The types of credit cards available are vast and diverse. When I first discovered the world of credit cards, I was amazed at the breadth of the selection offered to consumers. Even today, after years of exploring the farthest reaches of credit cards and personal finance, I still occasionally come across an awesome card I never knew existed.

While experienced cardholders and rewards churners may revel in the abundance and diversity of credit card types available to them, a novice to the modern credit card marketplace can easily be overwhelmed by the sheer number of options. To help put the field of choices into perspective, we’ve answered many of the most common questions about the different types of credit cards — and how to pick the right one. Keep reading to learn about the major types of credit cards, card rewards, introductory offers, and more.

In most cases, if you’re asked what type of credit card you have by a merchant or checkout form, the question is likely referring to the credit card network, which is the company that processes the credit card transaction. The four major credit card networks are American Express (Amex), Discover, Mastercard, and Visa.

To determine which credit card network your credit card operates on, you can simply check your physical card for the network logo and/or name. For many modern EMV chip cards, the network logo will be near the printed credit card number.

It’s common to mistake credit card networks with credit card issuers, particularly because two of the major credit card networks — Amex and Discover — also issue all of their own credit cards. In contrast, most credit cards operating on the Mastercard and Visa networks are really issued by a secondary bank, such as Capital One or Chase, or another financial institution.

For example, the Chase Freedom Flex℠ credit card is issued by Chase Bank, but the card is processed on the Mastercard network. On the other hand, the Discover it® Cash Back credit card is solely a Discover card, because Discover is both the issuing bank and credit card network.

Since it’s the network — not the issuing bank — that determines where your credit card will be accepted, you may wish to choose a card based on a specific network. While all four networks are regularly accepted in the U.S., Visa and Mastercard are generally considered to be the most universally accepted around the world (though American Express and Discover are growing in global popularity).

Visa | Mastercard | Discover | Amex

Best “Visa” Credit Cards

Often credited as the very first credit card network, Visa began in 1958 as a part of the first mass-market consumer credit card, the BankAmericard offered by Bank of America. The company expanded internationally in 1974 and officially formed Visa, Inc. in 2007.

Though hundreds of millions of credit cards around the world boast Visa logos, Visa doesn’t issue any of its own cards, instead partnering with a variety of third-party banks.

- $200 online cash rewards bonus after you make at least $1,000 in purchases in the first 90 days of account opening.

- Earn 3% cash back in the category of your choice, automatic 2% at grocery stores and wholesale clubs (up to $2,500 in combined choice category/grocery store/wholesale club quarterly purchases) and unlimited 1% on all other purchases.

- Choose 3% cash back on gas and EV charging station, online shopping/cable/internet/phone plan/streaming, dining, travel, drug store/pharmacy or home improvement/furnishing purchases.

- If you're a Bank of America Preferred Rewards® member, you can earn 25%-75% more cash back on every purchase. That means you could earn 3.75%-5.25% cash back on purchases in your choice category.

- No annual fee and cash rewards don’t expire as long as your account remains open.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% - 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- Contactless Cards - The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

|

|

|

|

|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% - 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

- Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more.

- Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Travel℠. For example, 60,000 points are worth $750 toward travel.

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2024.

- Member FDIC

|

|

|

|

|

|

N/A

|

N/A

|

21.49%-28.49% Variable

|

$95

|

Good/Excellent

|

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

- $300 Annual Travel Credit as reimbursement for travel purchases charged to your card each account anniversary year.

- Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases

- Get 50% more value when you redeem your points for travel through Chase Travel℠. For example, 60,000 points are worth $900 toward travel.

- 1:1 point transfer to leading airline and hotel loyalty programs

- Access to 1,300+ airport lounges worldwide after an easy, one-time enrollment in Priority Pass™; Select and up to $100 application fee credit every four years for Global Entry, NEXUS, or TSA PreCheck®

|

|

|

|

|

|

N/A

|

N/A

|

22.49%-29.49% Variable

|

$550

|

Good/Excellent

|

+See More Visa Credit Cards

Best “Mastercard” Credit Cards

Mastercard was founded by a group of banks in 1966 as a way to compete with the upstart BankAmericard credit card, and has since become one of the most widely accepted credit card networks in the world. Similar to Amex and Discover, Mastercard does issue several of its own credit cards.

