It’s comforting to have one or more of the best cash advance credit cards in your wallet when you need some money right away.

A cash advance is an immediate loan charged against your credit card which you can receive without any intervening approvals or paperwork. Cash advances aren’t cheap, but at least they are convenient.

-

Navigate This Article:

Best Overall Card For Cash Advances

If you are one of the almost 1 million members of Digital Credit Union, you can get the DCU Visa® Platinum Credit Card and enjoy one of the lowest starting APRs — 8.50% — for cash advances. What’s more, the card charges no transaction fee for cash advances, nor does it charge an annual fee, a balance transfer fee, or a foreign transaction fee.

- DCU’s Visa Platinum Credit Card offers a rate lower than you’ll find on most other bank or store cards. With one of the lowest rates in the nation, this is the perfect starter card for anyone trying to establish credit or save on interest with no-fee balance transfers.

- Embedded EMV chip – this tiny chip protects your information in a big way.

- Mobile Wallet Compatible – works with Apple Pay®, Google Pay™, and Samsung® Pay.*

- Optional overdraft protection – We’ll transfer the balance of any overdrafts from your DCU checking account to your DCU Visa Platinum account up to your available limit.

- No annual fee, balance transfer fee, or cash advance fees

- Must meet eligibility criteria to join Digital Federal Credit Union

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

As low as 13.50%

|

$0

|

Average/Good

|

The card is compatible with major mobile wallets and offers optional overdraft protection when the cardmember also has a DCU checking account.

Best Cash Advance Cards From a Major Issuer

We give top honors to Capital One for its low 3% cash advance fee, which stands in contrast to the standard 5% charged on the cards from other major issuers. Capital One credit cards consistently have high cardmember ratings for their competitive cash back and rewards points offerings.

- $0 annual fee and no foreign transaction fees

- Earn a bonus of 20,000 miles once you spend $500 on purchases within 3 months from account opening, equal to $200 in travel

- Earn unlimited 1.25X miles on every purchase, every day

- Miles won’t expire for the life of the account and there’s no limit to how many you can earn

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you’ll get Capital One’s best prices on thousands of trip options

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 15 months

|

0% for 15 months

|

19.99% – 29.99% (Variable)

|

$0

|

Excellent, Good

|

- Earn a one-time $200 cash bonus after you spend $500 on purchases within 3 months from account opening

- Earn unlimited 1.5% cash back on every purchase, every day

- $0 annual fee and no foreign transaction fees

- Enjoy up to 6 months of complimentary Uber One membership statement credits through 11/14/2024

- Earn unlimited 5% cash back on hotels and rental cars booked through Capital One Travel, where you’ll get Capital One’s best prices on thousands of trip options. Terms apply

- No rotating categories or sign-ups needed to earn cash rewards; plus, cash back won’t expire for the life of the account and there’s no limit to how much you can earn

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 15 months

|

0% for 15 months

|

19.99% – 29.99% (Variable)

|

$0

|

Excellent, Good

|

- Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you’ll get Capital One’s best prices on thousands of trip options

- Miles won’t expire for the life of the account and there’s no limit to how many you can earn

- Receive up to a $100 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

19.99% – 29.99% (Variable)

|

$95

|

Excellent, Good

|

- Earn a one-time $200 cash bonus after you spend $500 on purchases within the first 3 months from account opening

- Earn unlimited 3% cash back on dining, entertainment, popular streaming services and at grocery stores (excluding superstores like Walmart® and Target®), plus 1% on all other purchases

- Earn 10% cash back on purchases made through Uber & Uber Eats, plus complimentary Uber One membership statement credits through 11/14/2024

- Earn 8% cash back on Capital One Entertainment purchases

- Earn unlimited 5% cash back on hotels and rental cars booked through Capital One Travel, where you’ll get Capital One’s best prices on thousands of trip options. Terms apply

- No rotating categories or sign-ups needed to earn cash rewards; plus cash back won’t expire for the life of the account and there’s no limit to how much you can earn

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 15 months

|

0% for 15 months

|

19.99% – 29.99% (Variable)

|

$0

|

Excellent, Good

|

Honorable mention goes to Bank of America. It also only charges a 3% fee on cash advances. However, its variable APR on cash advances is about 2 percentage points higher than that from Capital One. Bank of America has branches throughout the country and offers several popular credit cards.

