Written by: Lauren Keys

Edited by: Lillian Guevara-Castro

Lillian Guevara-Castro brings more than 30 years of editing and journalism experience to the CardRates team. She has written and edited for major news organizations, including The Atlanta Journal-Constitution and the New York Times, and she previously served as an adjunct journalism instructor at the University of Florida. Today, Lillian edits all CardRates content for clarity, accuracy, and reader engagement.

See full bio »Updated:

I was in college when I first realized the importance of establishing a credit history, and I began to explore how to apply for a credit card online. At the time, there weren’t as many guides and resources around like there are today. So I took to my laptop to peruse numerous applications and read the fine print on card offerings.

I selected a card that seemed suitable for someone with a limited credit history and waited. It wasn’t until I finally saw my name printed along the bottom of my first credit card that I realized the process of applying wasn’t as difficult as I once believed. Since that day, I’ve applied and been approved for over 50 credit cards.

Using what I’ve learned from my personal experiences, this guide will walk you through the necessary steps for getting a new credit card in your wallet as quickly and easily as possible. Because your credit rating ultimately determines which cards you’ll be approved for, I’ve also rounded up the best credit cards to apply for based on your current credit score. So, let’s dive in as we explore how to apply for credit cards online and take a look at some top picks for excellent credit, good credit, fair credit, bad credit, and even no credit.

4 Steps to Apply Online

Cards for: Excellent Credit | Good Credit | Fair Credit | Bad Credit | No Credit

4 Steps to Apply for a Credit Card Online

While there are a few different ways to apply for a credit card, the credit card companies have made it extremely easy to apply online. Depending on your credit score, you may find that you’ll receive a response sooner when you apply for a credit card online than through other methods such as regular mail or over the phone.

1. Check Your Credit Score

Your FICO credit score provides the credit card companies with a sense of your creditworthiness because it includes several factors related to credit use:

- Payment History makes up 35% of your FICO score

- Amounts Owed accounts for 30%

- Length of Credit History accounts for 15%

- Credit Mix & New Credit both contribute 10% each to your score

FICO scores range from 300 to 850, and your approval for certain cards depends on where your score falls. You’ll want to look into and apply for cards you feel confident you’ll be approved for, and there are many great credit card options for no credit, bad credit (, fair credit (620-679), good credit (680-719), and excellent credit (720+).

You can check your score through FICO directly or through one of the credit bureaus, like TransUnion.

2. Gather the Information You’ll Need to Apply

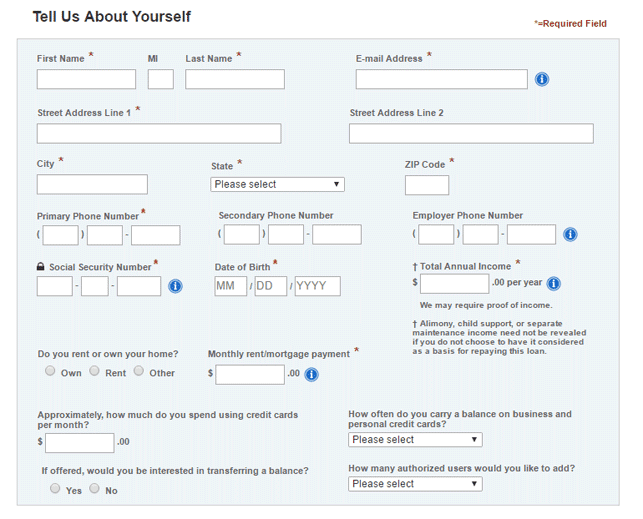

Before you begin to apply for a credit card, you’ll want to make sure you have the information necessary to complete the online application. You’ll be asked for some basic information including your name, contact details, and current address, as well as specific financial data such as your income. Further, you’ll need to supply security information including your Social Security number, date of birth, and mother’s maiden name.

If you have a thin credit file, meaning you have little to no credit history, then you may be asked for more information or proof of the information you provided, such as a copy of a government-issued ID or a previous address.

Most credit card applications will require the same personal and financial details, such as income and address.

It’s important to note that the terms “pre-qualified” and “pre-approved” are generally interchangeable and result in a soft credit inquiry, which does not affect your credit score. However, a pre-approval does not guarantee an actual approval for the card of your choice. With that said, if you’ve been prescreened for a card, you are more likely to be approved. In that instance, the issuer looks at available information to make a good estimate of your creditworthiness.