That said, the vast majority of active credit cards sporting the Mastercard logo are issued by third-party banks, including Barclays and HSBC.

EXPERT'S RATING

★★★★★

4.9

- Earn a one-time $200 cash bonus after you spend $500 on purchases within 3 months from account opening

- Earn unlimited 1.5% cash back on every purchase, every day

- $0 annual fee and no foreign transaction fees

- Enjoy up to 6 months of complimentary Uber One membership statement credits through 11/14/2024

- Earn unlimited 5% cash back on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options. Terms apply

- No rotating categories or sign-ups needed to earn cash rewards; plus, cash back won't expire for the life of the account and there's no limit to how much you can earn

|

|

|

|

|

|

0% for 15 months

|

0% for 15 months

|

19.99% - 29.99% (Variable)

|

$0

|

Excellent, Good

|

EXPERT'S RATING

★★★★★

4.8

- Earn a one-time $200 cash bonus after you spend $500 on purchases within the first 3 months from account opening

- Earn unlimited 3% cash back on dining, entertainment, popular streaming services and at grocery stores (excluding superstores like Walmart® and Target®), plus 1% on all other purchases

- Earn 10% cash back on purchases made through Uber & Uber Eats, plus complimentary Uber One membership statement credits through 11/14/2024

- Earn 8% cash back on Capital One Entertainment purchases

- Earn unlimited 5% cash back on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options. Terms apply

- No rotating categories or sign-ups needed to earn cash rewards; plus cash back won't expire for the life of the account and there's no limit to how much you can earn

|

|

|

|

|

|

0% for 15 months

|

0% for 15 months

|

19.99% - 29.99% (Variable)

|

$0

|

Excellent, Good

|

EXPERT'S RATING

★★★★★

4.8

- Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $100 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

|

|

|

|

|

|

N/A

|

N/A

|

19.99% - 29.99% (Variable)

|

$95

|

Excellent, Good

|

+See More Mastercard Credit Cards

Best “Discover” Credit Cards

Discover’s heritage traces back to the 1980s as an offshoot of the popular department store, Sears, before branching out on its own in the mid-2000s. Discover is credited with pioneering the cash back rewards credit card, and carries that legacy into its card offerings to this day.

Discover is both a credit card network and an issuer, operating as its own issuing bank.

EXPERT'S RATING

★★★★★

4.9

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! There’s no minimum spending or maximum rewards. You could turn $150 cash back into $300.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Get a 0% intro APR for 15 months on purchases. Then 17.24% to 28.24% Standard Variable Purchase APR applies, based on credit worthiness.

- No annual fee.

- Terms and conditions apply.

|

|

|

|

|

|

0% Intro APR for 15 months

|

0% Intro APR for 15 months

|

17.24% - 28.24% Variable APR

|

$0

|

Excellent/Good

|

EXPERT'S RATING

★★★★★

4.9

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! There’s no minimum spending or maximum rewards. You could turn $150 cash back into $300.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- Your account may not always be eligible for balance transfers. Balance transfer eligibility is determined at Discover’s discretion.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- No annual fee.

- Terms and conditions apply.

|

|

|

|

|

|

0% Intro APR for 6 months

|

0% Intro APR for 18 months

|

17.24% - 28.24% Variable APR

|

$0

|

Excellent/Good

|

EXPERT'S RATING

★★★★★

4.8

- UNLIMITED BONUS: Unlimited Mile-for-Mile match for all new cardmembers - only from Discover. Discover gives you an unlimited match of all the Miles you’ve earned at the end of your first year. For example, if you earn 35,000 Miles, you get 70,000 Miles. There’s no signing up, no minimum spending or maximum rewards. Just a Miles-for-Miles match.

- Automatically earn unlimited 1.5x Miles on every dollar of every purchase

- No annual fee

- Turn Miles into cash. Or redeem as a statement credit for your travel purchases like airfare, hotels, rideshares, gas stations, restaurants and more.

- 0% intro APR for 15 months on purchases. Then 17.24% - 28.24% Standard Variable Purchase APR will apply.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Discover is accepted nationwide by 99% of the places that take credit cards.

