Credit cards have become such an ingrained part of our modern society that most of us don’t give them much thought. But how many of us could really provide a thorough answer to someone who asks, “How do credit cards work?”

Credit cards are easy to use, widely accepted for making purchases, and as long as we pay at least the minimum amount owed when the bill comes due, they’re ours to use as we please. It’s a convenient way for us to buy things now and pay for them at a later time. Of course, this convenience isn’t free.

Banks and other lending institutions issue credit cards to consumers as a type of revolving credit line (more on that in a bit). The banks make money by charging interest on the balance we carry on our cards, and in some cases, by charging fees. So with credit cards, the banks can lend us money without needing to be involved in every purchase. In this way, we as cardholders are able to borrow from the bank every time we use our card. Let’s dive into this topic with a breakdown of the various types of credit cards and reward programs available. We’ll also look at some of our top picks for rewards cards in a number of categories.

Card Types | Rewards Programs | Account Management Apps

Since banks earn their money by charging interest and fees on what they lend to us, it is in a consumer’s best interest to understand exactly how these things work. While very few of us has read all of the legal jargon and fine print within our credit card agreement, there are a few easy things we can understand that can help save us some money.

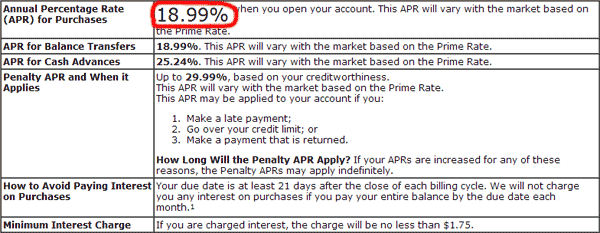

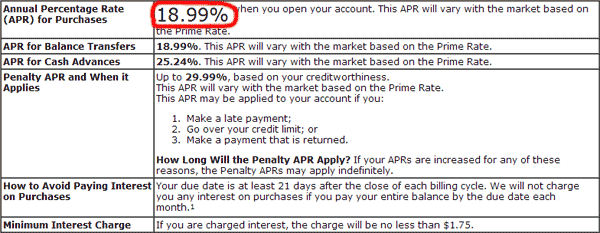

The amount of interest charged by credit card issuers is almost always represented as APR, or Annual Percentage Rate. While this term might indicate interest calculated on a yearly basis, we all know credit card interest is not charged annually. In fact, a credit card’s APR is actually a representation of interest that is accumulated daily.

Of course most cards have a grace period, usually around 25 days, during which time if you pay your balance in full, no interest will be charged. However, if you do carry a balance into your next credit card billing cycle, expect to pay interest that’s calculated on a daily basis. This means the interest you accrue during the previous month will actually be charged interest in this month too. That’s called compound interest, and it’s how many people end up paying a lot more in credit card costs than they expected.

Fees are another way that banks and credit card issuers earn money. Late payments, balance transfers, exceeding your credit limit — all of these things will typically incur fees. And if you’re not careful, these fees can add up to even more than you pay in interest charges. This is why it is so important to make on-time payments, and if possible, to not carry a balance.

Although almost all credit cards look and feel the same, there are different kinds of cards for different purposes. The Federal Trade Commission defines these card types in an excellent tutorial on the FTC website. A person’s credit history, credit score, and perceived creditworthiness by the banks will all help to determine the type of cards that are available. The vast majority of credit cards issued in the US are unsecured, meaning they don’t require a deposit or any collateral in order to get one. However, they do require a good or at least decent credit score.

Here’s a detailed breakdown of the different types of cards and how they work.

How Secured Cards Work

As the name implies, secured credit cards are cards that require a deposit be made into an account at the bank issuing the card. This deposit then becomes the credit line of the secured card. This type of credit card is intended to help build or rebuild credit, and is issued by banks to people who have poor credit or a limited credit history.

A secured card works just like any other credit card, although typically they have a much lower credit limit (the deposit amount). One nice thing about a secured credit card is that payments and usage are reported to the three major credit bureaus just like a standard card, helping to build or rebuild credit for the user.

If you’re interested in a secured card, we recommend visiting our secured credit card comparison before applying. Card offers vary in terms of annual fee, APR, and other criteria.