Unlike our top recommendation, these two issuers and others like them charge a relatively high fixed or variable APR for cash advances. You want to repay a cash advance as soon as possible because they have no grace period — you begin accruing interest from the first day and continue to do so until you repay the advance.

You can also get a business credit card, including from Capital One and Bank of America, that offers more generous cash advances.

Cash Advance Alternatives

Cash advances are convenient, but you pay for that convenience with a high interest rate and fees. A small personal loan may be a better option, especially if you have good credit.

The APRs on personal loans may be lower than those for credit cards, and payments are predictable. You have at least three months to repay the loan and as long as 84 months if you need more time. The number of monthly installment payments is equivalent to the term of the loan.

In addition to personal loans, the following three loan networks may be able to get you a short-term online cash advance that you repay all at once when you next get paid. Online payday loans may cost less than those available from storefronts and can be funded as soon as the next business day.

- Short-term loans up to $5,000

- Online marketplace of lenders

- Funds available in as few as 24 hours

- Simple online form takes less than 5 minutes

- Trusted by more than 2 million customers

- Not available in NY or CT

It takes only a few minutes to prequalify for an unsecured loan arranged by MoneyMutual®. That’s all the time it takes to fill out the company’s short loan request form.

To prequalify, you must have a reliable income of at least $800 a month. After you prequalify, MoneyMutual® will transfer you to one of the direct lenders on its network, where you finish the application process before receiving an instant loan decision.

- Loans from $500 to $10,000

- All credit types accepted

- Receive a loan decision in minutes

- Get funds directly to your bank account

- Use the loan for any purpose

CashUSA can instantly prequalify you for a fast cash loan if you are a U.S. citizen or permanent resident, 18 or older, with an after-tax monthly income of at least $1,000.

You must also have an active checking account in your name, as well as a valid email address and phone number.

CashUSA serves consumers with all types of credit. Its large lender network can approve your loan immediately and fund your bank account as soon as the next business day.

- Quick loans of up to $5,000

- Submit one form to receive multiple options without harming your credit score

- All credit ratings welcome to apply

- Requires a driver's license, bank account, and SSN

- Get your funds as soon as tomorrow

BillsHappen® can instantly prequalify you for a personal loan that you repay in as few as three equal monthly payment installments. Its network of direct lenders offers loans of various sizes, making it easier to find the right size loan for your needs.

You must have a Social Security number and be employed, self-employed, or receiving benefits to prequalify. The BillsHappen® website utilizes advanced encryption protocols to ensure your privacy and security.

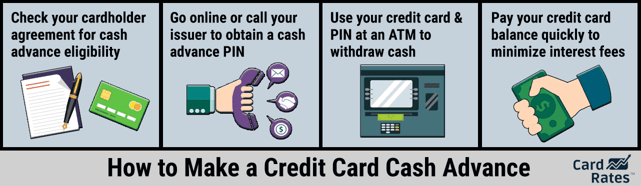

How Do I Get a Credit Card Cash Advance?

A cash advance is a handy perk that is available on most credit cards. In fact, only cards aimed at consumers with bad credit may omit cash advances from its benefits.

Getting a credit card cash advance is quite easy, but first, you’ll need a credit card. We venture to say that most consumers don’t choose their credit cards based on cash advance policies, but if you often find it necessary to borrow small amounts for short periods, you’ll want to consider competing cash advance APRs when choosing a card.

As far as obtaining a cash advance, you have a few ways to collect the money. Perhaps the easiest path to a cash withdrawal is to go to an ATM on your card’s network to get your advance. You can also get one at a bank branch, and many cards offer online advances wired to your bank account.