- Terms and conditions apply.

|

|

|

|

|

|

0% Intro APR for 15 months

|

0% Intro APR for 15 months

|

17.24% - 28.24% Variable APR

|

$0

|

Excellent/Good

|

+See More Discover Credit Cards

Best “American Express” Credit Cards

American Express, often nicknamed Amex, was founded in 1850 as an express transport service. The company flourished throughout the next 50 years with innovations, like the first American Express Money Order and the American Express Travelers Cheque. Amex introduced its first charge card in 1958, and has since become one of the top five credit card issuers in the world.

CATEGORY RATING

★★★★★

4.9

- Earn 80,000 Membership Rewards® points after you use your new card to make $6,000 in purchases in your first 6 months of Card Membership

- Earn 5X Membership Rewards® points for flights booked directly through airlines or American Express Travel, on up to $500,000 on these purchases per calendar year. Also earn 5X Membership Rewards® points on prepaid hotels on AmexTravel.com. Earn 1X points on all other purchases.

- $200 annual hotel credit, $200 annual airline fee credit, $25 monthly Equinox credit, $15 monthly Uber cash credit, $50 bi-annual Saks Fifth Avenue credit, and more.

- Platinum Card Members have unlimited complimentary access to all locations of The Global Lounge Collection, including 1,400 airport lounges across 650 cities.

- Automatic Marriott Bonvoy Gold Elite Status and Hilton Honors Gold Status. Enrollment required.

- Choose among three card designs

|

|

|

|

|

|

N/A

|

N/A

|

20.49% - 27.49% Pay Over Time

|

$695

|

Excellent

|

CATEGORY RATING

★★★★★

4.8

- Earn 60,000 Membership Rewards® points after you spend $4,000 on purchases on your new card in your first 6 months of card membership

- Earn 4X Points at U.S. supermarkets on up to $25,000 per calendar year in purchases. Also earn 4X Points at restaurants, including takeout and delivery, and 3X points on flights when booked directly with airlines or on amextravel.com. All other eligible purchases earn 1X point.

- No foreign transaction fees

- Earn up to $10 in statement credits monthly when you pay with the Gold Card at Grubhub, Seamless, Boxed and other participating partners. This can be an annual savings of up to $120. Enrollment required.

- Delight your senses when you book The Hotel Collection with American Express Travel. Get a $100 experience credit to use during your stay. A minimum 2-night stay is required.

- $250 Annual Fee

|

|

|

|

|

|

N/A

|

N/A

|

20.49% - 28.49% Pay Over Time

|

$250

|

Excellent

|

CATEGORY RATING

★★★★★

4.8

- Earn 120,000 Membership Rewards® points after you spend $15,000 on eligible purchases with your Card within the first 3 months of card membership

- Earn 5X Membership Rewards® points on flights and prepaid hotels on amextravel.com, 1.5X points on business categories and purchases of $5,000 or more on up to $2 million per calendar year, and 1X point for each dollar you spend on other purchases.

- Get up to $400 back per year toward U.S. purchases with Dell Technologies, up to $360 back per year for purchases with Indeed, and $120 back per year for wireless telephone service purchases on the Business Platinum Card, plus additional credits. Enrollment is required for all.

- Access to more than 1,400 lounges across 140 countries and counting with the American Express Global Lounge Collection®

- Use Membership Rewards® Pay with Points for all or part of an eligible fare and get 35% of those points back, up to 1,000,000 points back per calendar year

- $695 Annual Fee

|

|

|

|

|

|

N/A

|

N/A

|

18.74% - 26.74% Pay Over Time

|

$695

|

Excellent

|

+See More Amex Credit Cards

If each credit card issuer put out only a single card, you’d still have dozens of options when seeking out a revolving credit line — but the options are hardly so limited. Even when you’ve narrowed down your search to a particular network and issuer, you still have a very important decision to make: which type of rewards do you want?

Indeed, with such a glut of credit cards on the market, the rewards a card offers can be the deciding factor for many consumers. Unfortunately, there’s no easy way to pick the very best rewards card, as making the most out of credit card rewards will depend on your personal spending habits, as well as other facets of your lifestyle.

For example, if you rarely travel because you have an intense fear of planes, a credit card offering airline miles is probably not the way to go. On the other hand, if you spend so much time in the air, you’ve been adopted by a flock of geese, a travel rewards card might be extremely lucrative.

All in all, cash back rewards are the most straightforward to redeem, essentially providing a rebate on every purchase, while points programs are the most flexible, offering a variety of redemption options. Air miles are most valuable for cardholders who are frequent travelers — or who would like to be.