How Unsecured Cards Work

An unsecured card is what we all think of when we use the term credit card. It is true credit, meaning there is no deposit or collateral requirement in order to get one. These cards are issued based on a person’s credit score and perceived creditworthiness. An applicant with a higher score and better credit history will usually be offered better terms, a lower APR, and a higher credit limit.

They also usually come with various perks such as cash back rewards, airline miles, bonus points, and other incentives. An unsecured credit card offers savvy holders the opportunity to earn extra rewards for purchases they would be making already.

To obtain an unsecured credit card, apply directly with issuers like AmEx, Capital One, Chase, and Discover. Each is known to offer unsecured credit cards with top-notch perks to applicants with good-to-excellent credit ratings.

How Debit Cards Work

Debit cards may look similar to a credit card, but they are a very different animal. For one thing, a debit card is tied to a banking or investment account and draws money from that account. There is no credit involved since the banks are simply processing a withdrawal of your own funds. As such, there is no reporting to the credit agencies and no impact on credit scores.

However, debit cards can be used almost anywhere a credit card is accepted. As long as you don’t overdraw the account associated with your debit card, this is an inexpensive way to use plastic instead of cash. To open a debit card, you’d simply visit your local bank branch or your bank’s website to request one.

How Prepaid Cards Work

Prepaid cards are similar to secured cards, in that they use your own money rather than borrowing from a bank. They’re also similar to debit cards, although they don’t pull from a bank account. In fact, prepaid cards may seem similar, but they really are different than either of those two.

First, unlike secured cards, prepaid card use isn’t reported to the credit bureaus. And unlike debit cards, a prepaid card isn’t backed by a bank account. Prepaid cards can be purchased at retail locations, at your local bank, or even online. They can also be “reloaded” with cash at many locations.

One thing to be aware of with prepaid cards is the fees they charge, including transaction fees, activation fees, cash withdrawal fees, and more. Be sure to check our prepaid credit card comparison to review these fees before applying.

Among the cards we’ve mentioned here, standard credit cards are used for the vast majority of all card purchases, at more than 50%. They are also the most diverse, offering consumers the greatest choices of any other card type. Depending on whether you use your card primarily for travel, business purchases, or everyday use, there are cards specifically designed to meet almost any need. There are also bonus and incentive programs that make using your card that much more rewarding. Some of the various credit card types and reward programs include:

Travel & Air Mile Cards

Frequent flyers and business travelers can take advantage of a wide range of credit cards aimed directly at rewarding their patronage. How these cards work is by offering points toward air travel, usually at a 1:1 ratio, for every dollar spent on the card. Often you’ll find 2:1 and 3:1 air mile rewards for certain purchases or expenditures. There are also signup bonuses that can offer up to 50,000 bonus points or more if you spend a minimum amount during the initial signup period. Points can then be converted for travel vouchers.

AIR MILES RATING

★★★★★

4.9

- UNLIMITED BONUS: Unlimited Mile-for-Mile match for all new cardmembers - only from Discover. Discover gives you an unlimited match of all the Miles you’ve earned at the end of your first year. For example, if you earn 35,000 Miles, you get 70,000 Miles. There’s no signing up, no minimum spending or maximum rewards. Just a Miles-for-Miles match.

- Automatically earn unlimited 1.5x Miles on every dollar of every purchase

- No annual fee

- Turn Miles into cash. Or redeem as a statement credit for your travel purchases like airfare, hotels, rideshares, gas stations, restaurants and more.

- 0% intro APR for 15 months on purchases. Then 17.24% - 28.24% Standard Variable Purchase APR will apply.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Discover is accepted nationwide by 99% of the places that take credit cards.

- Terms and conditions apply.

|

|

|

|

|

|

0% Intro APR for 15 months

|

0% Intro APR for 15 months

|

17.24% - 28.24% Variable APR

|

$0

|

Excellent/Good

|

AIR MILES RATING

★★★★★

4.9

- $0 annual fee and no foreign transaction fees

- Earn a bonus of 20,000 miles once you spend $500 on purchases within 3 months from account opening, equal to $200 in travel

- Earn unlimited 1.25X miles on every purchase, every day

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

|

|

|

|

|

|

0% for 15 months

|

0% for 15 months

|

19.99% - 29.99% (Variable)

|

$0

|

Excellent, Good

|

AIR MILES RATING

★★★★★

4.8

- Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $100 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

|

|

|

|

|

|

N/A

|

N/A

|

19.99% - 29.99% (Variable)

|

$95

|

Excellent, Good

|

+ See More Travel Rewards Cards

Travel and air mile cards are not to be confused with frequent flyer programs, as these are usually offered by a specific airline.

