According to a 2016 Gallup survey on the future of cash, a full 62% of those surveyed felt it was likely that they would see the end of cash within their lifetimes — including almost 60% of respondents 65 and older. The modern American is relying less and less on cash, and between the convenience, security, and usage rewards that come with using alternative payment methods, like credit cards, who can blame them?

Yes, instead of wondering where they can find change for a $20 bill, the average American seems to be wondering, “Which credit card should I get?” Which is, of course, an important question with so many quality credit cards available from which to choose. The best method is to compare your options side by side to see which options work best for you.

Cash Back | Travel Rewards | Balance Transfer | Business | Students | Bad Credit

A good cash back program is like a coupon that’s valid everywhere your credit card is accepted, giving you a percentage of your purchases as a statement credit or gift card. When it comes to comparing cash back offers, the main factor to consider is the nature of the cash back program; you’ll need to decide whether you want your cash back to be an unlimited flat rate, or if you want to receive bonus cash back rewards for spending in specific categories.

In general, an unlimited flat-rate cash back program will offer a small percentage — 1.5% tends to be average — on any purchase made with your card. Some programs may offer a larger cash back rate in specific set categories, such as gas or restaurant purchases, while offering a smaller unlimited rate on other purchases. And another popular type of cash back program offers a large cash back rate in quarterly rotating categories, with a small unlimited flat rate on everything else.

CASH BACK RATING

★★★★★

4.9

- $200 online cash rewards bonus after you make at least $1,000 in purchases in the first 90 days of account opening.

- Earn 3% cash back in the category of your choice, automatic 2% at grocery stores and wholesale clubs (up to $2,500 in combined choice category/grocery store/wholesale club quarterly purchases) and unlimited 1% on all other purchases.

- Choose 3% cash back on gas and EV charging station, online shopping/cable/internet/phone plan/streaming, dining, travel, drug store/pharmacy or home improvement/furnishing purchases.

- If you're a Bank of America Preferred Rewards® member, you can earn 25%-75% more cash back on every purchase. That means you could earn 3.75%-5.25% cash back on purchases in your choice category.

- No annual fee and cash rewards don’t expire as long as your account remains open.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% - 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- Contactless Cards - The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

|

|

|

|

|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% - 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

CASH BACK RATING

★★★★★

4.9

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! There’s no minimum spending or maximum rewards. You could turn $150 cash back into $300.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Get a 0% intro APR for 15 months on purchases. Then 17.24% to 28.24% Standard Variable Purchase APR applies, based on credit worthiness.

- No annual fee.

- Terms and conditions apply.

|

|

|

|

|

|

0% Intro APR for 15 months

|

0% Intro APR for 15 months

|

17.24% - 28.24% Variable APR

|

$0

|

Excellent/Good

|

CASH BACK RATING

★★★★★

4.8

- INTRO OFFER: Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back!

- Enjoy 6.5% cash back on travel purchased through Chase Travel, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more; 4.5% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and 3% on all other purchases (on up to $20,000 spent in the first year).

- After your first year or $20,000 spent, enjoy 5% cash back on travel purchased through Chase Travel, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

- No minimum to redeem for cash back. You can choose to receive a statement credit or direct deposit into most U.S. checking and savings accounts. Cash Back rewards do not expire as long as your account is open!

- Enjoy 0% Intro APR for 15 months from account opening on purchases and balance transfers, then a variable APR of 20.49% - 29.24%.

- No annual fee – You won't have to pay an annual fee for all the great features that come with your Freedom Unlimited® card

|

|

|

|

|

|

0% Intro APR on Purchases 15 months

|

0% Intro APR on Balance Transfers 15 months

|

20.49% - 29.24% Variable

|

$0

|

Good/Excellent

|

+Compare More Cash Back Cards

An additional factor to consider when comparing cash back offers is the signup bonus offered by the card. Many credit cards will give you a set bonus amount for reaching specific spending requirements within a certain time period, typically 90 days after account opening.