3. Submit Your Application

When you submit your credit card application online, by mail, or over the phone, you’re giving the issuer permission to do a hard pull on your credit, which has the potential to negatively affect your credit score, especially if you’re not approved.

Submitting your application online tends to be the most common and preferred method because you can easily compare multiple offers across issuers to ensure you get the best available rewards and rates. You can use our reviews as a shortcut and click the “Apply Now” button to go to each card’s official application:

- 2016’s Best Overall Cards

- Air Miles

- Cash Back

- 0% Intro APR

- Low Ongoing APR

- For Limited / No Credit

- For Bad Credit

Once you click “Submit,” your application will be sent to the issuer for approval.

4. Wait (Up to 2 Weeks) for a Decision on Your Credit Card Application

Many people with good to excellent credit will find they’re approved immediately after they submit their application online. If you apply by mail or phone, regardless of credit score, you may find it takes a little longer to hear back from the issuer. Applicants with fair to bad credit could end up waiting nearly two weeks for a decision from the credit card company.

If you’re not approved, you should wait about six months before applying again to give yourself time to rebuild your credit. Plus, requesting more credit too quickly could raise an avoidable red flag. Hard inquiries, such as credit card applications, remain on your credit report for two years.

However, if you believe you should have been approved or don’t understand why you were denied, you can reach out to the issuer directly for reconsideration. Each issuer will provide its own reconsideration phone number, and you’ll need to be prepared to answer additional questions as to why they should reconsider you. Also, be sure to call within 30 days or you may have to reapply, resulting in another hard inquiry.

5 Best Credit Cards to Apply for Online

It’s important to only apply for cards you think you can qualify for or risk not being approved, which can knock your score down a few points. By starting the search for you next credit card within your credit qualifications, you can feel more confident submitting your application.

Below are some of the best cards currently available, broken down by the different credit score ranges.

Apply for a Credit Card with “Excellent Credit” (720+)

If you have excellent credit, then you’ve likely paid your bill on time without overextending your credit allowance, and if you continue those practices, a new card can be a responsible way to earn additional rewards. Check out this top pick for applicants with excellent credit:

EXCELLENT CREDIT RATING

4.9

OVERALL RATING

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! There’s no minimum spending or maximum rewards. You could turn $150 cash back into $300.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Get a 0% intro APR for 15 months on purchases. Then 17.24% to 28.24% Standard Variable Purchase APR applies, based on credit worthiness.

- No annual fee.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 months

|

0% Intro APR for 15 months

|

17.24% - 28.24% Variable APR

|

$0

|

Excellent/Good

|

+ See more cards for excellent credit

Apply for a Credit Card with “Good Credit” (680 – 719)

While factors such as your credit utilization ratio and payment history can keep you out of the excellent credit range, you can still qualify for cards with excellent benefits, including cash back, rewards points, and no annual fee. Below is a popular credit card for those with good credit:

Chase Freedom Flex℠

This card is currently not available.

Good Credit Rating

N/A

OVERALL RATING

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

Additional Disclosure: The information related to Chase Freedom Flex℠ credit card has been collected by CardRates.com and has not been reviewed or provided by the issuer of this card.

+ See more cards for good credit

Apply for a Credit Card with “Fair Credit” (620 – 679)

Sending in a late payment, or missing one altogether, may account for lower scores in the fair range. However, there are cards that, when used responsibly, can help you build your credit score. This top card for fair credit offers benefits attractive to any cardholder, regardless of credit score:

FAIR CREDIT RATING

4.9

OVERALL RATING

- No annual or hidden fees. See if you're approved in seconds

- Be automatically considered for a higher credit line in as little as 6 months

- Help build your credit through responsible use of a card like this

- Enjoy peace of mind with $0 Fraud Liability so that you won't be responsible for unauthorized charges

- Monitor your credit score with CreditWise from Capital One. It's free for everyone

- Get access to your account 24 hours a day, 7 days a week with online banking from your desktop or smartphone, with Capital One's mobile app

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

29.99% (Variable)

|

$0

|

Average, Fair, Limited

|

+ See more cards for fair credit

Apply for a Credit Card with “Bad Credit” (

Bad credit can happen to anyone after a few missed payments or biting off more debt than you can chew, but responsible use of a credit card can actually help to rebuild your credit. There are many credit cards that are more likely to approve applicants with bad credit, and out of the best credit cards for people with bad credit, this is a favorite:

Credit One Bank® Visa® Credit Card

This card is currently not available.