The nice thing about a credit card cash advance transaction is that you don’t have to jump through hoops to get one. You did all the hard work when you applied for the card, and your cash advances won’t require any new applications or approvals.

Just bear the following in mind:

- Limits: The size of your advance is limited by your cash advance credit line, which is usually up to 80% of your available credit limit.

- Interest: You will begin accruing interest at the stated APR starting from the first day of the cash advance. Contrast this to the interest-free grace period of 21 or more days on eligible purchases offered by almost all credit cards. The Interest rate on cash advances is usually higher than that for net purchases, although the DCU Visa® Platinum Credit Card offers a remarkably low cash advance APR.

- Fees: Almost all credit cards charge a 3% to 5% upfront charge on each cash advance. A 5% fee can mean a $50 charge on a $1,000 cash advance transaction on top of the APR.

- Credit quality: Your credit score plays a big role in which credit cards you can get and what credit limits you’ll receive. If you have bad credit and want access to bigger cash advances, you’ll have to improve your credit score. That means paying your bills on time every month and keeping your unpaid balances in check.

You should expect the upfront fee to be subtracted from the loan proceeds when you get a cash advance. Also, there may be additional fees if you obtain your cash advance from an ATM cash withdrawal.

You can’t get a cash advance from a debit card. Any withdrawals from a debit card are from your bank account balance. For prepaid or gift cards, withdrawals come from the card account. Gift cards are usually not reloadable.

Do Cash Advances Hurt Your Credit?

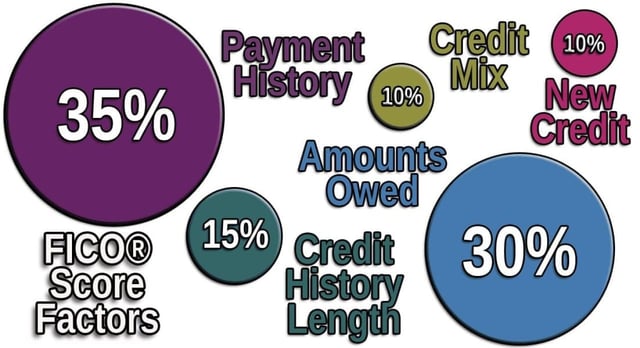

The impact of cash advances on your credit score depends on how much you borrow and how quickly you pay it back. Your FICO credit score depends on various factors, and 30% of the score hinges on the amount of credit card debt you use.

Specifically, FICO measures your credit utilization rate, which is the credit card balance you have compared with the amount of credit you have available. FICO deducts credit score points for cardholders who have a CUR above 30%.

Cash advances are included in the CUR calculation, so if you take advances that swallow up your available credit, you risk harming your credit score.

Don’t be fooled if you have a credit card with a 0% introductory APR. Just because your introductory APR is zero, your CUR will suffer if you rack up a high purchase balance.

You can easily rectify a high CUR by repaying the amount you owe. You should try to get your CUR back down below 30% if it suddenly spikes, such as when you take a cash advance.

More ominous to your credit score is failure to repay the minimum amount due each month. Late payments trigger fees and even card account cancellations. And if you are 90 or more days late on payments, your credit card will report you to the major credit bureaus, thereby dropping your credit score and leaving a mark on your credit reports for up to seven years.

All that being said, an occasional cash advance that you repay quickly should have a minimal effect on your credit score.

Is It Wise to Get a Credit Card Cash Advance?

You may as well ask whether it’s wise to let your family go hungry because you ran short of money this month. Cash advances are as wise a choice as the uses you put them toward.

For example, Las Vegas is probably not the place to get a cash advance, as the odds of a gambling win are always stacked against you.

But if you genuinely need some cash right away, a credit card cash advance can be a very good idea. It will cost less than a payday loan and doesn’t need the approval necessary for a personal loan.