Of course, if you can’t meet the required amount without carrying that debt for months (or, worse, years) afterward, then the signup bonus loses its value. It only takes six months to negate a $200 signup bonus when you’re paying 20% interest on a $2,000 balance.

In many ways, travel rewards operate very similarly to cash back rewards, offering a certain number of rewards points or airline miles for every qualifying credit card purchase. These programs will generally offer a flat-rate point-per-dollar reward, with some programs also offering bonus rewards for spending in specific categories such as travel and dining.

Also like cash back cards, travel rewards cards will often come with signup bonuses, granting a lump sum of points or miles for hitting specified spending requirements, so be sure to take that into account when comparing offers. You’ll also want to look at any applicable annual fees, as these can take a significant bite out of your rewards.

AIR MILES RATING

★★★★★

4.9

- UNLIMITED BONUS: Unlimited Mile-for-Mile match for all new cardmembers - only from Discover. Discover gives you an unlimited match of all the Miles you’ve earned at the end of your first year. For example, if you earn 35,000 Miles, you get 70,000 Miles. There’s no signing up, no minimum spending or maximum rewards. Just a Miles-for-Miles match.

- Automatically earn unlimited 1.5x Miles on every dollar of every purchase

- No annual fee

- Turn Miles into cash. Or redeem as a statement credit for your travel purchases like airfare, hotels, rideshares, gas stations, restaurants and more.

- 0% intro APR for 15 months on purchases. Then 17.24% - 28.24% Standard Variable Purchase APR will apply.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Discover is accepted nationwide by 99% of the places that take credit cards.

- Terms and conditions apply.

|

|

|

|

|

|

0% Intro APR for 15 months

|

0% Intro APR for 15 months

|

17.24% - 28.24% Variable APR

|

$0

|

Excellent/Good

|

AIR MILES RATING

★★★★★

4.9

- $0 annual fee and no foreign transaction fees

- Earn a bonus of 20,000 miles once you spend $500 on purchases within 3 months from account opening, equal to $200 in travel

- Earn unlimited 1.25X miles on every purchase, every day

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

|

|

|

|

|

|

0% for 15 months

|

0% for 15 months

|

19.99% - 29.99% (Variable)

|

$0

|

Excellent, Good

|

AIR MILES RATING

★★★★★

4.8

- Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $100 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

|

|

|

|

|

|

N/A

|

N/A

|

19.99% - 29.99% (Variable)

|

$95

|

Excellent, Good

|

+Compare More Travel Rewards Cards

While travel rewards will be most useful for those who frequently travel, they can be beneficial to those who don’t live in the proverbial saddle, as well. In fact, redeeming your rewards for travel — and, sometimes, travel-related purchases — can often present the greatest per-point value.

For instance, the Chase Ultimate Rewards points earned with the Chase Sapphire Preferred credit card can be redeemed for cash back via a statement credit, giving a value of $0.01 per point back as cash back. This means every 10,000 Ultimate Rewards points can be redeemed for $100 in cash back.

On the other hand, when Ultimate Rewards points are redeemed via the Chase portal for airline travel, they can net $0.0125 per point, making those 10,000 points worth $125 in travel. Particularly travel-reward-savvy users can get even more bang for their buck (or pow for their point, as the case may be) by transferring rewards to one of the dozen or so airline and hotel partners, earning up to $0.04 per point with smart transfers.

For many, the most impactful downside to credit cards is the interest fees they charge for carrying a balance. Often ranging from 12% up to 30% (or more), interest fees can turn even a small balance into a big burden over time. Thankfully, those who need a little relief from killer interest rates can often find it with a quality balance transfer credit card.

Pretty much as it sounds, a balance transfer involves transferring the balance on one credit card to a second credit card with a lower interest rate. Thus, when comparing balance transfer cards, the main factor to consider will be the interest rate charged by the new credit card. Typically, balance transfer credit card offers will provide 0% APR on new balance transfers for a set period of time, often 12 to 18 months, so compare offers for the best introductory rate.

