Credit cards can be an excellent tool to easily and conveniently finance purchases without carting around a cumbersome collection of cash and coins. And rewards credit cards, in particular, can be a great way to get a little extra value out of your purchases.

Unfortunately, credit cards can also be easy and convenient ways to swipe your way into credit card debt — debt for which you will often pay two-digit interest rates to carry. Even if you make more than the minimum payment each month, you’re still responsible for paying interest on the remaining balance, which can add up fast. Below, we’ll take a look at how to get a lower interest credit card.

The ideal solution to avoiding credit card interest fees is to pay off your entire balance each statement cycle, it simply isn’t always an option for everyone. A more realistic option for many consumers is to find a way to lower your credit card interest rate — perhaps using one of these methods. Read on to learn about beneficial introductory offers, how to request a lower rate, and tips to improve your credit score, which can potentially lead to lower rates in the future.

1. Sign Up for an Introductory 0% APR Credit Card Offer

No matter what interest rate your current cards are charging, the chances are pretty good that “zero” is a fair sight better. Credit cards that come with introductory 0% APR offers allow you to carry a balance interest-free for the length of the introductory period. This means that every penny you pay will actually go toward your balance — not your interest fees — saving you a bundle and helping you get debt-free faster.

Additionally, the vast majority of rewards credit cards with 0% APR intro offers also allow you to earn rewards on your purchases while still enjoying interest-free payments. To really experience a savings trifecta, pair great rewards and a killer intro APR offer with no annual fee. The best introductory offers, including our top-rated picks, have rates good for a year or more.

Additional Disclosure: Bank of America is a CardRates advertiser. Additional Disclosure: Bank of America is a CardRates advertiser. Additional Disclosure: Bank of America is a CardRates advertiser.

Always keep in mind that your introductory interest rate will revert to the default purchase APR listed on your cardholder agreement after the introductory period has ended. The specific rate you’re charged after your intro offer expires will depend on your credit score but will, more than likely, be in the double digits, so it’s in your best interest to pay off your complete balance before your offer ends to avoid interest fees.

You may want to set a calendar alert for this because if your introductory interest rate reverts to the default purchase APR in six months or even 12 months, you may have forgotten all about the special rate and could be surprised at a sudden interest increase.

2. Request a Reduced Rate Directly From Your Issuer

If you’d prefer to keep your current card but still want a lower interest rate, you may have success contacting your issuer directly and requesting a decrease in your rate. In fact, according to one survey, your odds are fairly good — 69% of surveyed cardholders who asked for a lower rate were able to negotiate a rate reduction with their issuer.

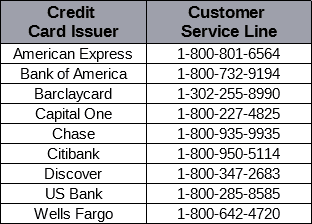

Interest rate decreases can be requested by calling your issuer’s customer service department. You can do a few things to increase your chances of success when you call, starting with a little research into your credit situation. Interest rates are based on creditworthiness, so knowing where you stand — and being able to demonstrate it for your issuer — can go a long way toward proving that you’ve earned a break on your interest rate.

You can contact your issuer’s customer service department to request a rate reduction.

You’re also more likely to be approved for a rate decrease if the rate you ask for is reasonable; few companies will drop your rate to zero just because you asked nicely. To determine what might be a reasonable request, look into what rates the issuer offers on the card.

Most credit cards have a predetermined APR range from which your exact interest rate is assigned based on your credit. Ranges can cover 10 percentage points or more and will often vary based on the prime rate.

This range is largely based on the risk analysis done by the issuer regarding that specific card and will, to an extent, represent the company’s risk tolerance. This means you’ll probably have the best luck if you keep your request within the predetermined range of rates.

For example, a cash back card aimed at those with good credit could have an APR range of 13.99% to 23.99%. In this case, those with excellent credit would likely receive an APR close to 13.99%, while those with more questionable credit will receive an APR closer to 23.99%. A cardholder looking for a rate decrease on this card would do best requesting a rate above 13.99%.