Bad Credit Rating

N/A

OVERALL RATING

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

+ See more cards for bad credit

Apply for a Credit Card with “No Credit” (0 Credit Score)

If you’ve never opened a line of credit, it’s hard for issuers to judge whether you’ll be a good credit risk or not. However, you can still be approved for a credit card with no credit history — you may just have to provide additional details about yourself, such as proof of income. Below is one of my favorite cards for applicants with no credit:

NO/LIMITED CREDIT RATING

4.6

OVERALL RATING

- Earn unlimited 1.5% cash back on every purchase, every day

- No rotating categories or limits to how much you can earn, and cash back doesn't expire for the life of the account. It's that simple

- Be automatically considered for a higher credit line in as little as 6 months

- Enjoy peace of mind with $0 Fraud Liability so that you won't be responsible for unauthorized charges

- Help strengthen your credit for the future with responsible card use

- Enjoy up to 6 months of complimentary Uber One membership statement credits through 11/14/2024

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

29.99% (Variable)

|

$39

|

Average, Fair, Limited

|

+ See more cards for no credit

Time to Make Room in Your Wallet

It’s easier than ever to research and apply for a credit card online. The most important part of applying for a new credit card is figuring out what you can effectively qualify for based on your credit score, otherwise, you may end up with a hard inquiry on your report with no card to show for it. Use this guide to help you stay organized and on track as you prepare to apply for a credit card. By following the simple steps outlined above, you can soon see your name along the bottom of a new card, too.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

Editorial Note: Our site content is not provided or commissioned by any credit card issuer(s). Opinions expressed on CardRates.com are the author's alone, not those of any credit card issuer, and have not been reviewed, approved, or otherwise endorsed by credit card issuers. Every reasonable effort has been made to maintain accurate information; however, all credit card offer details, including information about rewards, signup bonuses, introductory offers, and other terms and conditions, is presented without warranty. Clicking on any offer on CardRates.com will direct you to the issuer's website, where you can review the current terms and conditions of the offer.

Related Topics:

Share This Article

About the Author

Lauren Keys

Lauren Keys has over nine years of writing and editing experience for media outlets including The New York Times, Entrepreneur.com, Gainesville Magazine, and numerous other publications. Lauren strives to inform readers of how they can make the most of their budgets by sharing personal finance tips and highlighting the brands and products that can help them achieve their financial goals.

![5 Steps to Apply for a Business Credit Card ([updated_month_year]) 5 Steps to Apply for a Business Credit Card ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/12/How-to-Apply-for-a-Business-Credit-Card.jpg?width=158&height=120&fit=crop)

![How to Apply For a Credit Card With Bad Credit ([updated_month_year]) How to Apply For a Credit Card With Bad Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/01/How-to-Apply-For-a-Credit-Card-With-Bad-Credit.jpg?width=158&height=120&fit=crop)

![7 Credit Card Requirements & Minimums to Apply ([updated_month_year]) 7 Credit Card Requirements & Minimums to Apply ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/08/req.png?width=158&height=120&fit=crop)

![Apply For a Prepaid Card: 5 Best Card Options ([updated_month_year]) Apply For a Prepaid Card: 5 Best Card Options ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/09/Apply-For-a-Prepaid-Card.jpg?width=158&height=120&fit=crop)

![How to Get a Credit Card in 6 Easy Steps ([updated_month_year]) How to Get a Credit Card in 6 Easy Steps ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/09/GETCARD.png?width=158&height=120&fit=crop)

![How Do I Get a Credit Card? 3 Easy Steps ([updated_month_year]) How Do I Get a Credit Card? 3 Easy Steps ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/01/getcard2.png?width=158&height=120&fit=crop)

![Is It Bad to Apply For Multiple Credit Cards At The Same Time? ([updated_month_year]) Is It Bad to Apply For Multiple Credit Cards At The Same Time? ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/11/Is-It-Bad-to-Apply-For-Multiple-Credit-Cards-At-The-Same-Time.jpg?width=158&height=120&fit=crop)

![3 Steps for Maximizing Credit Card Perks & Rewards ([updated_month_year]) 3 Steps for Maximizing Credit Card Perks & Rewards ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/12/maximizing-credit-card-perks-and-rewards-1.png?width=158&height=120&fit=crop)