0% BALANCE TRANSFER RATING

★★★★★

4.8

- 0% Intro APR for 21 months on balance transfers from date of first transfer and 0% Intro APR for 12 months on purchases from date of account opening. After that the variable APR will be 18.24% - 28.99%, based on your creditworthiness. Balance transfers must be completed within 4 months of account opening.

- There is a balance transfer fee of either $5 or 5% of the amount of each transfer, whichever is greater

- Get free access to your FICO® Score online.

- With Citi Entertainment®, get special access to purchase tickets to thousands of events, including concerts, sporting events, dining experiences and more.

- No Annual Fee - our low intro rates and all the benefits don’t come with a yearly charge.

|

|

|

|

|

|

0% 12 months on Purchases

|

0% 21 months on Balance Transfers

|

18.24% - 28.99% (Variable)

|

$0

|

Excellent, Good

|

Additional Disclosure: Citi is a CardRates advertiser.

0% BALANCE TRANSFER RATING

★★★★★

4.8

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! There’s no minimum spending or maximum rewards. You could turn $150 cash back into $300.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- Your account may not always be eligible for balance transfers. Balance transfer eligibility is determined at Discover’s discretion.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- No annual fee.

- Terms and conditions apply.

|

|

|

|

|

|

0% Intro APR for 6 months

|

0% Intro APR for 18 months

|

17.24% - 28.24% Variable APR

|

$0

|

Excellent/Good

|

0% BALANCE TRANSFER RATING

★★★★★

4.8

- Earn $200 cash back after you spend $1,500 on purchases in the first 6 months of account opening. This bonus offer will be fulfilled as 20,000 ThankYou® Points, which can be redeemed for $200 cash back.

- Earn 2% on every purchase with unlimited 1% cash back when you buy, plus an additional 1% as you pay for those purchases. To earn cash back, pay at least the minimum due on time. Plus, for a limited time, earn 5% total cash back on hotel, car rentals and attractions booked on the Citi Travel℠ portal through 12/31/24.

- Balance Transfer Only Offer: 0% intro APR on Balance Transfers for 18 months. After that, the variable APR will be 19.24% - 29.24%, based on your creditworthiness.

- Balance Transfers do not earn cash back. Intro APR does not apply to purchases.

- If you transfer a balance, interest will be charged on your purchases unless you pay your entire balance (including balance transfers) by the due date each month.

- There is an intro balance transfer fee of 3% of each transfer (minimum $5) completed within the first 4 months of account opening. After that, your fee will be 5% of each transfer (minimum $5).

|

|

|

|

|

|

N/A

|

0% Intro APR Period 18 months on Balance Transfers

|

19.24% - 29.24% (Variable)

|

$0

|

Excellent, Good, Fair

|

Additional Disclosure: Citi is a CardRates advertiser.

+Compare More Balance Transfer Cards

Another factor to consider when comparing balance transfer offers is the transfer fee charged by the credit card. Most credit cards will charge between 3% and 5% of the total balance being transferred, although the Chase Slate® credit card does not charge a balance transfer fee on transfers made within the first 60 days of account opening. The caveat with that deal, however, is that you cannot transfer the balance from one Chase credit card to another Chase card.

For the most part, comparing credit cards for your business is the same as comparing personal credit cards. Business have many of the same costs and credit cards come with many of the same perks as consumer cards, including cash back and travel rewards.

When looking at business cards, you’ll want to compare reward types and amounts, the size of (and requirements for) the signup bonus, and the annual fee you’ll need to pay. Additionally, be sure to check out the APR, especially if you know you’ll have to carry the occasional balance. If you have employees who will be using the company card to make purchases, you’ll also want to look into any fees for additional cards when comparing offers.

