Whether you make a lot of large purchases for your home or business, or simply spend a lot on small things that seem to add up fast, your card’s credit limit can make or break your ability to finance your purchases.

With your trusty Wells Fargo credit card, however, you have several options for obtaining a higher credit limit. This includes requesting a higher limit by phone or online, as well as applying for a brand new Wells Fargo card, hopefully with a higher initial limit.

Call or Login Online | Choose a New Card | 6 Tips from Experts

Call or Go Online to Request an Increase from Wells Fargo

You can request a credit limit increase (CLI) directly from Wells Fargo by phone or online.

1. Call Wells Fargo customer service at 1-800-642-4720

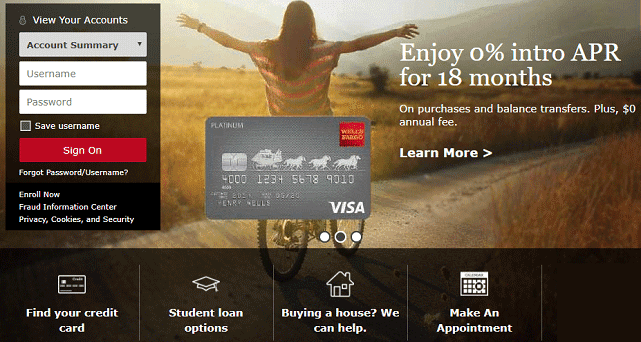

2. Log into your Wells Fargo online banking account for your credit card and go to the “Manage Credit Limit” tab.

Wells Fargo gives you the option to increase your credit card limit by either making a general increase request (which increases your total available credit) or by reallocating your credit limit from another Wells Fargo credit card (which transfers your current available credit between cards). If you don’t qualify for a general increase, reallocation may be a good option.

You can request a Wells Fargo credit card credit limit increase through your online banking account.

If you’re not currently enrolled in Wells Fargo online banking, you can choose to do so at any time through the Wells Fargo website. You’ll need your Social Security number and credit card or account number to enroll in online banking.

Before making a request, consider if the credit limit increase is worth the possible consequences. Each credit limit increase has the potential to result in a hard credit inquiry, which can have a negative impact on your credit score. While anecdotal evidence suggests Wells Fargo uses a soft credit pull if possible, hard credit pulls are not unheard of, particularly if your credit history has a few bumps.

Not every cardholder will qualify for a CLI. For example, if your credit card account is less than six months old, you will likely be ineligible for a credit limit increase. You will also likely be ineligible if you have had an increase within the last six months. Those who have positive payment histories (no late or missed payments) and who show credit score improvement will be the most likely to obtain an increase.

Apply for a New Wells Fargo Card

As most of us quickly learn, not all credit cards are created equally — and this concept applies to potential credit limits as much as any other factor. In general, each credit card has a certain consumer demographic, and the credit limits offered by that card will be based on its intended market. Many cards will have a minimum and/or maximum credit limit that can be awarded for that specific card.

So, while your specific credit limit will be based on your individual credit profile and income, sometimes it really is just the card. If you’ve hit the top of the credit limit range for your card — or have experienced increases in your credit score and income — applying for a new Wells Fargo card may be the best way to obtain a higher credit limit.

+See Wells Fargo’s Credit Cards

Read the “6 Expert Tips” for Increasing Credit Limits

As is often true in the world of finance, your odds of successfully obtaining a credit limit increase can be improved by doing a little research ahead of time. You can learn when — and how — to request an increase with these tips from our credit card experts.

- 6 Expert Tips for Increasing Your Credit Limit

A little bit of credit knowledge can often go a long way on your personal finance journey. Of course, no matter how high your credit limit reaches, it’s important to never charge more than you can afford to repay in a reasonable amount of time. Whether it’s a few large purchases or a series of small ones, interest fees can add up faster than you think.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![6 Best Wells Fargo Credit Cards ([updated_month_year]) 6 Best Wells Fargo Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/07/wellsfargo.png?width=158&height=120&fit=crop)

![6 Top Cards: Credit Score Needed for Wells Fargo ([updated_month_year]) 6 Top Cards: Credit Score Needed for Wells Fargo ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/04/cover-2.jpg?width=158&height=120&fit=crop)

![6 Tips: How to Increase Citi Credit Limit ([updated_month_year]) 6 Tips: How to Increase Citi Credit Limit ([updated_month_year])](https://www.cardrates.com/images/uploads/2016/02/Citi-Credit-Limit-2.jpg?width=158&height=120&fit=crop)

![6 Tips: How to Increase Chase Credit Limit ([updated_month_year]) 6 Tips: How to Increase Chase Credit Limit ([updated_month_year])](https://www.cardrates.com/images/uploads/2015/08/Chase-Credit-Limit-2.jpg?width=158&height=120&fit=crop)

![6 Tips: Increase Your Capital One Credit Limit ([updated_month_year]) 6 Tips: Increase Your Capital One Credit Limit ([updated_month_year])](https://www.cardrates.com/images/uploads/2015/08/Capital-One-Credit-Limit-2--1.jpg?width=158&height=120&fit=crop)

![6 Tips: How to Increase Discover Credit Limit ([updated_month_year]) 6 Tips: How to Increase Discover Credit Limit ([updated_month_year])](https://www.cardrates.com/images/uploads/2015/09/DiscoverCreditLimit--1.jpg?width=158&height=120&fit=crop)

![9 Best No-Limit, High-Limit Prepaid Debit Cards ([updated_month_year]) 9 Best No-Limit, High-Limit Prepaid Debit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/04/Best-No-Limit_High-Limit-Prepaid-Debit-Cards--1.jpg?width=158&height=120&fit=crop)