Air Miles | Cash Back | Points

Best “Air Miles” Credit Cards

The main choice you’ll need to make when selecting an air miles rewards card is whether you want a bank-branded card or an airline-branded card. Airline-branded cards, such as the Gold Delta SkyMiles® card from Amex, reward you directly with frequent flyer miles that are added to your airline loyalty account. Meanwhile, bank-branded cards, like the Capital One Venture Rewards Credit Card, don’t limit to you a particular airline.

AIR MILES RATING

★★★★★

4.9

- UNLIMITED BONUS: Unlimited Mile-for-Mile match for all new cardmembers - only from Discover. Discover gives you an unlimited match of all the Miles you’ve earned at the end of your first year. For example, if you earn 35,000 Miles, you get 70,000 Miles. There’s no signing up, no minimum spending or maximum rewards. Just a Miles-for-Miles match.

- Automatically earn unlimited 1.5x Miles on every dollar of every purchase

- No annual fee

- Turn Miles into cash. Or redeem as a statement credit for your travel purchases like airfare, hotels, rideshares, gas stations, restaurants and more.

- 0% intro APR for 15 months on purchases. Then 17.24% - 28.24% Standard Variable Purchase APR will apply.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Discover is accepted nationwide by 99% of the places that take credit cards.

- Terms and conditions apply.

|

|

|

|

|

|

0% Intro APR for 15 months

|

0% Intro APR for 15 months

|

17.24% - 28.24% Variable APR

|

$0

|

Excellent/Good

|

AIR MILES RATING

★★★★★

4.9

- $0 annual fee and no foreign transaction fees

- Earn a bonus of 20,000 miles once you spend $500 on purchases within 3 months from account opening, equal to $200 in travel

- Earn unlimited 1.25X miles on every purchase, every day

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

|

|

|

|

|

|

0% for 15 months

|

0% for 15 months

|

19.99% - 29.99% (Variable)

|

$0

|

Excellent, Good

|

AIR MILES RATING

★★★★★

4.8

- Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $100 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

|

|

|

|

|

|

N/A

|

N/A

|

19.99% - 29.99% (Variable)

|

$95

|

Excellent, Good

|

+See More Air Miles Credit Cards

Best “Cash Back” Credit Cards

Cash back credit card rewards come in two main flavors: unlimited flat-rate rewards, or bonus category rewards. Unlimited programs give you the same flat earnings rate on all purchases, while cards that offer bonus categories provide higher earnings rates for purchases in the predetermined categories. Additionally, some bonus-category cards have rotating categories that change quarterly.

CASH BACK RATING

★★★★★

4.9

- $200 online cash rewards bonus after you make at least $1,000 in purchases in the first 90 days of account opening.

- Earn 3% cash back in the category of your choice, automatic 2% at grocery stores and wholesale clubs (up to $2,500 in combined choice category/grocery store/wholesale club quarterly purchases) and unlimited 1% on all other purchases.

- Choose 3% cash back on gas and EV charging station, online shopping/cable/internet/phone plan/streaming, dining, travel, drug store/pharmacy or home improvement/furnishing purchases.

- If you're a Bank of America Preferred Rewards® member, you can earn 25%-75% more cash back on every purchase. That means you could earn 3.75%-5.25% cash back on purchases in your choice category.

- No annual fee and cash rewards don’t expire as long as your account remains open.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% - 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- Contactless Cards - The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

|

|

|

|

|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% - 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

CASH BACK RATING

★★★★★

4.9

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! There’s no minimum spending or maximum rewards. You could turn $150 cash back into $300.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Get a 0% intro APR for 15 months on purchases. Then 17.24% to 28.24% Standard Variable Purchase APR applies, based on credit worthiness.

- No annual fee.

- Terms and conditions apply.

|

|

|

|

|

|

0% Intro APR for 15 months

|

0% Intro APR for 15 months

|

17.24% - 28.24% Variable APR

|

$0

|

Excellent/Good

|

CASH BACK RATING

★★★★★

4.8

- INTRO OFFER: Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back!

- Enjoy 6.5% cash back on travel purchased through Chase Travel, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more; 4.5% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and 3% on all other purchases (on up to $20,000 spent in the first year).

