reloadable card. These are actually more like debit cards, but they don’t require you to own a bank account. Instead, you deposit cash into the card account and then use the card to make purchases against the deposited balance.

The problem with prepaid cards is that they don’t involve credit and, therefore, will not help you build your credit score. Nonetheless, if you’d like the simplicity of a prepaid card, our top pick is the PayPal Prepaid Mastercard®. This card allows you to exchange money with your PayPal account and get direct deposits up to two days faster.

- Move money from your PayPal account to fund your prepaid card account.

- Earn cash back and personalized offers, just for using your card.

- With Direct Deposit, you can get paid faster than a paper check.

- Card issued by The Bancorp Bank, Member FDIC. Card may be used everywhere Debit Mastercard is accepted.

- Click PayPal Prepaid Mastercard® for additional features & program details, and to request a Card.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

Variable Monthly Fee

|

Not applicable

|

As mentioned earlier, a student credit card pays less attention to credit scores as long as you can confirm enrollment and meet other requirements. One student card that does not perform credit checks is the Deserve EDU Mastercard for Students.

The card comes with cash back rewards, no annual or foreign transaction fees, no Social Security number requirement, and an above-average APR.

Which Credit Cards Give You Instant Approval?

There isn’t anything particularly novel about credit cards offering an instant verdict when you apply. That’s because most credit cards allow you to prequalify.

When you attempt to prequalify for a subprime credit card, the issuer will not perform a hard pull (i.e., inquiry) of your credit report that would hurt your score.

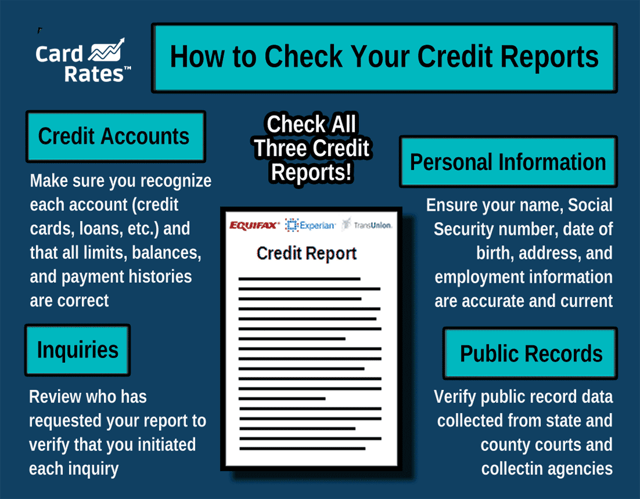

It works like this: The three credit bureaus (Equifax, TransUnion, and Experian) maintain your credit history and assign you a credit score so card issuers can decide whether to give you a card. When you want to prequalify for a card, you fill in a form that the issuer uses to do a soft credit check. A soft check provides limited information to the issuer but doesn’t affect your credit score.

If you do prequalify, you can then allow the issuer to perform the hard credit check necessary to approve your application. The hard pull of your credit report may lower your credit score by a small amount. All this takes just a few minutes, and although final approval is not guaranteed, your chances are improved by the prequalification step.

Our top-ranked unsecured credit card that offers instant approval to consumers with bad credit is the Surge® Platinum Mastercard®. The card gives you free access to your Vantage 3.0 credit score from Experian (a FICO competitor) and provides 0% fraud liability. The issuer can instantly prequalify you and give you a final decision within a minute.

Do Unsecured Credit Cards Build Credit?

You can use most unsecured cards to build credit, but only if you use your cards responsibly.

The process starts with the payment information collected by the three major credit bureaus. Nearly all credit cards report your payment activity to at least one of the credit bureaus, and cards geared toward bad-credit consumers usually report to all three bureaus.

The bureaus keep track of your payment activity and credit history, including:

- Your credit card payments, including dates and amounts

- Late payments

- Card balances

- Approved credit limits

- Start and end dates for credit accounts

- Credit inquiries

- Collections

- Written-off accounts

- Foreclosures

- Bankruptcies

The credit bureaus compile all this information into the consumer’s credit history and generate an updated credit report each month. The bureaus also use this information to calculate your FICO credit score as well as their own proprietary scores.

Because the credit bureaus may not collect the same information about a consumer, they each may calculate slightly different credit scores for the same person. FICO credit scores range from 300 to 850 and are based on five different factors. Credit cards can impact all five factors, as follows:

1. Payment history (35% of your FICO score)

Credit card companies expect you to make at least the minimum payment on time each monthly billing cycle. If you miss the payment due date or if you pay less than the minimum, you’re subject to a late fee and perhaps a penalty APR.