BUSINESS CARD RATING

★★★★★

4.7

- Earn $750 bonus cash back after you spend $6,000 on purchases in the first 3 months from account opening

- Earn unlimited 1.5% cash back on every purchase made for your business

- No Annual Fee

- Redeem rewards for cash back, gift cards, travel and more through Chase Ultimate Rewards®.

- Earn rewards faster with employee cards at no additional cost. Set individual spending limits for greater control.

- Round-the-clock monitoring for unusual credit card purchases

|

|

|

|

|

|

0% Intro APR on Purchases 12 months

|

N/A 12 months

|

18.49% - 24.49% Variable

|

$0

|

Good/Excellent

|

BUSINESS CARD RATING

★★★★★

4.7

- 0% Intro APR for the first 12 months; 21.24% - 29.24% variable APR after that

- Earn unlimited 1.5% cash back for your business on every purchase, everywhere — with no limits or category restrictions

- No annual fee

- Earn unlimited 5% cash back on hotels and rental cars booked through Capital One Travel

- Rewards won't expire for the life of the account

- Redeem your cash back rewards for any amount

|

|

|

|

|

|

0% for 12 months

|

N/A

|

21.24% - 29.24% (Variable)

|

$0

|

Good

|

BUSINESS CARD RATING

★★★★★

4.7

- Earn a one-time bonus of 50,000 miles – equal to $500 in travel – once you spend $4,500 on purchases within the first 3 months from account opening

- Earn unlimited 2X miles per dollar on every purchase, everywhere, no limits or category restrictions, and miles won't expire for the life of the account

- Unlimited 5X miles on hotels and rental cars booked through Capital One Travel

- Transfer your miles to 15+ travel loyalty programs

- Redeem your miles instantly for any travel-related purchases, from flights and hotels to ride-sharing services

- Skip the lines with up to a $100 statement credit on TSA PreCheck® or Global Entry

|

|

|

|

|

|

N/A

|

N/A

|

26.24% (Variable)

|

$0 intro for first year; $95 after that

|

Excellent, Good

|

+Compare More Business Cards

Another major comparison point for business cards will be the qualification requirements. While your personal credit can influence your ability to obtain a business credit card, your company will also develop its own business credit score and history over time. New businesses without established business credit may have a more difficult time obtaining the best business credit cards than established companies with long credit histories.

Be it academic lessons in the classroom, interpersonal lessons in the dorm room, or life lessons in the common room, your job as a student is to learn. And, as a student, one of the most important skills you can learn is to properly use and manage credit. Thankfully, while some credit card issuers may blanch at your lack of credit history, others are more than happy to help you learn.

As you compare student credit cards, you’ll learn to weigh many of the same options as do other credit card users, like deciding between flat-rate or category-based cash back rewards. You’ll also face a few options that may not be as important to other cardholders, such as whether a card offers a statement credit for good grades — or whether the issuer reports to all three of the major credit bureaus, an important part of building your credit.

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! So you could turn $50 cash back into $100. Or turn $100 cash back into $200. There’s no minimum spending or maximum rewards. Just a dollar-for-dollar match.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- No credit score required to apply.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- No annual fee and build your credit with responsible use.

- 0% intro APR on purchases for 6 months, then the standard variable purchase APR of 18.24% - 27.24% applies.

- Terms and conditions apply.

|

|

|

|

|

|

0% Intro APR for 6 months

|

10.99% Intro APR for 6 months

|

18.24% - 27.24% Variable APR

|

$0

|

Fair/New to Credit

|

- Earn unlimited 1.5% cash back on every purchase, every day

- Early Spend Bonus: Earn $50 when you spend $100 in the first three months

- Earn 10% cash back on purchases made through Uber & Uber Eats, plus complimentary Uber One membership statement credits through 11/14/2024

- Enjoy peace of mind with $0 Fraud Liability so that you won't be responsible for unauthorized charges

- Enjoy no annual fee, foreign transaction fees, or hidden fees

- Lock your card in the Capital One Mobile app if it's misplaced, lost or stolen

|

|

|

|

|

|

N/A

|

N/A

|

19.99% - 29.99% (Variable)

|

$0

|

Average, Fair, Limited

|

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! So you could turn $50 cash back into $100. Or turn $100 cash back into $200. There’s no minimum spending or maximum rewards. Just a dollar-for-dollar match.