- After your first year or $20,000 spent, enjoy 5% cash back on travel purchased through Chase Travel, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

- No minimum to redeem for cash back. You can choose to receive a statement credit or direct deposit into most U.S. checking and savings accounts. Cash Back rewards do not expire as long as your account is open!

- Enjoy 0% Intro APR for 15 months from account opening on purchases and balance transfers, then a variable APR of 20.49% - 29.24%.

- No annual fee – You won't have to pay an annual fee for all the great features that come with your Freedom Unlimited® card

|

|

|

|

|

|

0% Intro APR on Purchases 15 months

|

0% Intro APR on Balance Transfers 15 months

|

20.49% - 29.24% Variable

|

$0

|

Good/Excellent

|

+See More Cash Back Credit Cards

Best “Points” Credit Cards

Credit cards offering rewards points tend to be the most versatile rewards, typically providing redemption options that include cash back and travel, as well as things like gift cards, merchandise, and exclusive experiences. Many points programs offer the most per-point value when you transfer your points to a partner airline or hotel loyalty program.

POINTS & GIFTS RATING

★★★★★

4.9

- Earn unlimited 1.5 points per $1 spent on all purchases, with no annual fee and no foreign transaction fees and your points don't expire as long as your account remains open.

- 25,000 online bonus points after you make at least $1,000 in purchases in the first 90 days of account opening - that can be a $250 statement credit toward travel purchases.

- Use your card to book your trip how and where you want - you're not limited to specific websites with blackout dates or restrictions.

- Redeem points for a statement credit to pay for travel or dining purchases, such as flights, hotel stays, car and vacation rentals, baggage fees, and also at restaurants including takeout.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% - 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- If you're a Bank of America Preferred Rewards® member, you can earn 25%-75% more points on every purchase. That means instead of earning an unlimited 1.5 points for every $1, you could earn 1.87-2.62 points for every $1 you spend on purchases.

- Contactless Cards - The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

|

|

|

|

|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% - 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

POINTS & GIFTS RATING

★★★★★

4.8

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

- Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more.

- Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Travel℠. For example, 60,000 points are worth $750 toward travel.

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2024.

- Member FDIC

|

|

|

|

|

|

N/A

|

N/A

|

21.49%-28.49% Variable

|

$95

|

Good/Excellent

|

POINTS & GIFTS RATING

★★★★★

4.8

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

- $300 Annual Travel Credit as reimbursement for travel purchases charged to your card each account anniversary year.

- Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases

- Get 50% more value when you redeem your points for travel through Chase Travel℠. For example, 60,000 points are worth $900 toward travel.

- 1:1 point transfer to leading airline and hotel loyalty programs

- Access to 1,300+ airport lounges worldwide after an easy, one-time enrollment in Priority Pass™; Select and up to $100 application fee credit every four years for Global Entry, NEXUS, or TSA PreCheck®

|

|

|

|

|

|

N/A

|

N/A

|

22.49%-29.49% Variable

|

$550

|

Good/Excellent

|

+See More Points Credit Cards

In addition to using credit card rewards to motivate potential cardholders, many credit card issuers are also offering a range of introductory deals to new members. These deals run the gamut, ranging from lucrative signup bonuses that provide a bounty of cash back, points, or miles, all the way to interest rate offers of 0% APR for 12 months or more.

Most rewards-based signup bonuses change every few months, but the basic requirements tend to stay the same across the board. In general, you’ll need to spend a certain minimum amount with your card in a given time period, typically within the first 90 days after opening your account. Signup bonuses can be a great way to enjoy some extra savings or jump-start your points or miles.

As valuable as signup rewards can be, however, intro-APR deals can often be even more lucrative for cardholders prone to carrying a balance. That’s because the average credit card charges an APR around 16%, which can equal sizable interest fees each month you tote around a balance on your card. With a solid intro-APR offer providing a 0% APR on new purchases, you can potentially save hundreds in fees over the course of a year.

And if you already have a balance on which you’re stuck paying huge interest fees? Transfer that balance to a credit card with an introductory interest rate deal offering 0% APR on balance transfers. Eliminating your interest fees can be a great way to put more money toward your balance and get closer to being debt-free.

New Purchases | Balance Transfers

Best Intro-APR “New Purchases” Credit Cards

Cards offering intro-APR deals for new purchases can be a great way to finance big purchases you need to repay over a few months, with typical introductory periods extending to 12 months or more. Plus, you can still earn rewards on your interest-free purchases. Your APR will revert to the default purchase APR when the offer expires, so remember to pay off your balance before the end of your introductory term to avoid being charged interest fees.