Cash Back Cards

Credit cards that offer cash back rewards are aimed at people who may use credit cards for everyday purchases, and who seldom carry a balance from month to month. That’s because cash back rewards are usually paid at a 1% rate, meaning if you carry a balance, it will outweigh what cash is coming back to you. Certain purchases — like for gas, groceries, or specific categories of items — can earn two, three, or even five times the points under certain conditions.

CASH BACK RATING

★★★★★

4.9

- $200 online cash rewards bonus after you make at least $1,000 in purchases in the first 90 days of account opening.

- Earn 3% cash back in the category of your choice, automatic 2% at grocery stores and wholesale clubs (up to $2,500 in combined choice category/grocery store/wholesale club quarterly purchases) and unlimited 1% on all other purchases.

- Choose 3% cash back on gas and EV charging station, online shopping/cable/internet/phone plan/streaming, dining, travel, drug store/pharmacy or home improvement/furnishing purchases.

- If you're a Bank of America Preferred Rewards® member, you can earn 25%-75% more cash back on every purchase. That means you could earn 3.75%-5.25% cash back on purchases in your choice category.

- No annual fee and cash rewards don’t expire as long as your account remains open.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% - 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- Contactless Cards - The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

|

|

|

|

|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% - 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

CASH BACK RATING

★★★★★

4.9

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! There’s no minimum spending or maximum rewards. You could turn $150 cash back into $300.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Get a 0% intro APR for 15 months on purchases. Then 17.24% to 28.24% Standard Variable Purchase APR applies, based on credit worthiness.

- No annual fee.

- Terms and conditions apply.

|

|

|

|

|

|

0% Intro APR for 15 months

|

0% Intro APR for 15 months

|

17.24% - 28.24% Variable APR

|

$0

|

Excellent/Good

|

CASH BACK RATING

★★★★★

4.8

- INTRO OFFER: Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back!

- Enjoy 6.5% cash back on travel purchased through Chase Travel, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more; 4.5% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and 3% on all other purchases (on up to $20,000 spent in the first year).

- After your first year or $20,000 spent, enjoy 5% cash back on travel purchased through Chase Travel, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

- No minimum to redeem for cash back. You can choose to receive a statement credit or direct deposit into most U.S. checking and savings accounts. Cash Back rewards do not expire as long as your account is open!

- Enjoy 0% Intro APR for 15 months from account opening on purchases and balance transfers, then a variable APR of 20.49% - 29.24%.

- No annual fee – You won't have to pay an annual fee for all the great features that come with your Freedom Unlimited® card

|

|

|

|

|

|

0% Intro APR on Purchases 15 months

|

0% Intro APR on Balance Transfers 15 months

|

20.49% - 29.24% Variable

|

$0

|

Good/Excellent

|

+ See More Cash Back Cards

Be careful, however, that you don’t waste that cash back by carrying a balance, or by spending on things you don’t need just to get reward points.

Balance Transfer Cards

People with multiple credit cards acquired over a number of years may find themselves with an array of interest rates. And getting rid of the balance on a card with a particularly high interest rate by transferring it to a lower-interest rate card sounds great, right? Sounds great, right? Well, yes and no. The new balance transfer card will likely have a low, or even 0% interest rate for a set period of time.

However, a balance transfer fee of around 3% may need to be paid up front, adding to what you owe… meaning that you’ve just increased your debt. But, if you’re diligent about making your monthly payment, and not using the card for new purchases, it can mean big savings in interest charges.

0% BALANCE TRANSFER RATING

★★★★★

4.8

- 0% Intro APR for 21 months on balance transfers from date of first transfer and 0% Intro APR for 12 months on purchases from date of account opening. After that the variable APR will be 18.24% - 28.99%, based on your creditworthiness. Balance transfers must be completed within 4 months of account opening.

- There is a balance transfer fee of either $5 or 5% of the amount of each transfer, whichever is greater

- Get free access to your FICO® Score online.

- With Citi Entertainment®, get special access to purchase tickets to thousands of events, including concerts, sporting events, dining experiences and more.