Bad credit card debt management can be quite harmful. If you consistently find yourself short of money, consider whether you have fundamental issues that may be better addressed by credit counseling than with another loan.

How Do I Know My Cash Advance Limit?

You’re probably very familiar with your credit card credit limit. It’s the account’s total amount of credit available to you for net purchases, balance transfer transactions (a balance transfer fee applies), and cash advances. However, many cards set the cash advance limit well below the credit limit.

You can see your cash advance limit on your monthly statement under a heading like “Cash Access Line” or similar wording. That’s the total amount available. The next line, labeled something like “Available for Cash,” tells you your available cash advance credit, which considers your current cash advance balance.

You’ll find similar information on your online account page. If all else fails, you can call your account rep for all the details.

If you have a cash rewards credit card for qualifying purchases like the Citi Double Cash® Card or another type of rewards credit card, note that cash advances will not earn you any rewards points, miles, or cash rewards, including no statement credit.

For example, cash advances will not earn you any Chase Ultimate Reward points from its credit cards, including the Chase Freedom Visa Card.

Do Cash Advances Get Paid Off First?

Quite possibly. The CARD Act of 2009 specifies that credit card companies must apply any payment amounts above the minimum payment in descending APR order, starting with the highest APR.

Since cash advances usually carry the highest APRs, they are likely to be paid first. But it’s not a slam dunk. Take, for instance, the DCU Visa® Platinum Credit Card, in which eligible purchases, balance transfers, and cash advances share the same low APR (no cash advance or balance transfer fee applies).

You would still want the card to repay the cash advances first since they don’t have a grace period, unlike qualifying purchases.

If a situation leaves you in doubt, you can contact the credit card company and verify how your payments are being allocated.

Consider Your Alternatives to the Best Cash Advance Credit Cards

Our review of the best cash advance credit cards may prove helpful if you worry about running short of cash until your next paycheck or benefits payment. You can find more information about the reviewed cards by clicking on the START HERE link, which will transfer you to the card’s web page.

Be sure to check the card’s Schumer Box to verify its cash advance APR and fees. Also, read the fine print for other information pertaining to cash advances, such as any limits on their use.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![7 Cash Advance & Personal Loans For No Credit ([updated_month_year]) 7 Cash Advance & Personal Loans For No Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/05/Cash-Advance-Personal-Loans-For-No-Credit.jpg?width=158&height=120&fit=crop)

![7 Cash Advance Loans For Bad Credit ([updated_month_year]) 7 Cash Advance Loans For Bad Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/11/Cash-Advance-Loans-For-Bad-Credit.jpg?width=158&height=120&fit=crop)

![6 Easy Approval Cash Advance Loans ([updated_month_year]) 6 Easy Approval Cash Advance Loans ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/10/shutterstock_1693980259--1.jpg?width=158&height=120&fit=crop)

![[current_year] Cash Advance Limits by Issuer ([updated_month_year]) [current_year] Cash Advance Limits by Issuer ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/12/shutterstock_2980733.jpg?width=158&height=120&fit=crop)

![4 Facts: Bank of America Unlimited Cash vs. Customized Cash ([updated_month_year]) 4 Facts: Bank of America Unlimited Cash vs. Customized Cash ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/04/Bank-of-America-Unlimited-Cash-vs.-Customized-Cash.jpg?width=158&height=120&fit=crop)

![13 Highest Cash Back Credit Cards ([updated_month_year]) 13 Highest Cash Back Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/11/Highest-Cash-Back-Credit-Cards-Feat.jpg?width=158&height=120&fit=crop)

![2 Methods: How to Get Cash from a Credit Card ([updated_month_year]) 2 Methods: How to Get Cash from a Credit Card ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/06/cash.png?width=158&height=120&fit=crop)

![3 Steps: Get Cash Back On a Credit Card? ([updated_month_year]) 3 Steps: Get Cash Back On a Credit Card? ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/10/Can-You-Get-Cash-Back-on-a-Credit-Card-Feat.jpg?width=158&height=120&fit=crop)