0% INTRO APR RATING

★★★★★

4.8

- $200 online cash rewards bonus after you make at least $1,000 in purchases in the first 90 days of account opening.

- Earn 3% cash back in the category of your choice, automatic 2% at grocery stores and wholesale clubs (up to $2,500 in combined choice category/grocery store/wholesale club quarterly purchases) and unlimited 1% on all other purchases.

- Choose 3% cash back on gas and EV charging station, online shopping/cable/internet/phone plan/streaming, dining, travel, drug store/pharmacy or home improvement/furnishing purchases.

- If you're a Bank of America Preferred Rewards® member, you can earn 25%-75% more cash back on every purchase. That means you could earn 3.75%-5.25% cash back on purchases in your choice category.

- No annual fee and cash rewards don’t expire as long as your account remains open.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% - 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- Contactless Cards - The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

|

|

|

|

|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% - 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

0% INTRO APR RATING

★★★★★

4.8

- $200 online cash rewards bonus after you make at least $1,000 in purchases in the first 90 days of account opening.

- Earn unlimited 1.5% cash back on all purchases.

- If you're a Bank of America Preferred Rewards® member, you can earn 25%-75% more cash back on every purchase. That means you could earn 1.87%-2.62% cash back on every purchase with Preferred Rewards.

- No annual fee.

- No limit to the amount of cash back you can earn and cash rewards don’t expire as long as your account remains open.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% - 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- Contactless Cards - The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

|

|

|

|

|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% - 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

0% INTRO APR RATING

★★★★★

4.8

- Earn unlimited 1.5 points per $1 spent on all purchases, with no annual fee and no foreign transaction fees and your points don't expire as long as your account remains open.

- 25,000 online bonus points after you make at least $1,000 in purchases in the first 90 days of account opening - that can be a $250 statement credit toward travel purchases.

- Use your card to book your trip how and where you want - you're not limited to specific websites with blackout dates or restrictions.

- Redeem points for a statement credit to pay for travel or dining purchases, such as flights, hotel stays, car and vacation rentals, baggage fees, and also at restaurants including takeout.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% - 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- If you're a Bank of America Preferred Rewards® member, you can earn 25%-75% more points on every purchase. That means instead of earning an unlimited 1.5 points for every $1, you could earn 1.87-2.62 points for every $1 you spend on purchases.

- Contactless Cards - The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

|

|

|

|

|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% - 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

+See More Intro-APR New Purchases Card Offers

Best Intro-APR “Balance Transfer” Credit Cards

Although you can’t earn rewards on transferred balances, you can certainly save a lot of money in interest fees by using a balance transfer credit card with an intro-APR offer. Keep in mind that most credit cards charge a balance transfer fee — typically 3% to 5% of your transferred balance — and you’ll need to pay the fee at the time of your transfer. Your balance transfer APR will revert to the default balance transfer APR at the end of your intro period.

0% BALANCE TRANSFER RATING

★★★★★

4.8

- 0% Intro APR for 21 months on balance transfers from date of first transfer and 0% Intro APR for 12 months on purchases from date of account opening. After that the variable APR will be 18.24% - 28.99%, based on your creditworthiness. Balance transfers must be completed within 4 months of account opening.

- There is a balance transfer fee of either $5 or 5% of the amount of each transfer, whichever is greater

- Get free access to your FICO® Score online.

- With Citi Entertainment®, get special access to purchase tickets to thousands of events, including concerts, sporting events, dining experiences and more.

- No Annual Fee - our low intro rates and all the benefits don’t come with a yearly charge.

|

|

|

|

|

|

0% 12 months on Purchases

|

0% 21 months on Balance Transfers

|

18.24% - 28.99% (Variable)

|

$0

|

Excellent, Good

|

Additional Disclosure: Citi is a CardRates advertiser.

0% BALANCE TRANSFER RATING

★★★★★

4.8

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! There’s no minimum spending or maximum rewards. You could turn $150 cash back into $300.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- Your account may not always be eligible for balance transfers. Balance transfer eligibility is determined at Discover’s discretion.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- No annual fee.

