Before the rise of the internet, submitting credit card applications was a laborious process. Your choices were often limited to the mail or the bank, which essentially came down to choosing between filling out a long, tedious form — or enduring a long, tedious interview.

While modern credit card applicants can still choose to honor their ancestors by using the mail-in form — or practice the art of small talk with their local teller — today’s credit seeker has an even better option: the online application. Online credit card applications are usually the fastest way to apply — often in 13 lines or less — and typically resulting in an answer in just 60 seconds.

The application will request standard personal information, such as your name and address, as well as information about your income and employment status. You’ll also need to agree to allow the credit card issuer to run your credit, the result of which will determine whether your credit card application is accepted, and, if so, the terms you are offered by the issuer. Let’s take a look at some of our top choices for credit cards available today for a range of credit scores, from the excellent, good, fair, and bad classifications.

Excellent Credit | Good Credit | Fair Credit | Bad Credit

Best Cards for Excellent Credit (750+ FICO Score)

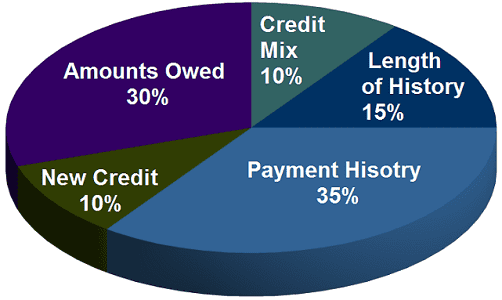

The crème de la crème of the credit card applicant pool, those with excellent credit have high credit scores and pristine credit reports. They’ve shown a long, steady history of positive financial behavior, including having a healthy mix of credit and maintaining all of their accounts in good standing.

To reward their credit diligence, excellent credit applicants are almost guaranteed acceptance for most credit cards (provided they meet income requirements). Additionally, these cardholders will be offered the lowest interest rates and fees, as well as many of the best rewards and signup bonuses.

- $200 online cash rewards bonus after you make at least $1,000 in purchases in the first 90 days of account opening.

- Earn 3% cash back in the category of your choice, automatic 2% at grocery stores and wholesale clubs (up to $2,500 in combined choice category/grocery store/wholesale club quarterly purchases) and unlimited 1% on all other purchases.

- Choose 3% cash back on gas and EV charging station, online shopping/cable/internet/phone plan/streaming, dining, travel, drug store/pharmacy or home improvement/furnishing purchases.

- If you're a Bank of America Preferred Rewards® member, you can earn 25%-75% more cash back on every purchase. That means you could earn 3.75%-5.25% cash back on purchases in your choice category.

- No annual fee and cash rewards don’t expire as long as your account remains open.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% - 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- Contactless Cards - The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% - 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

- Earn unlimited 1.5 points per $1 spent on all purchases, with no annual fee and no foreign transaction fees and your points don't expire as long as your account remains open.

- 25,000 online bonus points after you make at least $1,000 in purchases in the first 90 days of account opening - that can be a $250 statement credit toward travel purchases.

- Use your card to book your trip how and where you want - you're not limited to specific websites with blackout dates or restrictions.

- Redeem points for a statement credit to pay for travel or dining purchases, such as flights, hotel stays, car and vacation rentals, baggage fees, and also at restaurants including takeout.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% - 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- If you're a Bank of America Preferred Rewards® member, you can earn 25%-75% more points on every purchase. That means instead of earning an unlimited 1.5 points for every $1, you could earn 1.87-2.62 points for every $1 you spend on purchases.

- Contactless Cards - The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% - 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

- $0 annual fee and no foreign transaction fees

- Earn a bonus of 20,000 miles once you spend $500 on purchases within 3 months from account opening, equal to $200 in travel

- Earn unlimited 1.25X miles on every purchase, every day

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 15 months

|

0% for 15 months

|

19.99% - 29.99% (Variable)

|

$0

|

Excellent, Good

|

+See More Cards for Excellent Credit

The caveat to the near-guaranteed acceptance will often be meeting an individual issuer’s requirements for application frequency. For example, Chase is infamous for rigorously upholding its “5/24 Rule,” which stipulates that applicants cannot have applied for more than five new lines of credit in the last 24 months, regardless of their credit score.

Best Cards for Good Credit (700+ FICO Score)

Before you reach excellent credit status, you’ll spend some time in the good credit category. Those with good credit scores have demonstrated many of the same healthy credit behaviors as their excellent-credit counterparts, such as paying their bills on time and as agreed, but may not have the same diversity of credit types or as extensive a credit history.