- No Annual Fee - our low intro rates and all the benefits don’t come with a yearly charge.

|

|

|

|

|

|

0% 12 months on Purchases

|

0% 21 months on Balance Transfers

|

18.24% - 28.99% (Variable)

|

$0

|

Excellent, Good

|

Additional Disclosure: Citi is a CardRates advertiser.

0% BALANCE TRANSFER RATING

★★★★★

4.8

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! There’s no minimum spending or maximum rewards. You could turn $150 cash back into $300.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- Your account may not always be eligible for balance transfers. Balance transfer eligibility is determined at Discover’s discretion.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- No annual fee.

- Terms and conditions apply.

|

|

|

|

|

|

0% Intro APR for 6 months

|

0% Intro APR for 18 months

|

17.24% - 28.24% Variable APR

|

$0

|

Excellent/Good

|

0% BALANCE TRANSFER RATING

★★★★★

4.8

- Earn $200 cash back after you spend $1,500 on purchases in the first 6 months of account opening. This bonus offer will be fulfilled as 20,000 ThankYou® Points, which can be redeemed for $200 cash back.

- Earn 2% on every purchase with unlimited 1% cash back when you buy, plus an additional 1% as you pay for those purchases. To earn cash back, pay at least the minimum due on time. Plus, for a limited time, earn 5% total cash back on hotel, car rentals and attractions booked on the Citi Travel℠ portal through 12/31/24.

- Balance Transfer Only Offer: 0% intro APR on Balance Transfers for 18 months. After that, the variable APR will be 19.24% - 29.24%, based on your creditworthiness.

- Balance Transfers do not earn cash back. Intro APR does not apply to purchases.

- If you transfer a balance, interest will be charged on your purchases unless you pay your entire balance (including balance transfers) by the due date each month.

- There is an intro balance transfer fee of 3% of each transfer (minimum $5) completed within the first 4 months of account opening. After that, your fee will be 5% of each transfer (minimum $5).

|

|

|

|

|

|

N/A

|

0% Intro APR Period 18 months on Balance Transfers

|

19.24% - 29.24% (Variable)

|

$0

|

Excellent, Good, Fair

|

Additional Disclosure: Citi is a CardRates advertiser.

+ See More Balance Transfer Cards

0% Intro APR Cards

Credit cards that offer a 0% introductory APR rate can be a great way to save some money on interest charges. However, there are some precautions to keep in mind when choosing these cards. The first is that your 0% intro rate will eventually end, leaving you with a potentially high APR after that. But for large one-time purchases, this can be a great way to spread out the payments, and get a no-interest loan — as long as you have the proper discipline to pay it off on time.

0% INTRO APR RATING

★★★★★

4.8

- $200 online cash rewards bonus after you make at least $1,000 in purchases in the first 90 days of account opening.

- Earn 3% cash back in the category of your choice, automatic 2% at grocery stores and wholesale clubs (up to $2,500 in combined choice category/grocery store/wholesale club quarterly purchases) and unlimited 1% on all other purchases.

- Choose 3% cash back on gas and EV charging station, online shopping/cable/internet/phone plan/streaming, dining, travel, drug store/pharmacy or home improvement/furnishing purchases.

- If you're a Bank of America Preferred Rewards® member, you can earn 25%-75% more cash back on every purchase. That means you could earn 3.75%-5.25% cash back on purchases in your choice category.

- No annual fee and cash rewards don’t expire as long as your account remains open.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% - 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- Contactless Cards - The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

|

|

|

|

|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% - 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

0% INTRO APR RATING

★★★★★

4.8

- Earn unlimited 1.5 points per $1 spent on all purchases, with no annual fee and no foreign transaction fees and your points don't expire as long as your account remains open.

- 25,000 online bonus points after you make at least $1,000 in purchases in the first 90 days of account opening - that can be a $250 statement credit toward travel purchases.

- Use your card to book your trip how and where you want - you're not limited to specific websites with blackout dates or restrictions.

- Redeem points for a statement credit to pay for travel or dining purchases, such as flights, hotel stays, car and vacation rentals, baggage fees, and also at restaurants including takeout.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% - 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- If you're a Bank of America Preferred Rewards® member, you can earn 25%-75% more points on every purchase. That means instead of earning an unlimited 1.5 points for every $1, you could earn 1.87-2.62 points for every $1 you spend on purchases.