- Earn 2% cash back at Gas Stations and Restaurants on up to $1,000 in combined purchases each quarter, automatically. Plus earn unlimited 1% cash back on all other purchases.

- Redeem your rewards for cash at any time.

- No credit score required to apply.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- No annual fee and build your credit with responsible use.

- 0% intro APR on purchases for 6 months, then the standard variable purchase APR of 18.24% - 27.24% applies.

- Terms and conditions apply.

|

|

|

|

|

|

0% Intro APR for 6 months

|

10.99% Intro APR for 6 months

|

18.24% - 27.24% Variable APR

|

$0

|

Fair/New to Credit

|

+Compare More Student Cards

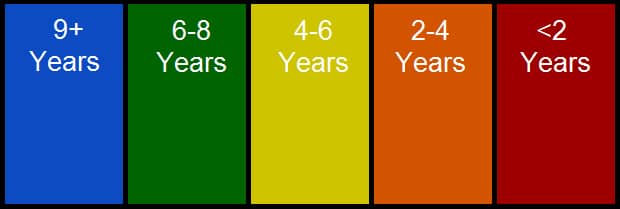

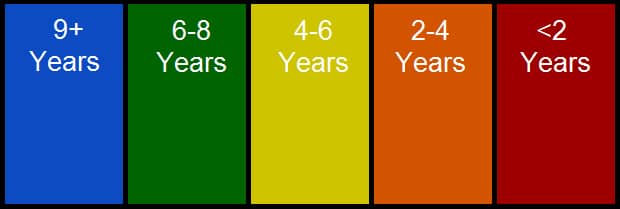

Credit cards that report to the major bureaus are a key comparison point for student credit cards. One of the most important reasons to get a student credit card in the first place is to use the one advantage you have as credit novice: time. The earlier you start building a positive credit history, the better off your credit will be in the long run. Specifically, it’s important to establish credit early because of the impacts of the age of your credit accounts on your overall credit score.

In fact, the length of your credit history, also called the average age of accounts, represents a full 15% of your FICO credit score. This means that no matter how perfect the rest of your credit is, your credit score will never reach similar perfection without a long, well-established credit history — and the only thing that can truly increase the length of your credit history is time.

One of the many facts of life — perhaps the fact of life — is, simply, “stuff happens.” Sometimes, all the planning in the world can’t prevent or solve some problems, and the consequences can often have long-term effects. When those effects are to your finances, your credit can suffer, making it difficult — but not impossible — to obtain new credit through traditional methods — but not impossible.

When comparing credit cards for poor credit consumers, the main point of comparison will be unsecured versus secured cards. With bad credit, unsecured credit cards will be harder to obtain from prime issuers, so you will need to obtain a subprime credit card. These cards often have very high interest rates and may also have large fees. Secured cards, on the other hand, require a security deposit to open, and your credit limit will be restricted to the size of your deposit.

BAD CREDIT RATING

★★★★★

4.9

- Greater access to credit than before - $700 credit limit

- Get a Mastercard accepted online, in store and in app

- Account history is reported to the three major credit bureaus in the U.S.

- $0 liability* for unauthorized use

- Access your account online or from your mobile device 24/7

- *Fraud protection provided by Mastercard Zero Liability Protection. If approved, you'll receive the Mastercard Guide to Benefits that details the complete terms with your card.

|

|

|

|

|

|

N/A

|

N/A

|

See terms

|

See terms

|

Fair/Good

|

BAD CREDIT RATING

★★★★★

4.9

- PREMIER Bankcard credit cards are for building credit.

