In the modern consumer marketplace, many industries are often dominated by two leading brands and their latest products. If you want a soda, for instance, you’re likely choosing between some version of Pepsi or Coke. Similarly, most people likely carry a phone sporting the latest version of either Android or iOS.

When it comes to cash back credit card rewards, two of the biggest names to beat are the Chase Freedom cards and Discover it® credit card line. These are somewhat similar cards that pack a lot of rewards punch for consumers who can make the most of them.

The two Chase Freedom cards and Discover’s flagship cash back card share some similarities, but a variety of differences set them apart.

Signup Bonus | Rewards | Qualifying | Networks | Summary

Signup Bonus: Quick Reward vs. Long-Term Savings

One of the first things a prospective cardholder may notice when comparing the Chase Freedom® cards and Discover it® Cash Back card is the all-important signup bonuses.

The Chase Freedom Flex℠ offers a more traditional signup bonus, namely a one-time, lump-sum cash bonus that becomes available when a new cardholder meets the minimum spending requirement on the card within the first 90 days after they open the account.

This card is currently not available. Additional Disclosure: The information related to Chase Freedom Flex℠ credit card has been collected by CardRates.com and has not been reviewed or provided by the issuer of this card.Chase Freedom Flex℠

Given the fairly small spending requirement of the Chase Freedom Flex℠‘s signup bonus, it should be easy for just about any cardholder to meet within the 90-day period. Since most signup bonuses are deposited within six weeks of earning them, this can mean a nice lump sum in just a few months.

In contrast, the Discover it® Cash Back card has a relatively unique signup bonus. Rather than offering a quick flat-rate sum, Discover offers cardholders a one-time bonus at the end of the first year, equal to the total amount of cash back rewards earned with their Discover it® Cash Back card during that first year.

The nice part is there’s no maximum amount you can earn. If you put all your purchases on this card over the course of a year, you can expect a sizable return soon after your account anniversary.

And finally, there’s the Chase Freedom Unlimited®, which also sports a year-long signup bonus. Every purchase earns a higher rate of cash back, but unlike the earlier mentioned Discover card, the amount you can earn is limited.

You are not eligible to earn a signup bonus on your new Chase card if you’ve received a signup bonus for that same card within the past 24 months.

Rewards: Duel of the Rotating Categories

When you get right down to it, the Chase Freedom® cards and the Discover it® Cash Back card have a few similarities, starting with the fact that none of them charge an annual fee.

Of course, the real déjà vu comes when you look at the rewards systems operated between the Chase Freedom Flex℠ and the Discover it® Cash Back. These cards share quarterly rotating bonus categories that earn higher rewards rates.

Each card has the same quarterly purchase cap, as well, limiting the amount of bonus cash back that can be earned in each rewards category.

Since bonus cash back is only as good as its categories, both cards offer popular everyday bonus categories, including things like gas, groceries, and restaurant purchases. Most quarters will also offer a secondary category in a more niche area, such as wholesale clubs.

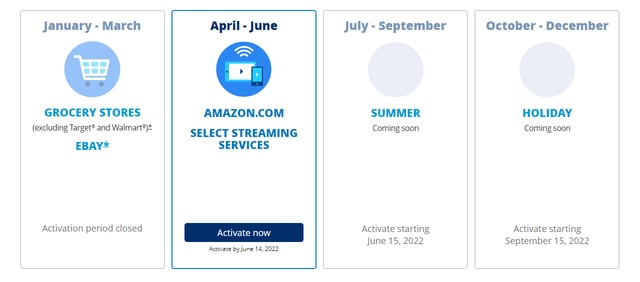

Both cards require you to activate your bonus category each quarter to be eligible for the bonus cash back rewards.

For many credit card rewards aficionados, the best way to maximize their cash back rewards is by using both cards. Essentially, while the bonus categories do occasionally overlap, it’s infrequent enough that you could effectively double your bonus cash back potential by obtaining both cards.

As an example, in Q2 of 2022, the Discover it® Cash Back card is offering bonus cash back on gas station and Target purchases, while the Chase Freedom Flex℠ is ofering bonus cash back for Amazon.com and select streaming services.

The Chase Freedom Unlimited® is a simpler card, offering an elevated rate of return on most purchases with no category activations to worry about. This card has changed its rewards structure a couple of times since its inception, but it’s always offered the same flat-rate return on purchases. It’s just added some elevated purchase tiers, including travel and restaurants, to make the card even more attractive.

All of the cards make it easy to redeem your cash back, which you can get as a statement credit, use to pay for purchases on Amazon, gift cards, or a deposit into a qualifying bank account. If you already have a card that earns Chase Ultimate Rewards, like the Chase Sapphire Preferred® card or the Chase Sapphire Reserve®, then you can transfer your Chase Ultimate Rewards Points to your Sapphire card for a 25% to 50% value boost, depending on the Sapphire card you have.

Qualifying: Credit Scores & the Chase 5/24 Rule

Other than a few fees and specific bonus categories, the biggest differences between the cards stem from the different issuers and networks (the latter of which is discussed in the next section). How the issuers come into play is more than just a matter of which bank you make your payments to; it also tends to play a big role in the card’s approval requirements.

For instance, Chase is generally considered to have higher credit qualifications for its cards, and the Chase Freedom cards are no exception. You’ll want to have a FICO credit score over 700 for decent approval chances, though a higher score will net you a better APR and a higher credit limit.

Discover cards, on the other hand, are typically considered to be easier to obtain. That being said, the average Discover it® Cash Back cardholder has a credit score above 650, and you’ll still need a credit score in the 700 or better range to qualify for the lowest APRs and highest credit limits.