- Terms and conditions apply.

|

|

|

|

|

|

0% Intro APR for 6 months

|

0% Intro APR for 18 months

|

17.24% - 28.24% Variable APR

|

$0

|

Excellent/Good

|

0% BALANCE TRANSFER RATING

★★★★★

4.8

- Earn $200 cash back after you spend $1,500 on purchases in the first 6 months of account opening. This bonus offer will be fulfilled as 20,000 ThankYou® Points, which can be redeemed for $200 cash back.

- Earn 2% on every purchase with unlimited 1% cash back when you buy, plus an additional 1% as you pay for those purchases. To earn cash back, pay at least the minimum due on time. Plus, for a limited time, earn 5% total cash back on hotel, car rentals and attractions booked on the Citi Travel℠ portal through 12/31/24.

- Balance Transfer Only Offer: 0% intro APR on Balance Transfers for 18 months. After that, the variable APR will be 19.24% - 29.24%, based on your creditworthiness.

- Balance Transfers do not earn cash back. Intro APR does not apply to purchases.

- If you transfer a balance, interest will be charged on your purchases unless you pay your entire balance (including balance transfers) by the due date each month.

- There is an intro balance transfer fee of 3% of each transfer (minimum $5) completed within the first 4 months of account opening. After that, your fee will be 5% of each transfer (minimum $5).

|

|

|

|

|

|

N/A

|

0% Intro APR Period 18 months on Balance Transfers

|

19.24% - 29.24% (Variable)

|

$0

|

Excellent, Good, Fair

|

Additional Disclosure: Citi is a CardRates advertiser.

+See More Intro-APR Balance Transfer Card Offers

With literally hundreds of different credit cards from which to choose, it can be hard to limit yourself to just one or two. In fact, to get the most value out of their credit card rewards, some consumers carry a variety of cards to ensure they always have a way to maximize rewards on any purchase. But is there is a limit to how many cards you can have?

The short answer is: Nope. There is no hard-and-fast limit to how many credit cards you can have in your name, nor are there any official restrictions on the types of cards you can carry. If you want to amass over 1,000 different credit cards — and you have the credit to qualify for them — no specific rule says you can’t do so.

That said, individual issuers sometimes have their own limitations on how many of their cards a particular cardholder can obtain. For example, American Express was long reported to have a five-card maximum per cardholder, though that no longer seems to be the case.

A more common credit card restriction is a limit on the number of cards you obtain in a specific time period. In particular, Chase is infamous for its 5/24 Rule, which automatically denies applicants who have opened more than five new credit accounts in the last 24 months. Additionally, Discover requires existing cardholders to have their current card for at least 12 billing cycles before they can apply for a second Discover card.

Overall, the only true limitation on how many credit cards you can have is, well, you. If you rarely carry a balance from month to month and always pay your bill on time, you can easily have multiple credit cards and a great credit score. In fact, consumers with the best FICO scores (800 to 850) have an average of 10 revolving credit lines.

On the other side of the coin, if you are prone to carrying credit card balances or often forget to pay your credit card bill on time, multiple credit cards could spell disaster for your credit score — and your pocketbook. In this case, you may want to limit yourself to one or two cards that you can learn to use responsibly, and stick to cash or prepaid cards for the rest of your purchases.

For a long while, whenever you used your credit card to make an online purchase, the checkout form would ask you which type of credit card you intended to use. These days, it’s less common to manually fill out this information, as most forms are coded to automatically identify your credit card network.

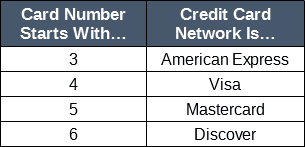

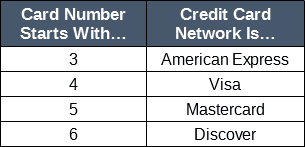

How does it work? Well, each credit card has a unique credit card number, which is the number used to identify your account during transactions. The first digit of your credit card number actually identifies your credit card network, according to the following:

So, as an example, suppose the first four digits of your credit card number are “3571.” In this case, the “3” would indicate that your credit card network was American Express. Similarly, credit cards with numbers that start with “4744” are processed by the Visa credit card network.

When compared to the alternative payment methods of our past — namely cash and checks — credit cards provide an unbeatable level of purchasing security. For instance, given the extensive fraud protection offered by credit card companies, you rarely need to worry about your credit card being stolen and used to put you in debt, as many issuers cap (or eliminate) your liability.