Thanks to their healthy histories, good credit applicants are likely to be approved for many prime credit cards, including great travel and cash back cards. While not as low as the rates offered to excellent credit consumers, those with good credit can still expect low interest rates and fees.

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! There’s no minimum spending or maximum rewards. You could turn $150 cash back into $300.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Get a 0% intro APR for 15 months on purchases. Then 17.24% to 28.24% Standard Variable Purchase APR applies, based on credit worthiness.

- No annual fee.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 months

|

0% Intro APR for 15 months

|

17.24% - 28.24% Variable APR

|

$0

|

Excellent/Good

|

- $0 annual fee and no foreign transaction fees

- Earn a bonus of 20,000 miles once you spend $500 on purchases within 3 months from account opening, equal to $200 in travel

- Earn unlimited 1.25X miles on every purchase, every day

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 15 months

|

0% for 15 months

|

19.99% - 29.99% (Variable)

|

$0

|

Excellent, Good

|

- Earn a one-time $200 cash bonus after you spend $500 on purchases within 3 months from account opening

- Earn unlimited 1.5% cash back on every purchase, every day

- $0 annual fee and no foreign transaction fees

- Enjoy up to 6 months of complimentary Uber One membership statement credits through 11/14/2024

- Earn unlimited 5% cash back on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options. Terms apply

- No rotating categories or sign-ups needed to earn cash rewards; plus, cash back won't expire for the life of the account and there's no limit to how much you can earn

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 15 months

|

0% for 15 months

|

19.99% - 29.99% (Variable)

|

$0

|

Excellent, Good

|

+See More Cards for Good Credit

One of the main differences between applying for a credit card with good credit instead of excellent credit will likely be your approved credit limit. While most people believe the credit limit is set by their income alone, income is only one of the factors. As with the general approval for a credit card, the limit for which you are approved will be most heavily influenced by your credit score.

Best Cards for Fair Credit (650+ FICO Score)

Being in the “fair” credit category shows you’ve made some of the right moves — but still have room to grow. This may mean you’re working on building your credit for the first time, or could indicate you have had a few hiccups with your credit, such as making several late payments, and need to rebuild.

Fair-credit consumers represent more of a credit risk to issuers and, thus, will not receive the same attractive rates as those with good or excellent credit. They also won’t qualify for the same rewards deals and signup offers, though consumers with fair credit can still find solid rewards card and great everyday cards.

- No annual or hidden fees. See if you're approved in seconds

- Be automatically considered for a higher credit line in as little as 6 months

- Help build your credit through responsible use of a card like this

- Enjoy peace of mind with $0 Fraud Liability so that you won't be responsible for unauthorized charges

- Monitor your credit score with CreditWise from Capital One. It's free for everyone

- Get access to your account 24 hours a day, 7 days a week with online banking from your desktop or smartphone, with Capital One's mobile app

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

29.99% (Variable)

|

$0

|

Average, Fair, Limited

|

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! So you could turn $50 cash back into $100. Or turn $100 cash back into $200. There’s no minimum spending or maximum rewards. Just a dollar-for-dollar match.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- No credit score required to apply.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- No annual fee and build your credit with responsible use.

- 0% intro APR on purchases for 6 months, then the standard variable purchase APR of 18.24% - 27.24% applies.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 6 months

|

10.99% Intro APR for 6 months

|

18.24% - 27.24% Variable APR

|

$0

|

Fair/New to Credit

|

- Earn unlimited 1.5% cash back on every purchase, every day

- No rotating categories or limits to how much you can earn, and cash back doesn't expire for the life of the account. It's that simple

- Be automatically considered for a higher credit line in as little as 6 months

- Enjoy peace of mind with $0 Fraud Liability so that you won't be responsible for unauthorized charges

- Help strengthen your credit for the future with responsible card use

- Enjoy up to 6 months of complimentary Uber One membership statement credits through 11/14/2024

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

29.99% (Variable)

|

$39

|

Average, Fair, Limited

|

+See More Cards for Fair Credit

With fair credit, credit card options will be more limited than for those with better credit.

Best Cards for Bad Credit (

Consumers with bad credit have likely experienced some bumps in the credit road, perhaps including several missed payments, defaulted loans, or even bankruptcy, and are at the bottom of the credit totem pole. Perhaps your financial position has changed or you’re simply ready to put your bad credit days behind you. The road ahead may be challenging, but have to start somewhere. Because of the poor credit behaviors demonstrated by those with bad credit, many issuers are wary of providing credit, meaning you may need to focus on issuers who specifically deal with subprime borrowers.