- Contactless Cards - The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

|

|

|

|

|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% - 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

0% INTRO APR RATING

★★★★★

4.8

- $200 online cash rewards bonus after you make at least $1,000 in purchases in the first 90 days of account opening.

- Earn unlimited 1.5% cash back on all purchases.

- If you're a Bank of America Preferred Rewards® member, you can earn 25%-75% more cash back on every purchase. That means you could earn 1.87%-2.62% cash back on every purchase with Preferred Rewards.

- No annual fee.

- No limit to the amount of cash back you can earn and cash rewards don’t expire as long as your account remains open.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% - 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- Contactless Cards - The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

|

|

|

|

|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% - 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

+ See More 0% Intro APR Cards

Be aware that with these types of cards, the intro rate can be revoked for making even one late payment, so always pay your bill on time!

Points & Gifts Cards

Points and gifts credit cards offer rewards in the form of redeemable points for a variety of cool products. These cards are meant for folks who don’t have a specific type of incentive goal, but who want to leverage their card use just the same. Points can be redeemed for travel or for gifts found in the issuer’s catalog, exchanged for gift cards, or even be turned into cash.

POINTS & GIFTS RATING

★★★★★

4.9

- Earn unlimited 1.5 points per $1 spent on all purchases, with no annual fee and no foreign transaction fees and your points don't expire as long as your account remains open.

- 25,000 online bonus points after you make at least $1,000 in purchases in the first 90 days of account opening - that can be a $250 statement credit toward travel purchases.

- Use your card to book your trip how and where you want - you're not limited to specific websites with blackout dates or restrictions.

- Redeem points for a statement credit to pay for travel or dining purchases, such as flights, hotel stays, car and vacation rentals, baggage fees, and also at restaurants including takeout.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% - 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- If you're a Bank of America Preferred Rewards® member, you can earn 25%-75% more points on every purchase. That means instead of earning an unlimited 1.5 points for every $1, you could earn 1.87-2.62 points for every $1 you spend on purchases.

- Contactless Cards - The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

|

|

|

|

|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% - 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

POINTS & GIFTS RATING

★★★★★

4.8

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

- Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more.

- Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Travel℠. For example, 60,000 points are worth $750 toward travel.

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2024.

- Member FDIC

|

|

|

|

|

|

N/A

|

N/A

|

21.49%-28.49% Variable

|

$95

|

Good/Excellent

|

POINTS & GIFTS RATING

★★★★★

4.8

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

- $300 Annual Travel Credit as reimbursement for travel purchases charged to your card each account anniversary year.

- Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases

- Get 50% more value when you redeem your points for travel through Chase Travel℠. For example, 60,000 points are worth $900 toward travel.

- 1:1 point transfer to leading airline and hotel loyalty programs

- Access to 1,300+ airport lounges worldwide after an easy, one-time enrollment in Priority Pass™; Select and up to $100 application fee credit every four years for Global Entry, NEXUS, or TSA PreCheck®

|

|

|

|

|

|

N/A

|

N/A

|

22.49%-29.49% Variable

|

$550

|

Good/Excellent

|

+ See More Points & Gifts Cards

As with other cards though, take care not to overspend just to maximize your reward points; i.e. spending a dollar to earn a penny. Doing so only defeats the purpose of earning a reward.

Business Cards

Business credit cards are specifically designed for small business owners and offer benefits that these hard-working entrepreneurs need. Some of these perks include more flexible payment plans, larger credit limits, incentive programs that are geared toward small business spending, and more.

BUSINESS CARD RATING

★★★★★

4.7

- Earn $750 bonus cash back after you spend $6,000 on purchases in the first 3 months from account opening

- Earn unlimited 1.5% cash back on every purchase made for your business

- No Annual Fee

- Redeem rewards for cash back, gift cards, travel and more through Chase Ultimate Rewards®.

- Earn rewards faster with employee cards at no additional cost. Set individual spending limits for greater control.