Chip-and-PIN cards require a four-digit PIN for purchase verification.

At the same time, no payment method is 100% secure, as fraudsters and thieves are constantly looking for new ways to get their hands on your money. Thankfully, you can look for a few security features that will help prevent unauthorized use of your credit cards.

The most important thing you can do is ensure your credit card is sporting the latest processing technology — the EMV microchip — rather than relying on outdated magnetic-stripe technology. While the old mag-stripe cards carried static information about your account that anyone could duplicate, the newer EMV-chip cards generate a unique code for each transaction that makes duplication difficult.

But even in the EMV world, not all chip cards are the same. Although most chip-card purchases in the US are verified via a signature, this is often considered to be less secure than the four-digit PIN verification utilized in many areas of the world, including the majority of Europe.

Other ways to reduce your credit card risk is to regularly monitor your credit card account to catch any unauthorized usage as soon as possible. A great way to make monitoring your card activity simple is to enable credit card alerts, which can email or text message you whenever a purchase — or another type of transaction — is made with your card.

Whether looking for your first credit card or your 21st, trying to choose between the hundreds of different types of credit cards on the market can be mind-boggling for experts and novices alike. However, selecting the best credit card for your needs doesn’t have to be an overwhelming experience if you break it down to a few key factors.

To start, consider if you need a particular credit card network. While all four major networks are accepted fairly widely in the U.S., worldwide acceptance can vary wildly by network, with Mastercard and Visa typically the most likely to be accepted abroad. If you travel overseas frequently, you may also want to consider a chip-and-PIN card over one that only provides chip-and-signature verification.

The next step is to figure out what you want your new card to actually do. If you’re looking for an everyday card that will help you save a little money on the purchases you make most frequently, then a good rewards card may be your best bet. For those who tend to carry a balance, a card with an intro-APR deal is a no-brainer. If you have good to excellent credit, you can even combine the two options.

For some consumers, the field of options may be limited by a poor credit score, as most consumers with FICO scores below 600 are unlikely to be approved for a prime credit card. If you’re looking at cards for bad credit, you’ll need to decide whether you want an unsecured subprime card, which typically have high rates and fees, or a secured credit card, which requires an initial deposit to open.

In the end, the very best credit card for you will be the one you use responsibly. While credit cards can mean trouble for those who misuse them, they can have a lot of perks when used with care. Indeed, for cardholders who pay off their cards each month — and always pay on time — credit cards can be a safe, convenient, and rewarding way to make your everyday purchases, as well as valuable credit-building tools.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![8 Types of Prepaid Cards & #1 Card For Each ([updated_month_year]) 8 Types of Prepaid Cards & #1 Card For Each ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/08/Types-of-Prepaid-Cards.jpg?width=158&height=120&fit=crop)

![15 FAQs: Annual Income on Credit Card Applications ([updated_month_year]) 15 FAQs: Annual Income on Credit Card Applications ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/11/shutterstock_394244284.jpg?width=158&height=120&fit=crop)

![3 FAQs: ATM Card vs. Debit Card vs. Credit Card ([updated_month_year]) 3 FAQs: ATM Card vs. Debit Card vs. Credit Card ([updated_month_year])](https://www.cardrates.com/images/uploads/2016/05/atm-card-vs-debit-card-vs-credit-card--1.png?width=158&height=120&fit=crop)

![Can I Use My Walmart Credit Card Anywhere? 3 FAQs ([updated_month_year]) Can I Use My Walmart Credit Card Anywhere? 3 FAQs ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/06/can-i-use-my-walmart-credit-card-anywhere--1.jpg?width=158&height=120&fit=crop)

![How Many Credit Cards Should I Have for Good Credit? ([updated_month_year]) How Many Credit Cards Should I Have for Good Credit? ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/07/howmany.png?width=158&height=120&fit=crop)

![12 Best Credit Cards By Credit Score Needed ([updated_month_year]) 12 Best Credit Cards By Credit Score Needed ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/02/Best-Credit-Cards-By-Credit-Score-Needed.jpg?width=158&height=120&fit=crop)

![10 Credit Repair Credit Cards ([updated_month_year]) 10 Credit Repair Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/11/Credit-Repair-Credit-Cards.jpg?width=158&height=120&fit=crop)