If your payment is 30 or more days delinquent, the credit card company will probably report you to a credit bureau, causing your credit score to suffer. The damage gets worse the later the payment, and those over 90 days late are marked as defaulted. Your credit history will also note any accounts turned over to a collection agency.

These unfortunate events remain on your credit report for seven years. However, the bulk of the damage to your credit score is immediate and only begins to dissipate after a couple of years.

On the other hand, always paying on time will help your credit score. If you realize you uncharacteristically forgot a payment for 30+ days, send the payment in right away and then contact the card issuer, asking them to remove the item from your credit report. If you have a good payment record, the issuer may oblige and remove the derogatory item.

Many credit cards offer an auto payment option so you never risk a missed payment. Alternatively, you can set your checking account to send automatic payment drafts each month to your card issuer.

2. Amounts owed (30%)

Revolving credit accounts, such as credit cards and home equity lines of credit, authorize a credit limit. Your credit utilization ratio (CUR) is the amount of revolving credit used divided by the amount available.

To help improve your credit score, you want to keep your CUR under 30%.

When your CUR gets too high, credit bureaus fret that you are under financial pressure, and that can hurt your score. The fix is to pay down your credit card balances and keep your CUR below 30%. Doing so should quickly help your score improve.

3. Length of Credit History (15%)

The FICO scoring system rewards consumers for having long-standing accounts. The system looks at the average age of your accounts as well as the age of the oldest and newest account. It also takes into consideration the age of each specific account and how long an account has been dormant.

When you get a new credit card, it reduces the age of your average and newest accounts, which is generally bad for your credit scores. Closing an old account is not helpful either because it may lower the average account age.

The general rule is to not close your credit card accounts and to use each card at least once a year.

The thinking behind this is that creditors want to know whether you have experience managing your credit accounts and loans. If you have old, active accounts, creditors infer that you’ve learned how to manage your finances responsibly. You lose this advantage if your old accounts are riddled with late payments and other derogatory information.

4. Credit mix (10%)

Creditors like to see you handle a variety of credit accounts and loans. Having experience with a diverse mix of revolving accounts, installment loans, mortgages, student loans, etc., is seen as a positive by lenders because it indicates you know how to manage your finances.

This is a minor factor. It may be important if you have a scant credit history with few accounts on your credit reports. Generally, it’s not worthwhile to open an account simply to enhance your credit score.

5. New credit (10%)

Your credit file tracks whenever a creditor performs a hard inquiry in response to an account application. Hard inquiries are visible to viewers of your credit reports and remain on your reports for two years (although they lose impact after one year). Too many hard inquiries within a short period will hurt your score, as it may indicate that you are in financial need.

A hard inquiry can drop your score by five to 10 points, but very frequent ones may be even more costly. However, there is an exception for comparison shopping. For example, if you are shopping for a mortgage, multiple hard inquiries from local banks and mortgage providers occurring within the same 45 to 60 days will count as only one hard pull.

The first two factors have the most impact on your credit score. You can use them to build your credit by always paying your bills on time and keeping your credit balances below 30% of your available credit.

The other action you should take that may improve your credit score is to examine each of your three credit reports for errors. Disputing mistakes and having them removed from your reports is an important way to ensure your scores aren’t being unfairly penalized.

You can get free copies of your credit reports from AnnualCreditReport.com, the sole source authorized by Federal law for free credit reports.

You can dispute credit report errors on your own, but many consumers with bad credit choose to hire a credit repair company. These companies know all the tricks of the trade and can help you identify potential mistakes you may otherwise miss.

Considering their modest cost, it may be well worth having a credit repair company help you get your reports as clean as possible.

Can I Get a Business Credit Card With Poor Credit?

Secured business credit cards make the most sense for business owners with poor or thin credit. These cards are available to almost anyone who can post the required cash deposit. You can use these cards to earn rewards on purchases made by you and your employees.

If you’d prefer an unsecured business card, we recommend the Capital One® Spark® Classic for Business. The card charges no annual fee and gives you unlimited cash back rewards on all purchases. You also get a variety of benefits for your business, including roadside assistance, no foreign transaction fees, and various security/purchase protections. (Information for this card not reviewed by or provided by Capital One.)

When you need a business credit card despite having poor credit, consider these four strategies:

- Build your business credit: Even if your personal credit is bad, you may be able to build up your business credit by satisfying certain metrics important to the credit bureaus. These include your transaction volume, outstanding balances, demographics, and more. You’ll need to obtain an EIN (Employer Identification Number) from the IRS before you can open business bank accounts that will be used to build your business credit. It’s also helpful to establish credit lines with your business suppliers and vendors. After creating three credit lines, you’ll be able to get a Paydex credit score from Dun & Bradstreet. As always, make sure you pay your bills on time (or even better, early) and keep tight control of your credit balances. Another factor in building strong business credit is to maintain clean public records — no late payments, adverse court judgments, nor bankruptcies.