- Round-the-clock monitoring for unusual credit card purchases

|

|

|

|

|

|

0% Intro APR on Purchases 12 months

|

N/A 12 months

|

18.49% - 24.49% Variable

|

$0

|

Good/Excellent

|

BUSINESS CARD RATING

★★★★★

4.7

- 0% Intro APR for the first 12 months; 21.24% - 29.24% variable APR after that

- Earn unlimited 1.5% cash back for your business on every purchase, everywhere — with no limits or category restrictions

- No annual fee

- Earn unlimited 5% cash back on hotels and rental cars booked through Capital One Travel

- Rewards won't expire for the life of the account

- Redeem your cash back rewards for any amount

|

|

|

|

|

|

0% for 12 months

|

N/A

|

21.24% - 29.24% (Variable)

|

$0

|

Good

|

BUSINESS CARD RATING

★★★★★

4.7

- Earn a one-time bonus of 50,000 miles – equal to $500 in travel – once you spend $4,500 on purchases within the first 3 months from account opening

- Earn unlimited 2X miles per dollar on every purchase, everywhere, no limits or category restrictions, and miles won't expire for the life of the account

- Unlimited 5X miles on hotels and rental cars booked through Capital One Travel

- Transfer your miles to 15+ travel loyalty programs

- Redeem your miles instantly for any travel-related purchases, from flights and hotels to ride-sharing services

- Skip the lines with up to a $100 statement credit on TSA PreCheck® or Global Entry

|

|

|

|

|

|

N/A

|

N/A

|

26.24% (Variable)

|

$0 intro for first year; $95 after that

|

Excellent, Good

|

+ See More Business Cards

It’s important to be aware that business credit cards aren’t included under the Credit CARD Act of 2009, and therefore don’t offer the same protections. However, many small businesses will benefit from the more personal and closer business services relationship with their bank.

Student Cards

A student credit card is specifically designed to help college-aged students and recent grads establish good credit and develop good spending habits. Many student cards offer more flexibility in making payments, more choices in rewards programs, and even offer online tools to help students manage their spending and budgets. In addition, credit requirements for student cards are often less stringent than those for other cards.

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! So you could turn $50 cash back into $100. Or turn $100 cash back into $200. There’s no minimum spending or maximum rewards. Just a dollar-for-dollar match.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- No credit score required to apply.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- No annual fee and build your credit with responsible use.

- 0% intro APR on purchases for 6 months, then the standard variable purchase APR of 18.24% - 27.24% applies.

- Terms and conditions apply.

|

|

|

|

|

|

0% Intro APR for 6 months

|

10.99% Intro APR for 6 months

|

18.24% - 27.24% Variable APR

|

$0

|

Fair/New to Credit

|

- Earn unlimited 1.5% cash back on every purchase, every day

- Early Spend Bonus: Earn $50 when you spend $100 in the first three months

- Earn 10% cash back on purchases made through Uber & Uber Eats, plus complimentary Uber One membership statement credits through 11/14/2024

- Enjoy peace of mind with $0 Fraud Liability so that you won't be responsible for unauthorized charges

- Enjoy no annual fee, foreign transaction fees, or hidden fees

- Lock your card in the Capital One Mobile app if it's misplaced, lost or stolen

|

|

|

|

|

|

N/A

|

N/A

|

19.99% - 29.99% (Variable)

|

$0

|

Average, Fair, Limited

|

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! So you could turn $50 cash back into $100. Or turn $100 cash back into $200. There’s no minimum spending or maximum rewards. Just a dollar-for-dollar match.

- Earn 2% cash back at Gas Stations and Restaurants on up to $1,000 in combined purchases each quarter, automatically. Plus earn unlimited 1% cash back on all other purchases.

- Redeem your rewards for cash at any time.

- No credit score required to apply.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- No annual fee and build your credit with responsible use.

- 0% intro APR on purchases for 6 months, then the standard variable purchase APR of 18.24% - 27.24% applies.

- Terms and conditions apply.

|

|

|

|

|

|

0% Intro APR for 6 months

|

10.99% Intro APR for 6 months

|

18.24% - 27.24% Variable APR

|

$0

|

Fair/New to Credit

|

+ See More Student Cards

If you’re serious about maximizing the reward points for each of the cards you carry, it can be pretty tough to do on your own. Remembering which of your cards is offering the best cash back rewards for which purchase type can be daunting. Then you have to remember where you are in the billing cycle for each card. Not to mention managing current APR rates and zero-interest expiration dates. It’s enough to make you switch to cash.

Luckily, some very creative folks have come up with some useful mobile apps to help you in this task. Here are two:

Reward Summit:  This is another app that tracks your credit card reward programs, and tells you the best card to use to make a purchase. It is completely secure and keeps your information private, and it’s easy to use. It will also generate reports on your rewards usage and can compare your rewards prowess with that of other Reward Summit users.

