Checking to see if you qualify for Credit One pre-approval can be easily accomplished by following the steps detailed below. When companies check your credit report, there are two ways it can be done: through a hard inquiry or a soft inquiry.

A hard inquiry, or pull, generally involves a lender (or another party) requesting your complete credit report. A hard pull will usually leave a small negative mark on your report that comes with a matching decrease in your credit score for up to 12 months.

A soft inquiry, on the other hand, does not affect your credit score or report, but it doesn’t provide the lender as much information as a hard pull. Soft inquiries are often made during background checks, but can also be used by credit card companies to pre-qualify, or pre-approve, a credit applicant.

Pre-qualification is a great way to test the credit waters and determine the likelihood of being approved by an issuer. For a Credit One Bank credit card, the fast, easy pre-approval process can be completed entirely online.

1: Go Online | 2: Enter Information | 3: Get Offers | 4. Alternatives

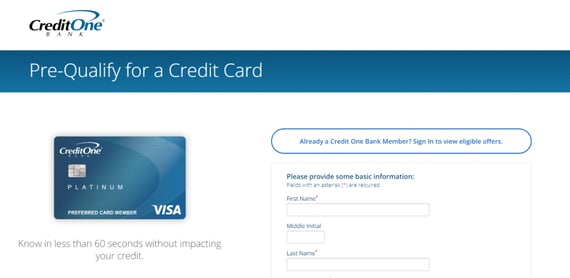

Step 1. Go Online to the Credit One Bank® Website

Everyone who applies for a Credit One credit card goes through pre-approval, particularly in light of the fact that Credit One specializes in subprime — bad credit — consumers. This helps ensure that everyone who applies for a credit card meets at least the minimum standards for approval. The pre-qualification process starts by heading to the Credit One website.

You can start the pre-approval process by clicking the link above, then moving on to Step 2. If you’ve already received a Credit One credit card pre-approval offer in the mail, you can skip the next step and instead use this link to enter your approval code.

Step 2. Enter Your Information Into the Pre-Approval Form

The straightforward pre-approval form takes just minutes to complete. You’ll be asked all the basics, including your name, address, and phone number, as well as your annual income and Social Security number.

Make sure that the information you enter is accurate; any missing or incorrect information could lead to a false rejection, making you think you don’t qualify for a particular card when you really do.

It could also lead to an incorrect pre-approval, causing you to apply for a credit card — and endure a hard credit pull — for which you don’t actually meet the minimum requirements.

Step 3. See Your Pre-Qualified Credit Card Offers

After you’ve completed the pre-qualification form, simply press the “See Card Offers” button to, well, see your card offers. The pre-approval process generally only takes minutes and will reveal the best Credit One cards for your credit history.

Credit One has unsecured credit card offers with cash back rewards on all purchases as well as a secured card with 1% cash back on select eligible purchases. It does not offer any business credit cards.

Once you’ve selected the pre-approval offer that suits your needs, you can complete the official application. Keep in mind that this application will result in a hard credit check, which may affect your credit score.

Top Credit One Alternatives

If you decide that Credit One isn’t the right credit card company for you, we have chosen similar cards for less-than-perfect credit scores that can help with building credit (or rebuilding credit). Among the options are a secured credit card that requires a deposit for approval and a student credit card for anyone enrolled in school.

Each credit card has different terms and fees associated with it, so make sure you read the cardholder agreement before choosing the best credit card for you.

Things to Keep in Mind Before You Apply

While pre-qualification can be a great way to check whether you’ll be approved for a credit card without affecting your credit score, you should always remember that pre-approval does not guarantee approval once you apply. Your complete report may reveal additional risk factors, or your income may not meet the qualifications.

Additionally, keep in mind that the Credit One Bank credit cards are generally designed for those with poor credit or fair credit, so the fees and interest rates will be higher than those for cards that require higher credit scores. The specific terms you are offered will depend on your credit score and income level.

Nevertheless, if you use the card responsibly, it can be a good way to rebuild your credit.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![18 Best Pre-Approval Credit Cards: 100% Online ([updated_month_year]) 18 Best Pre-Approval Credit Cards: 100% Online ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/09/preapprove-23.png?width=158&height=120&fit=crop)

![18 Credit Card Pre-Approval Links ([updated_month_year]) 18 Credit Card Pre-Approval Links ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/09/Credit-Card-PreApproval-Links-Feat.jpg?width=158&height=120&fit=crop)

![Capital One Pre-Approval: 5 Secrets to Prequalify ([updated_month_year]) Capital One Pre-Approval: 5 Secrets to Prequalify ([updated_month_year])](https://www.cardrates.com/images/uploads/2016/05/capital-one-pre-qualify-1.png?width=158&height=120&fit=crop)

![Discover Card Pre-Approval: 4 Best Offers to Prequalify ([updated_month_year]) Discover Card Pre-Approval: 4 Best Offers to Prequalify ([updated_month_year])](https://www.cardrates.com/images/uploads/2016/09/discover-pre-approved.jpg?width=158&height=120&fit=crop)

![Chase Pre-Approval: 6 Best Offers to Prequalify ([updated_month_year]) Chase Pre-Approval: 6 Best Offers to Prequalify ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/05/chase.png?width=158&height=120&fit=crop)

![7 Best Pre-Approval Auto Loans ([updated_month_year]) 7 Best Pre-Approval Auto Loans ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/10/Best-Pre-Approval-Auto-Loans.jpg?width=158&height=120&fit=crop)

![How to Apply for a Credit Card Online: 4 Easy Steps ([updated_month_year]) How to Apply for a Credit Card Online: 4 Easy Steps ([updated_month_year])](https://www.cardrates.com/images/uploads/2016/07/How-to-Apply-for-a-Credit-Card-Online--1.jpg?width=158&height=120&fit=crop)

![5 Steps to Apply for a Business Credit Card ([updated_month_year]) 5 Steps to Apply for a Business Credit Card ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/12/How-to-Apply-for-a-Business-Credit-Card.jpg?width=158&height=120&fit=crop)