- Start building credit by keeping your balance low and paying all your bills on time each month.

- When you need assistance our award-winning US-based Customer Service agents are there to help.

- Credit Limit Increase Eligible after 12 months of consistent responsible account management.

- We report monthly to the Consumer Reporting Agencies to help you build your credit.

|

|

|

|

|

|

N/A

|

N/A

|

See Provider Website

|

See Provider Website

|

Fair/Poor

|

BAD CREDIT RATING

★★★★★

4.8

- No credit check to apply

- Adjustable credit limit based on what you transfer from your Chime Checking account to the secured deposit account

- No interest* or annual fees

- Chime Checking Account and qualifying direct deposit of $200 or more required to apply. See official application, terms, and details link below.

- The secured Chime Credit Builder Visa® Card is issued by The Bankcorp Bank, N.A. or Stride Bank, N.A., Members FDIC, pursuant to a license from Visa U.S.A. Inc. and may be used everywhere Visa credit cards are accepted.

- *Out-of-network ATM withdrawal and OTC advance fees may apply. View The Bancorp agreement or Stride agreement for details; see back of card for issuer.

+Compare More Bad Credit Cards

Another option for those with poor credit will be limited brand or store credit cards. While only usable for specific locations or brands, these credit cards are often easier to obtain than unsecured credit cards from major issuers. Look for cards that report to all three credit bureaus to ensure your new credit card is helping to grow and improve your credit score.

Not so long ago, the average American toted around pocketfuls of cash and coins with which to make his or her daily purchases, often literally weighed down by the currency needed to operate in the world. Today, more and more shoppers are using plastic, not paper, for their purchases, lured by the convenience, security, and rewards represented by alternative currency formats.

Finding the right credit card is simply a matter of a little research and some solid comparison shopping. Consider each aspect of your new card, including rewards, fees, and credit requirements, to make the best choice for you and your personal needs.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![12 Best Credit Card Offers Now, Per Experts ([updated_month_year]) 12 Best Credit Card Offers Now, Per Experts ([updated_month_year])](https://www.cardrates.com/images/uploads/2016/05/12-Best-Credit-Card-Offers.png?width=158&height=120&fit=crop)

![12 Best Credit Card Signup Bonus Offers ([updated_month_year]) 12 Best Credit Card Signup Bonus Offers ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/06/credit-card-signup-bonus-offers.jpg?width=158&height=120&fit=crop)

![How to Transfer a Credit Card Balance (+7 Best 0% Offers) – [updated_month_year] How to Transfer a Credit Card Balance (+7 Best 0% Offers) – [updated_month_year]](https://www.cardrates.com/images/uploads/2017/06/how-to-transfer-credit-card-balance.jpg?width=158&height=120&fit=crop)

![Credit One Bank: Reviews & 5 Best Offers ([updated_month_year]) Credit One Bank: Reviews & 5 Best Offers ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/01/creditone.png?width=158&height=120&fit=crop)

![13 Category Winners: Best Credit Card Offers ([updated_month_year]) 13 Category Winners: Best Credit Card Offers ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/04/cover-4.jpg?width=158&height=120&fit=crop)

![7 Longest 0% APR Credit Card Offers ([updated_month_year]) 7 Longest 0% APR Credit Card Offers ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/11/Longest-0-APR-Credit-Card-Offers-Feat.png?width=158&height=120&fit=crop)

![7 Best Credit Card Offers Right Now ([updated_month_year]) 7 Best Credit Card Offers Right Now ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/02/Best-Credit-Card-Offers-Right-Now.jpg?width=158&height=120&fit=crop)

![How Do Balance Transfers Work? + 5 Top Offers ([updated_month_year]) How Do Balance Transfers Work? + 5 Top Offers ([updated_month_year])](https://www.cardrates.com/images/uploads/2016/04/complete-guide-to-balance-transfers.jpg?width=158&height=120&fit=crop)