- Use a cosigner: You can speed up the time it takes to build good credit by recruiting a qualified cosigner. That’s someone with good credit who is willing to be responsible for your credit card balances. With a good cosigner, you may be able to obtain a top-rated business credit card.

- Get a secured card: We’ve already seen how a secured card can be obtained by business owners with poor credit. You can get a secured card in the business’s name to help build its credit. The usefulness of a secured business credit card depends on its credit limit — some cards will allow you to deposit as much as $25,000 or as little as $500. As your business builds its credit, you may be able to replace your secured card with an unsecured one. This will free up your deposit for use elsewhere. By ensuring you pay on time, you’ll have the best chance to upgrade to an unsecured card within a reasonable time frame.

- Exploit banking relationships: As mentioned, you’ll need to get an EIN to establish a business checking account. A good strategic decision is to use a local community bank or credit union, where you have the opportunity to build a business relationship. The two-way loyalty of this relationship may help you arrange financing in return for your purchase of the institution’s financial products, such as a credit-builder account.

Business credit cards with cash back rewards can reduce your net expenditures and preserve more of your cash. For a startup or growing business, this is an important benefit that improves the chances of survival.

How Do I Choose the Right Card For Me?

You may have limited access to unsecured credit cards if you have bad credit. With the rare exception, the cards you’ll qualify for will be bare-bones options with high costs and few benefits. So, choosing the right card is an exercise in identifying those that are less bad than others.

This review is a good starting place for making your choice. All the cards we’ve reviewed allow you to prequalify without hurting your credit score. This gives you the opportunity to pre-apply for multiple cards and eliminate the issuers that turn you down while pursuing the cards for which you successfully prequalify.

While most of these cards share a lot of similarities, there are a few factors for you to evaluate when choosing a card:

- Annual fee: Some of the cards in this group do not charge an annual fee. However, none of these cards have an annual fee exceeding $100.

- Processing fee: This is a one-time fee charged when you open the account. It is typically $89 more or less. This fee exists because the issuer is willing to approve the riskiest applicants. Avoid it if you can.

- Maintenance fee: This is another nuisance fee, charged monthly starting in the second year after opening the account. It’s one more fee you should try to avoid.

- Credit limit increase fee: On the one hand, it’s nice when the issuer is willing to increase your credit limit after you demonstrate your ability to pay on time. But then some issuers ruin the party by charging a fee for the increase.

- Rewards: All but one of the reviewed cards offer no rewards for use of the card. If you want rewards, you may have to first boost your credit score, or check out a secured card that offers rewards, such as the Capital One Quicksilver Secured Cash Rewards Credit Card.

We’ve rated the Surge® Platinum Mastercard® as the best unsecured credit card. It offers a high potential starting credit limit, a reasonable APR for subprime applicants, and monthly reporting to the credit bureaus.

It doesn’t hurt to try and prequalify for this card, so give it a go.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![5 Unsecured Loans for Bad Credit Borrowers ([updated_month_year]) 5 Unsecured Loans for Bad Credit Borrowers ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/02/Unsecured-Loans-for-Bad-Credit.jpg?width=158&height=120&fit=crop)

![7 Unsecured Credit Cards After Bankruptcy ([updated_month_year]) 7 Unsecured Credit Cards After Bankruptcy ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/09/Unsecured-Credit-Cards-After-Bankruptcy.jpg?width=158&height=120&fit=crop)

![9 Unsecured Credit Cards For Fair Credit ([updated_month_year]) 9 Unsecured Credit Cards For Fair Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/08/shutterstock_617054912.jpg?width=158&height=120&fit=crop)

![6 Last-Chance Unsecured Credit Cards ([updated_month_year]) 6 Last-Chance Unsecured Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/08/lastchance1.jpg?width=158&height=120&fit=crop)

![9 Unsecured Credit Cards With $1,000 Limits ([updated_month_year]) 9 Unsecured Credit Cards With $1,000 Limits ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/09/Unsecured-Credit-Cards-With-1000-Limits.jpg?width=158&height=120&fit=crop)

![6 Steps for Graduating From Secured to Unsecured Credit ([updated_month_year]) 6 Steps for Graduating From Secured to Unsecured Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/05/Things-to-Do-After-Upgrading-From-Secured-to-Unsecured-Credit.jpg?width=158&height=120&fit=crop)

![11 Best Credit Cards For Bad Credit ([updated_month_year]) 11 Best Credit Cards For Bad Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/07/shutterstock_1405747820.jpg?width=158&height=120&fit=crop)