Another option for bad credit consumers struggling to obtain an unsecured credit card is to apply for a secured credit card. Requiring a cash deposit to open, secured credit cards are easier to get than unsecured cards but have many of the same features. For example, a secured card with a MasterCard logo can be used to make purchases anywhere MasterCard is accepted.

- No credit check to apply

- Adjustable credit limit based on what you transfer from your Chime Checking account to the secured deposit account

- No interest* or annual fees

- Chime Checking Account and qualifying direct deposit of $200 or more required to apply. See official application, terms, and details link below.

- The secured Chime Credit Builder Visa® Card is issued by The Bankcorp Bank, N.A. or Stride Bank, N.A., Members FDIC, pursuant to a license from Visa U.S.A. Inc. and may be used everywhere Visa credit cards are accepted.

- *Out-of-network ATM withdrawal and OTC advance fees may apply. View The Bancorp agreement or Stride agreement for details; see back of card for issuer.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

$0

|

None

|

- $400 credit limit doubles to $800! (Simply make your first 6 monthly minimum payments on time)

- All credit types welcome to apply

- Monthly reporting to the three major credit bureaus

- Initial Credit Limit of $400.00 (Subject to available credit)

- Fast and easy application process; results in seconds

- Use your card at locations everywhere Mastercard® is accepted

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

29.99%

|

$99

|

Fair/Poor/Bad

|

- Earn 1% cash back rewards^^ on payments made to your Revvi Credit Card

- Perfect credit not required

- $300 credit limit (subject to available credit)

- Checking account required

- Opportunity to request credit limit increase after twelve months, fee applies

- *See Rates, Fees, Costs & Limitations for complete offer details

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

See website for Details

|

N/A

|

35.99%

|

$75.00 1st year, $48.00 after

|

Fair

|

+See More Cards for Bad Credit

The credit card issuers who specialize in applicants with poor credit make up for the higher risk of their customers by charging cardholders fairly high interest rates, and many also charge additional fees. Compare your options before applying for a subprime card to ensure you have the best deal.

Of course, the way to qualify for the best credit cards is to improve your credit score. Paying your debts as agreed, establishing a healthy mix of credit types, and maintaining low balances on your credit cards can all contribute to rebuilding your credit.

Your Credit Future is an Application Away

Whether you like to put pen to paper, chat it up in person, or fly through an online application, applying for a new credit card can be an important step to building or maintaining your credit. The way you use — and the way you pay — your new credit card will influence your overall credit and help determine your future creditworthiness, so be sure to practice responsible credit behaviors.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![15 FAQs: Annual Income on Credit Card Applications ([updated_month_year]) 15 FAQs: Annual Income on Credit Card Applications ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/11/shutterstock_394244284.jpg?width=158&height=120&fit=crop)

![Which Credit Card Companies Provide the Best Credit Cards? ([updated_month_year]) Which Credit Card Companies Provide the Best Credit Cards? ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/08/Which-Credit-Card-Companies-Provide-the-Best-Credit-Cards-2.png?width=158&height=120&fit=crop)

![3 FAQs: ATM Card vs. Debit Card vs. Credit Card ([updated_month_year]) 3 FAQs: ATM Card vs. Debit Card vs. Credit Card ([updated_month_year])](https://www.cardrates.com/images/uploads/2016/05/atm-card-vs-debit-card-vs-credit-card--1.png?width=158&height=120&fit=crop)

![First Savings Credit Card: Login, Application & 5 Similar Cards ([updated_month_year]) First Savings Credit Card: Login, Application & 5 Similar Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2016/02/first-savings-credit-card.jpg?width=158&height=120&fit=crop)

![Discover Card: Credit Score Needed & 5 Best Cards ([updated_month_year]) Discover Card: Credit Score Needed & 5 Best Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2016/11/discovercard2.png?width=158&height=120&fit=crop)

![Credit Card Reviews: 5 Best Cards by Category ([updated_month_year]) Credit Card Reviews: 5 Best Cards by Category ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/08/Expert-Reviews_-5-Best-Cards-by-Category.jpg?width=158&height=120&fit=crop)

![Luxury Card: Review & 3 Better Cards ([updated_month_year]) Luxury Card: Review & 3 Better Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/07/Luxury-Card-Review.jpg?width=158&height=120&fit=crop)

![The 1 Discover Credit Card For Bad Credit ([updated_month_year]) The 1 Discover Credit Card For Bad Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/01/Discover-Credit-Card-For-Bad-Credit.jpg?width=158&height=120&fit=crop)