You may also want to look into the interest rates being charged by similar credit cards on the market. For instance, if you have a travel rewards card, compare the rates being offered by other travel rewards cards. And if you’ve received credit card offers in the mail, jot down the rates those offers included. Card companies like to keep loyal cardholders, so it may help if you can tell your issuer, “I’ve received an offer from so-and-so with this rate, can you match that rate?”

Of course, the most important thing to remember when you call is that you absolutely must be polite. While civility won’t guarantee you a rate decrease, not being civil is an extremely effective way of getting shot down quick. If the representative you speak with doesn’t have the authority to change your rate, don’t berate them for it, just request to speak to a supervisor. Be polite to everyone, peons and powerful alike.

3. Improve Your Credit Score to Qualify for Lower Rates

While not necessarily the easiest method — and hardly the fastest — the surest way to consistently receive lower interest rates on your credit cards (and every other type of credit) is to build up your credit score. Interest rates are based on financial risk, and your financial risk is determined based on your credit report and score. Those with excellent credit will consistently receive the lowest interest rates.

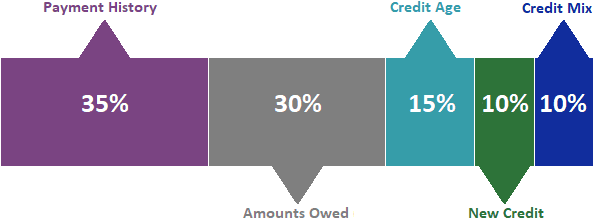

Since credit is so individualized, the exact actions you take to improve your score will depend on your particular credit situation. In general, however, the most effective way to improve your credit score is to address each factor that goes into the calculation. The two main scoring models, FICO and VantageScore, both use the same factors, albeit with different weights, to calculate your score.

Your payment history is the most important factor in both models, and it counts for a full 35% of your FICO score. This factor looks at whether you pay your debts as agreed, and can be damaged by late payments, missed payments, and account defaults. Always make on-time payments to ensure you are scoring well in this category.

Another important aspect of your credit score is your total debt and utilization. This looks at how much total debt you have, how much each of your individual debts total, and what portion of your available credit you are using. You can do well here by only taking on necessary debt and keeping your card balances low.

Being stingy about opening new credit accounts will also help you with two other scoring factors, namely your average account age and your new credit accounts. Old credit is the best kind of credit (so long as it’s in good standing), as it shows creditors that you can handle credit over the long term. And keeping the number of credit applications you make to a minimum will ensure you do well in the new account factor.

Pay Less for Your Balance with Low Interest Rates

While the best way to avoid paying interest fees on your credit card balance is to pay it off entirely each statement cycle, sometimes reality dictates the need to carry that balance. In these cases, obtaining a lower credit card interest rate can give you the breathing room you need to pay down your debt — without struggling to also make giant interest payments.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![What Is Credit Card Refinancing? 6 Ways to Lower Rates ([updated_month_year]) What Is Credit Card Refinancing? 6 Ways to Lower Rates ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/03/What-Is-Credit-Card-Refinancing.jpg?width=158&height=120&fit=crop)

![11 Ways to Lower Your Monthly Bill Payments ([updated_month_year]) 11 Ways to Lower Your Monthly Bill Payments ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/06/Ways-to-Lower-Your-Monthly-Bill-Payments.jpg?width=158&height=120&fit=crop)

![How to Calculate Credit Card Interest: 3 Steps to Find Your Rate ([updated_month_year]) How to Calculate Credit Card Interest: 3 Steps to Find Your Rate ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/02/how-to-calculate-credit-card-interest.jpg?width=158&height=120&fit=crop)

![APR vs. Interest Rate: Is There a Difference? ([updated_month_year]) APR vs. Interest Rate: Is There a Difference? ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/11/APR-vs-Interest-Rate-Feat.jpg?width=158&height=120&fit=crop)

![6 Ways to Save on Credit Card Interest Fees ([updated_month_year]) 6 Ways to Save on Credit Card Interest Fees ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/11/Ways-to-Save-on-Credit-Card-Interest-Fees.jpg?width=158&height=120&fit=crop)

![3 Ways to Avoid Interest Charges on Credit Cards ([updated_month_year]) 3 Ways to Avoid Interest Charges on Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/11/Ways-to-Avoid-Purchase-Interest-Charges-on-Credit-Cards-Feat.jpg?width=158&height=120&fit=crop)