This is another app that tracks your credit card reward programs, and tells you the best card to use to make a purchase. It is completely secure and keeps your information private, and it’s easy to use. It will also generate reports on your rewards usage and can compare your rewards prowess with that of other Reward Summit users.

Smorecard:  This free app for Android and iPhone promises to help you get the most out of your credit card programs. It uses a real-time GPS locater to help you get the best pricing based on where you are and then tells you the best card to use. Smorecard tracks changes to your reward programs, as well as your usage. It doesn’t retain your personal card information, so you don’t have to worry about it getting hacked and stolen.

This free app for Android and iPhone promises to help you get the most out of your credit card programs. It uses a real-time GPS locater to help you get the best pricing based on where you are and then tells you the best card to use. Smorecard tracks changes to your reward programs, as well as your usage. It doesn’t retain your personal card information, so you don’t have to worry about it getting hacked and stolen.

We always say education is a consumer’s best weapon, and the best way to optimize your credit card usage. Now that you know more about how credit card APRs, types, reward programs and incentives work, you’re on your way to becoming a more effective credit card user. You can be among the minority of credit card users who actually take full advantage of what the card issuers offer, while being sure to maintain thoughtful and responsible spending habits.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

This is another app that tracks your credit card reward programs, and tells you the best card to use to make a purchase. It is completely secure and keeps your information private, and it’s easy to use. It will also generate reports on your rewards usage and can compare your rewards prowess with that of other Reward Summit users.

This is another app that tracks your credit card reward programs, and tells you the best card to use to make a purchase. It is completely secure and keeps your information private, and it’s easy to use. It will also generate reports on your rewards usage and can compare your rewards prowess with that of other Reward Summit users. This free app for Android and iPhone promises to help you get the most out of your credit card programs. It uses a real-time GPS locater to help you get the best pricing based on where you are and then tells you the best card to use. Smorecard tracks changes to your reward programs, as well as your usage. It doesn’t retain your personal card information, so you don’t have to worry about it getting hacked and stolen.

This free app for Android and iPhone promises to help you get the most out of your credit card programs. It uses a real-time GPS locater to help you get the best pricing based on where you are and then tells you the best card to use. Smorecard tracks changes to your reward programs, as well as your usage. It doesn’t retain your personal card information, so you don’t have to worry about it getting hacked and stolen.

![How to Sign Up For a Credit Card: Expert Guide ([updated_month_year]) How to Sign Up For a Credit Card: Expert Guide ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/12/signup2.png?width=158&height=120&fit=crop)

![What Credit Card is Best for Me? Expert Guide ([updated_month_year]) What Credit Card is Best for Me? Expert Guide ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/03/me.png?width=158&height=120&fit=crop)

![9 Best Airline Rewards Programs: Expert Guide ([updated_month_year]) 9 Best Airline Rewards Programs: Expert Guide ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/10/airline.png?width=158&height=120&fit=crop)

![11 Best Credit Cards for Beginners ([updated_month_year] Guide) 11 Best Credit Cards for Beginners ([updated_month_year] Guide)](https://www.cardrates.com/images/uploads/2019/03/credit-cards-for-beginners-feature.jpg?width=158&height=120&fit=crop)

![Understanding Credit Cards: A Beginner’s Guide ([updated_month_year]) Understanding Credit Cards: A Beginner’s Guide ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/10/Understanding-Credit-Cards-Feat.jpg?width=158&height=120&fit=crop)

![How Does a Secured Credit Card Work? (+ 5 Best Cards) – [updated_month_year] How Does a Secured Credit Card Work? (+ 5 Best Cards) – [updated_month_year]](https://www.cardrates.com/images/uploads/2016/10/how-does-a-secured-credit-card-work.jpg?width=158&height=120&fit=crop)

![“Do Prepaid Cards Work on Venmo?” ([updated_month_year]) “Do Prepaid Cards Work on Venmo?” ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/06/Do-Prepaid-Cards-Work-on-Venmo_--1.jpg?width=158&height=120&fit=crop)

![5 Prepaid Cards That Work With Apple Pay ([updated_month_year]) 5 Prepaid Cards That Work With Apple Pay ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/10/Prepaid-Cards-That-Work-With-Apple-Pay.jpg?width=158&height=120&fit=crop)