Another important way the cards’ issuers come into the picture is through application limitations in place from each issuer. Chase, for example, operates under what’s known as the 5/24 rule, which means that most applicants will be automatically rejected for a new Chase credit card if they have opened more than five new credit accounts in the last 24 months.

While Discover doesn’t have any specific rules that prevent you from applying for a card, the issuer does have a rule in place that restricts the number of Discover cards you can have at any time to two. It also requires that you wait at least 12 months after opening your first Discover credit card account before you can open a second card account.

Networks: Discover vs. Visa vs. Mastercard

The final area in which cardholders may notice differences between the Chase Freedom® and Discover it® cards is related to the processing networks: The Discover it® Cash Back card obviously runs on the Discover network, the Chase Freedom Unlimited® operates on the Visa network, and the Chase Freedom Flex℠ operates on the Mastercard network.

This affects your card use in a few ways that will primarily be noticeable through your card’s acceptance rate and peripheral benefits.

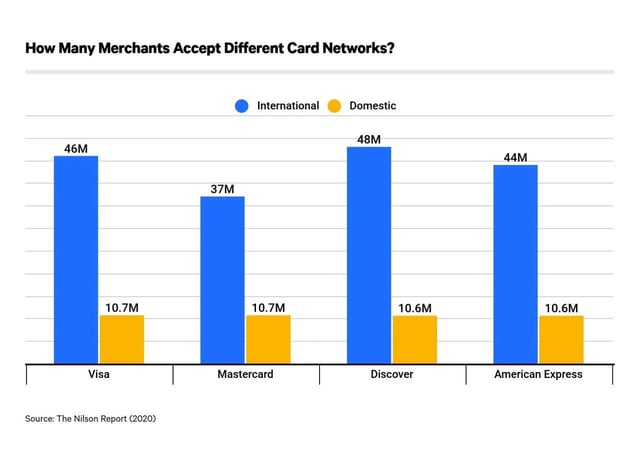

Not too long ago, Visa was the solid leader in worldwide acceptance — but not anymore. Discover has made huge leaps in its number of overseas merchants and is now the most widely accepted network by volume, with 48 million international merchants.

In contrast, Visa is accepted by 46 million merchants, Mastercard is accepted by 37 million merchants, and American Express by 44 million merchants, according to 2020 data from Domestically, you likely won’t notice much of a difference in acceptance rates, with Visa, Discover, and Mastercard accepted by more than 10 million US merchants across the country.

At the same time, Discover is accepted in only 175 countries, compared to Visa’s 200+ countries and territories, with limited to no Discover acceptance in some parts of Africa, South America, and the Middle East.

Beyond basic acceptance rates, the credit card network will also determine the extraneous perks and benefits cardholders enjoy. All Discover cardholders are given access to their FICO credit score for free each month, while Chase cardholders can see their VantageScore 3.0 credit score. Plus, every cardholder will receive $0 fraud liability and the ability to activate free Social Security number alerts.

Visa cardholders enjoy access to many of the same perks, including an auto rental collision damage waiver, zero liability for fraudulent purchases, and emergency cash disbursement. Your Visa card will also allow you to use Visa’s Roadside Dispatch® service, a pay-per-use roadside assistance program.

The Chase Freedom Flex℠ has its own set of Mastercard benefits that include cellphone protection (the only card in this group with this perk), monthly Lyft credits, and a free Shoprunner membership, among other benefits.

Summary: Similar Cards with Complementary Rewards

To some dedicated consumers, there are only two types of people in the world: Android People and Apple People. Similarly, the Coke and Pepsi superfans out there know which they prefer — and they’re happy to share every reason why. For the savvy savers who love to make the most of credit card rewards, it all comes down to the Chase Freedom® twins versus the Discover it® Cash Back.

But just like soda junkies who like to escalate their culinary creativity by blending both brands in the same cup, credit card rewards rebels know the Chase Freedom® and Discover it® Cash Back cards are great options for maximizing their cash back rewards.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![3 Key Differences: Chase Slate vs. Freedom Flex vs. Freedom Unlimited ([updated_month_year]) 3 Key Differences: Chase Slate vs. Freedom Flex vs. Freedom Unlimited ([updated_month_year])](https://www.cardrates.com/images/uploads/2016/12/chase-slave-vs-freedom.jpg?width=158&height=120&fit=crop)

![Is the Chase Freedom a Visa or Mastercard? ([updated_month_year]) Is the Chase Freedom a Visa or Mastercard? ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/03/chasevisa.png?width=158&height=120&fit=crop)

![Chase Freedom: Credit Limit & Benefits ([updated_month_year]) Chase Freedom: Credit Limit & Benefits ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/07/chasefreedom.png?width=158&height=120&fit=crop)

![9 Best: Discover vs. Capital One vs. Chase ([updated_month_year]) 9 Best: Discover vs. Capital One vs. Chase ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/10/Discover-Vs.-Capital-One-Vs.-Chase-Feat.jpg?width=158&height=120&fit=crop)

![3 Best Discover Cards For Beginners ([updated_month_year]) 3 Best Discover Cards For Beginners ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/05/Best-Discover-Cards-For-Beginners.jpg?width=158&height=120&fit=crop)

![Chase Refer-A-Friend Offer: Earn Bonus Points ([updated_month_year]) Chase Refer-A-Friend Offer: Earn Bonus Points ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/05/refer.png?width=158&height=120&fit=crop)

![Visa vs. Mastercard vs. Discover vs. Amex: Who Wins? ([updated_month_year]) Visa vs. Mastercard vs. Discover vs. Amex: Who Wins? ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/12/vs.png?width=158&height=120&fit=crop)

![Is Discover a Good Credit Card? ([updated_month_year]) Is Discover a Good Credit Card? ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/10/Is-Discover-a-Good-Credit-Card.jpg?width=158&height=120&fit=crop)